Preview: Due May 15 - U.S. April PPI - A stronger month after a weak March

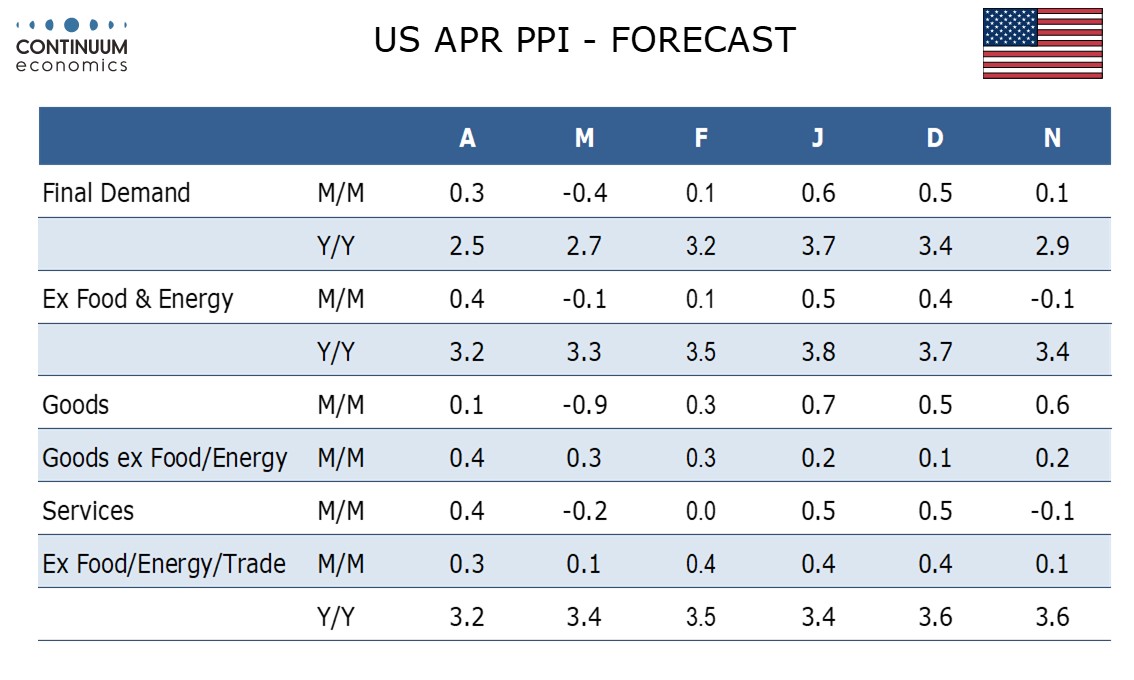

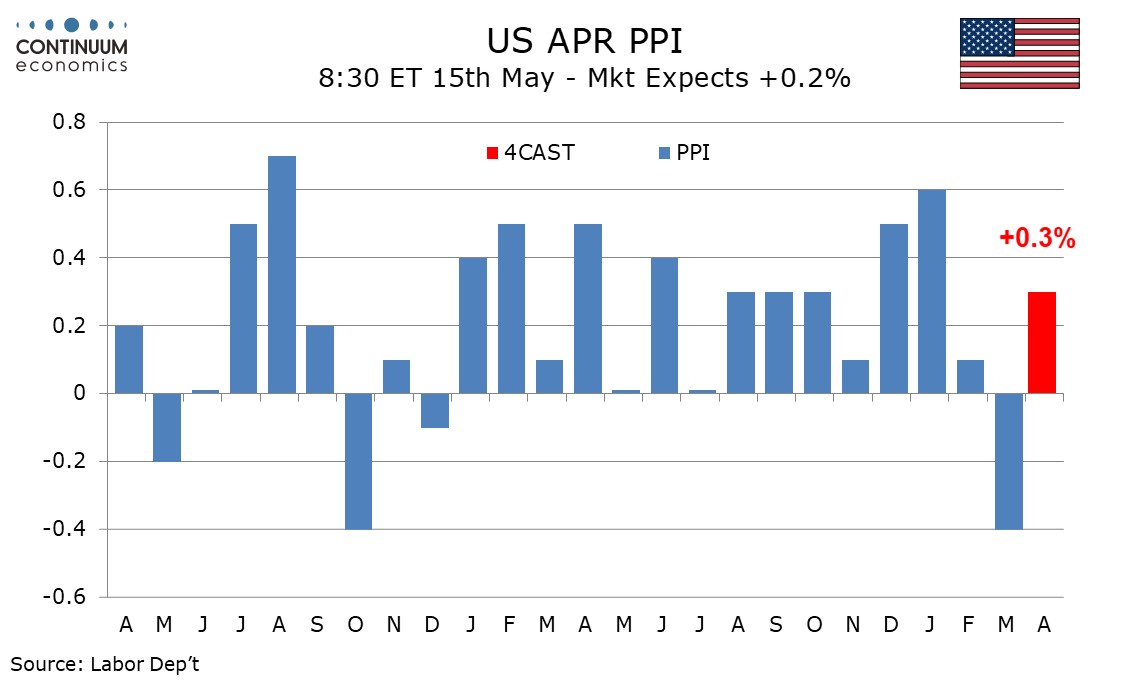

We expect April PPI to bounce from a weak March with a 0.3% rise overall and a 0.4% increase ex food and energy. Ex food, energy and trade, we expect a rise of 0.3%. Tariffs are likely to continue supporting goods prices while services are likely to correct from a weak March.

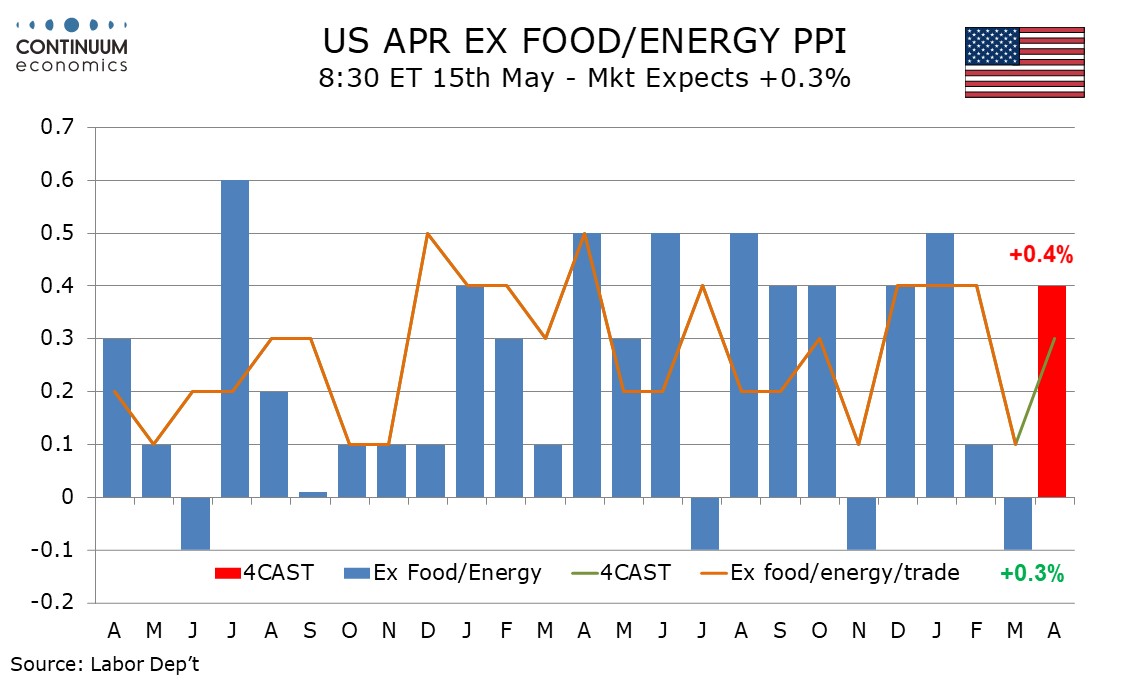

Goods prices ex food and energy rose by 0.3% in both February and March after eight straight months in which the gain was either 0.1% or 0.2%. This suggest tariffs are putting upward pressure on goods prices and we expect that the be extended in April, with goods prices ex food and energy rising by 0.4%. We expect energy prices to be unchanged after a dip in March but food to fall by 1.0%, a second straight decline as recent strength in eggs continues to fade, leaving overall goods prices up by only 0.1%.

We expect service prices to also rise by 0.4% after an unusual 0.2% decline in March that followed a flat February. February and March weakness in service prices was led by declines in the volatile trade component, which looks set to correct higher, but trend in services does appear to be slowing. We expect a 0.3% rise in PPI ex food, energy and trade, after a 0.1% rise in March but still softer than three straight gains of 0.4% in December, January and February.

Despite looking for a stronger month, we expect some slowing in yr/yr growth as even stronger year ago data drops out. We expect slowing to 2.5% from 2.7% overall, to 3.2% from 3.3% ex food and energy, and to 3,2% from 3.4% ex food, energy and trade.