Published: 2024-10-08T14:48:48.000Z

Preview: Due October 23 - U.S. September Existing Home Sales - Finding a base?

3

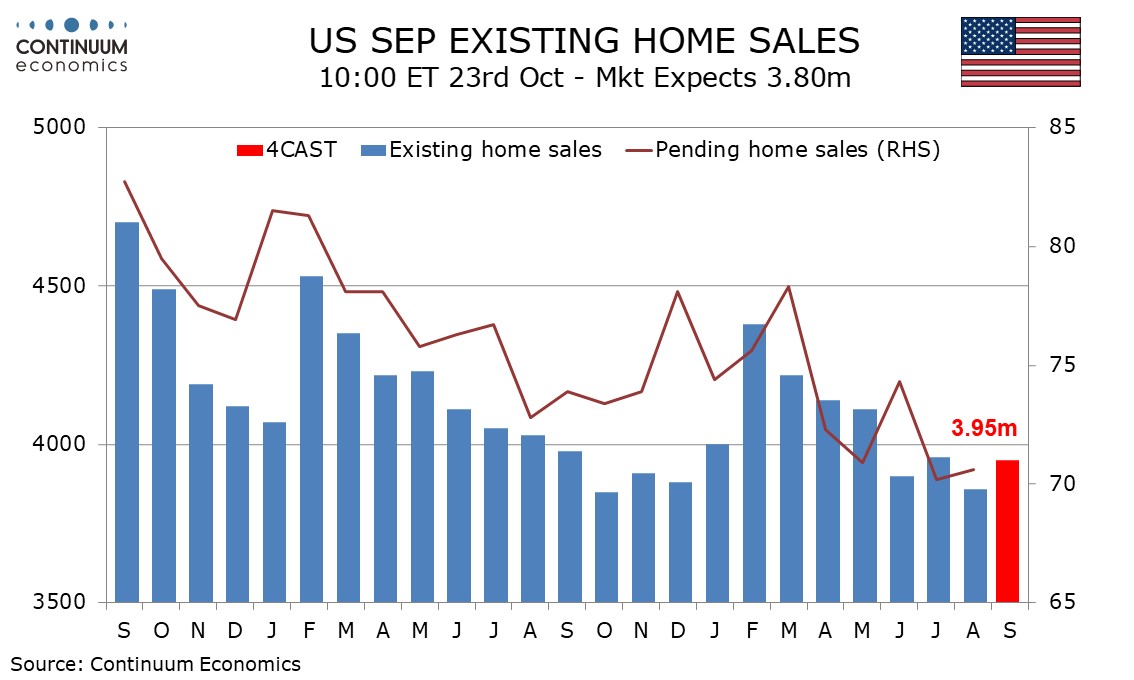

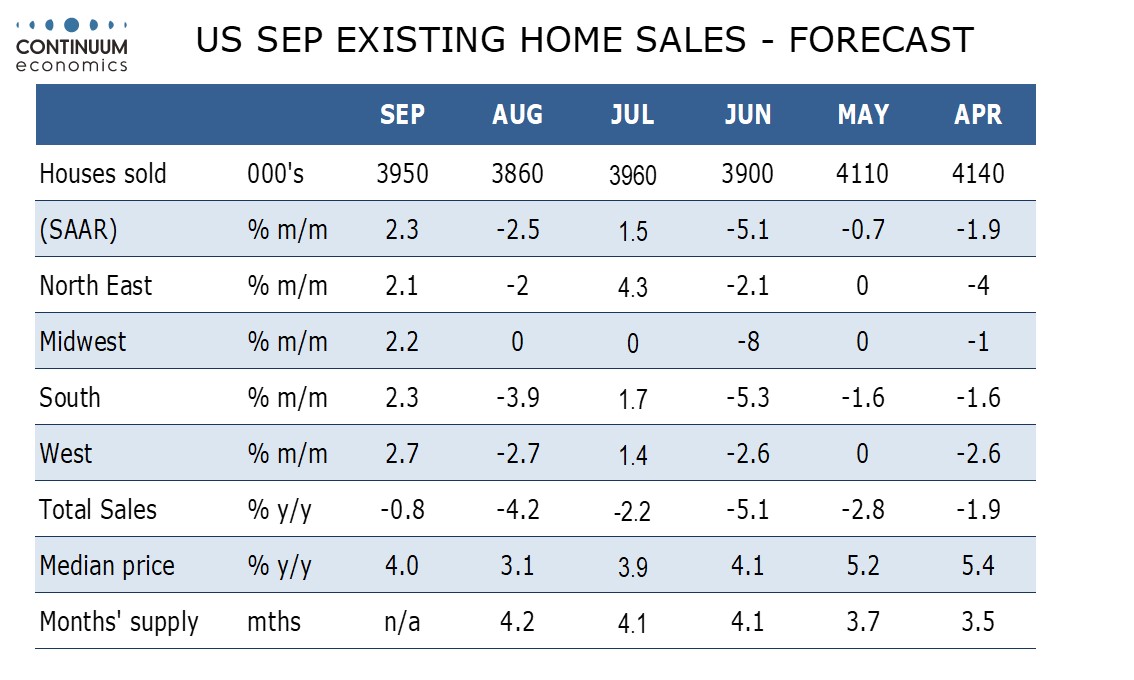

We expect a 2.3% increase in September existing home sales to 3.95m, not quite reversing a 2.5% decline seen in August. A recent slowing in trend may soon stabilize with Fed easing starting.

Pending home sales, designed to predict existing home sales, saw only a marginal increase in August after a steep July decline and still look quite weak. However survey evidence from the NAHB and MBA did show signs of finding a base in September, providing a more positive signal.

We expect sales in the Northeast and West to fully reverse August declines and the Midwest to pick up after two flat months. We do not expect the South to quite reverse an August decline, with Hurricane Helene a modest downside risk, coming at the end of the month.

We expect the median price to show a seasonal decline of 2.0% on the month but this would see yr/yr growth at 4.0%, back near the June and July levels after slippage to 3.1% in August.