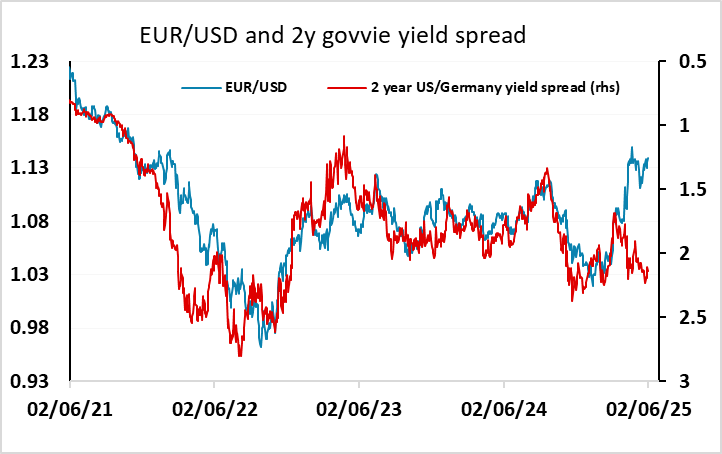

USD flows: USD softer on tariff concerns

USD softer as Trump threatens product tariff increases

The USD has been generally soft overnight as Trump has predictably announced plans to double tariffs on steel and aluminium. The court decision against his reciprocal tariffs make it highly probable that he will increase product tariffs to fill the gap. We would expect more to come this week, with pharma the most likely target. If the USD reaction to the threat of increased steel an aluminium tariffs is a guide, this will keep the USD on the back foot. However, if any new tariffs are targeted at countries or currency areas, those areas may suffer. Pharma tariffs could be expected to hit Switzerland and the Eurozone, so we would expect the JPY to outperform in those circumstances.

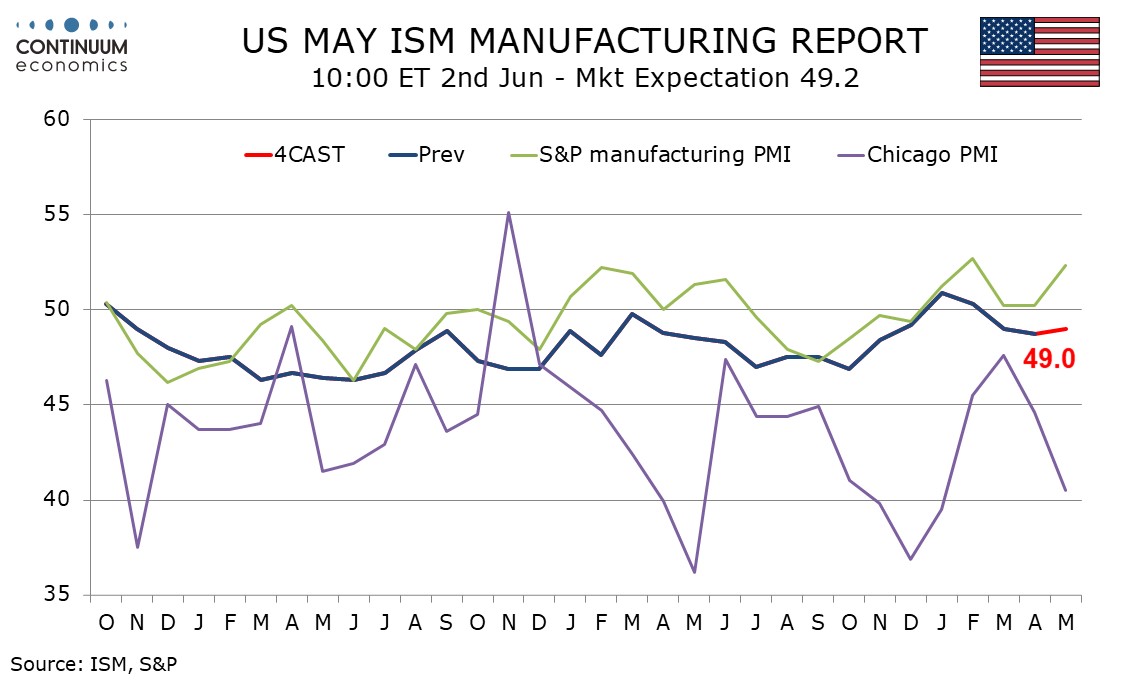

The main data today is the ISM manufacturing survey. We expect a May ISM manufacturing index of 49.0, which would be a marginal improvement from April’s 48.7, which was the weakest since November. However, the index would remain below the neutral 50 which was beaten in January and February for the first times since October 2022. In practice, this seems unlikely to have much FX impact, with the services sector more significant and the S&P PMIs having already provided a guide to the likely outcome.