GBP flows: GBP up on strong earnings data

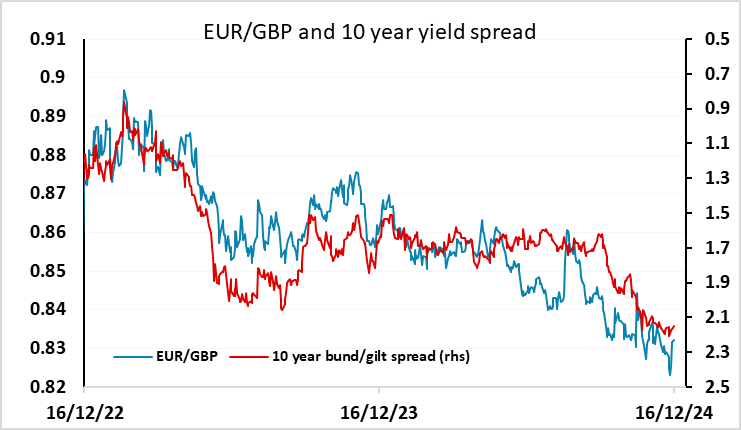

EUR/GBP dips further below 0.83 as average earnings growth picks up

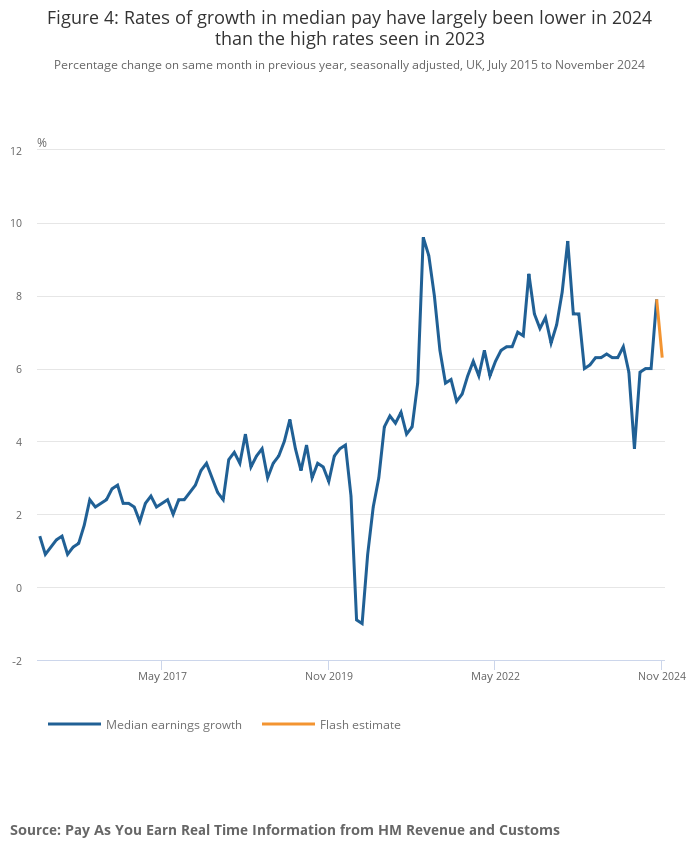

EUR/GBP has dropped 15 pips in response to the UK labour market data released this morning. Most aspects of the data were on the strong side of expectations, notably average earnings growth, which showed a 5.2% rise y/y in the ONS data representing the 3 months to October, and 6.3% y/y in the HMRC data for November.

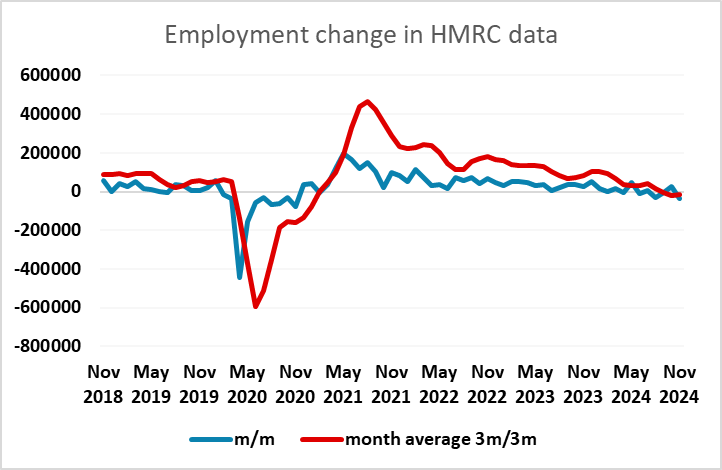

Employment growth in the ONS data was 173k in the quarter to October, but the HMRC data on payrolled employment shows a decline of 35k in employment in November, after a revised 24k rise in employment in October, and over the last 3 months employment has fallen an average of 16.6k per month. The ONS data includes self-employment, but is nowadays seen as unreliable due to small sample sizes, and the HMRC data is both more accurate and more up to date, so the underlying trend in employment does seem to be falling. Even so, the data on earnings is sufficiently strong to maintain the market’s scepticism about the potential for UK rate cuts, and GBP is consequently likely to remain well bid into the BoE MPC meeting this week. The hawks on the MPC will also likely see the data as evidence that wage growth is too strong to allow anything more than very gradual easing, so for now EUR/GBP looks set to hold below 0.83.