GBP flows: GBP rises on strong retail sales

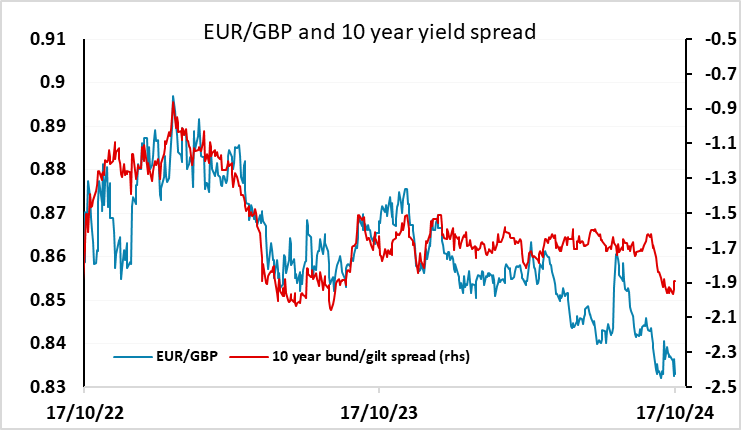

EUR/GBP lowest since April 2022 after an unexpected rise in UK retail sales in September

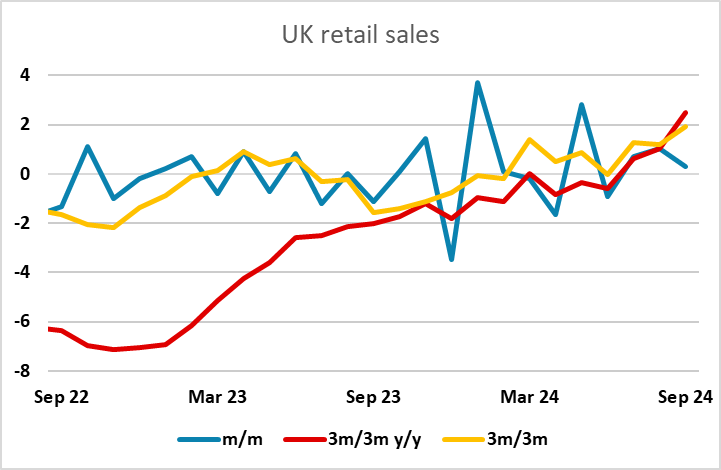

The European session kicks off with strong UK data. While UK retail sales only rose 0.3% m/m, this was well above consensus expectations of a 0.3% decline and follows gains of 0.7% and 1.0% in the previous two months, so that the 3m/3m trend is at its highest since the recovery from the pandemic. EUR/GBP has dipped below 0.83 for the first time since April 2022.

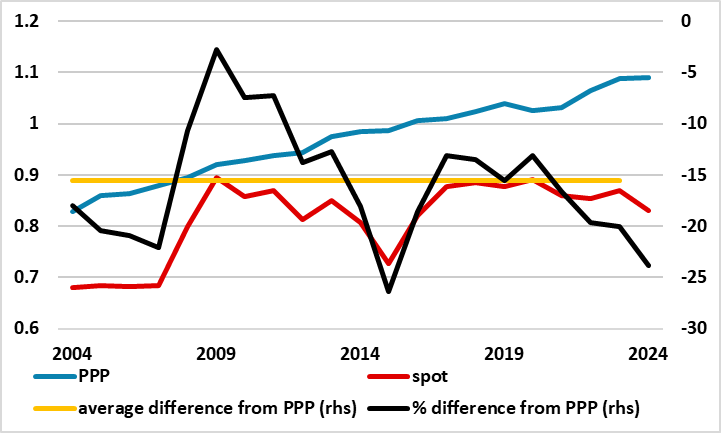

While we doubt this data will prevent the BoE from cutting rates in November, given the latest weak inflation data, this sort of relatively strong data will tend to push up longer term UK yields and maintain the current high level of GBP against the EUR. Even so, progress below 0.83 is likely to be tough. The UK economy is still only growing very modestly, and EUR/GBP is at historically low levels in real terms. The October 30 budget may turn out to be less contractionary than feared, but is unlikely to be significantly stimulative. GBP will continue to benefit from risk positive sentiment globally, but looks overextended on a 0.82 handle in anything other than the short term.