This week's five highlights

Trump Tariffs: Update

Some signs of slowing activity in U.S. June Employment

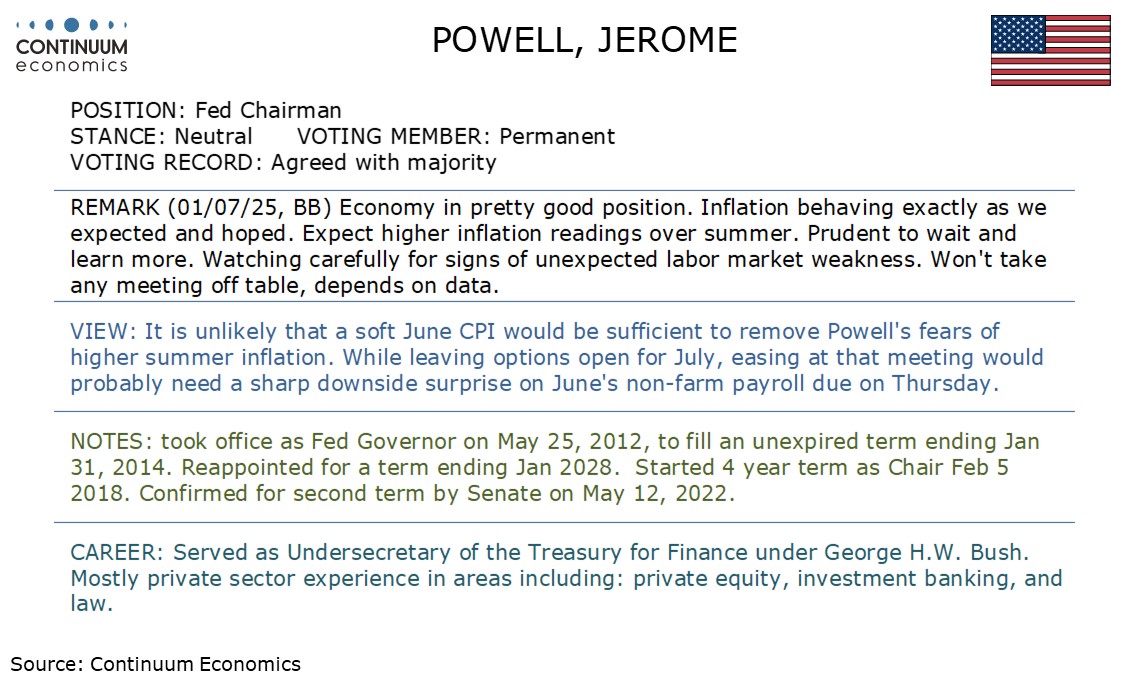

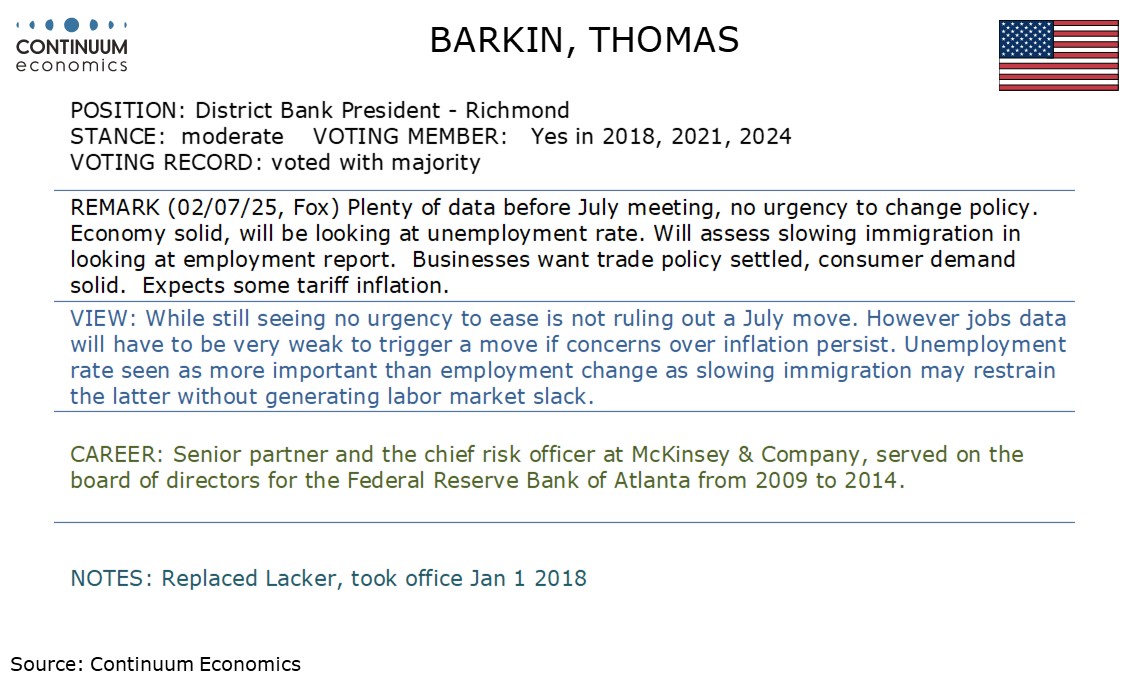

These Week's Fed Speaker

DXY Fresh Lows

EZ HICP and ECB Strategy

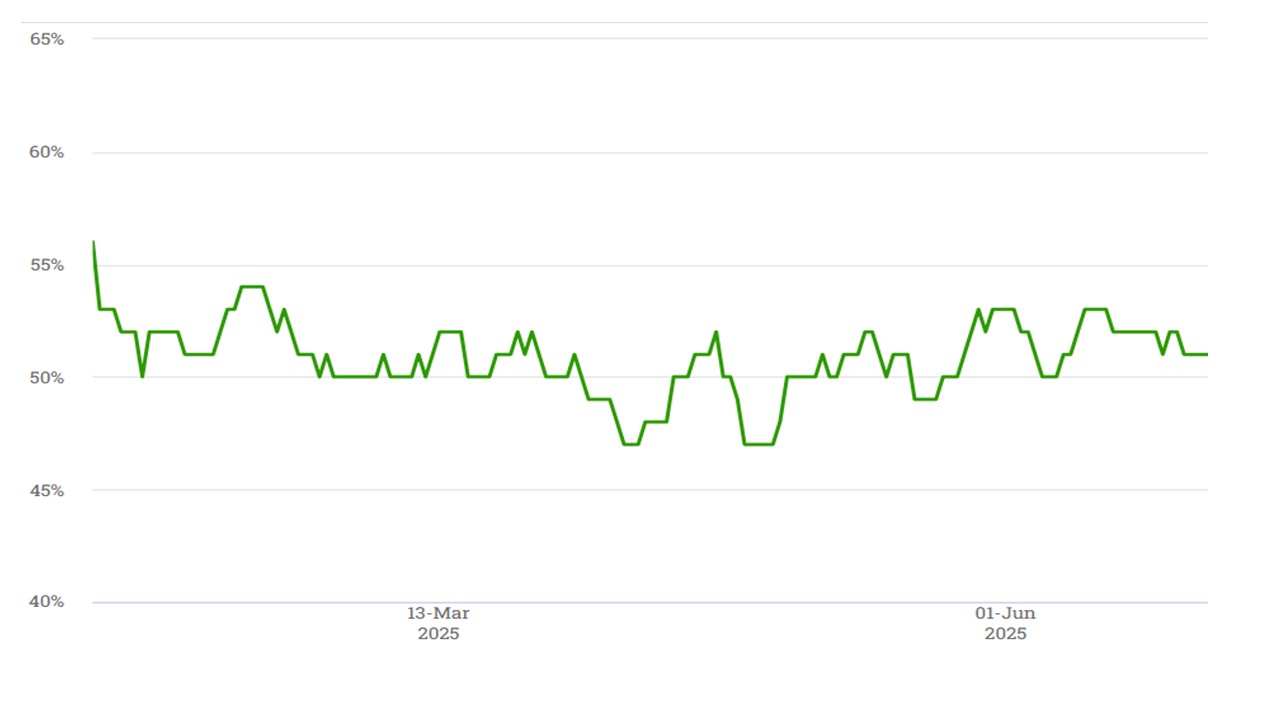

Figure: Trump Approval Ratings (%)

Our central scenario (but less than 50%) is towards a scenario of compromise, with some agreements in principle or trade framework deals, delays for most other negotiating in good faith but with one or two countries seeing a reciprocal tariff rise e.g. Spain and/or Vietnam. This could still be followed by higher product tariffs later in the summer after section 232 reports, with the most likely being pharmaceuticals with a delay to allow production to shift back to the U.S. This would still be consistent with an eventual average effective tariff rate of 13-15%, which we outlined in the June U.S. Outlook and means a softening of U.S. growth and a temporary rise in CPI/PCE inflation (here). However, the outcome is highly uncertain and we also highlight two other scenarios re the July 9 drama.

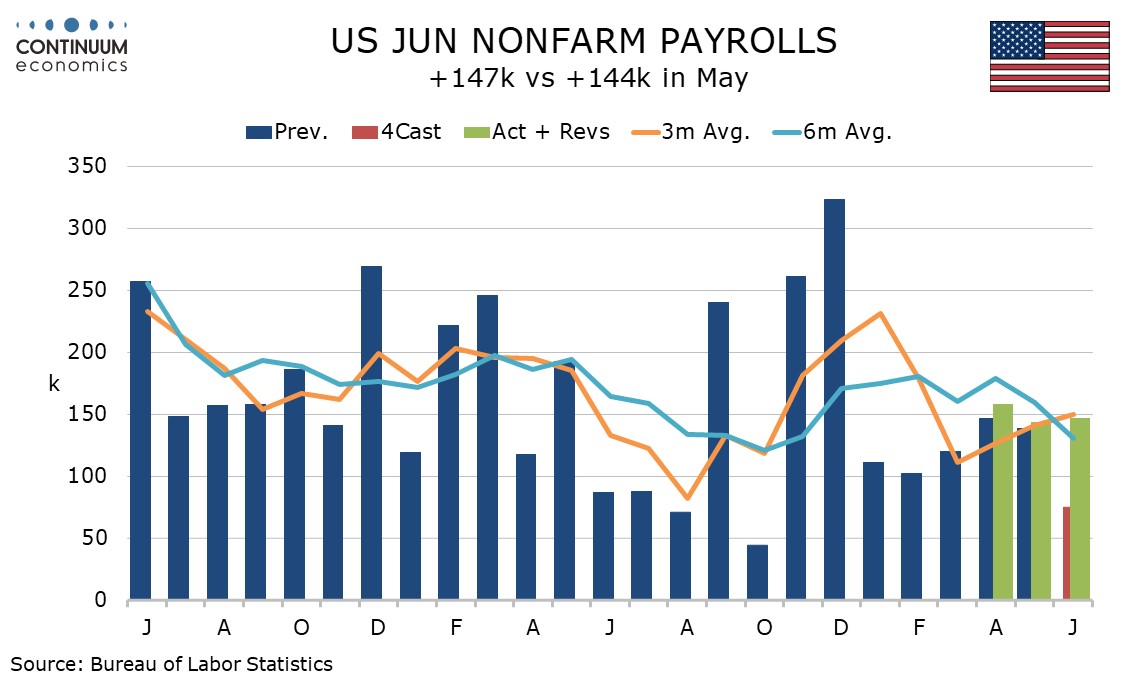

June’s non-farm payroll is surprisingly strong overall with a rise of 147k, with 16k in net upward revisions, but private payrolls at 75k are weaker than expected, with 16k in net negative revisions. Unemployment unexpectedly fell to 4.1% from 4.2%, but average hourly earnings are weaker than expected with a rise of 0.2%, while the workweek fell to 34.2 hours after three straight months at 34.3. The 73k surge in government is the biggest surprise. Federal government fell by a modest 7k, but state government surged by an unusual 47k, 40k of that in education, while local government rose by a less unusual 33k, 23k of that in education.

The 74k rise in private payrolls is the weakest since a hurricane-impacted 1k decline in October 2024, though weaker data were also seen in June, July and August of 2024 with no major special factors. The slowing came mainly in private sector services, up by 68k with 59k of that coming in health care, with even the rise in health care a significant slowing in what had been a strong trend. Leisure and hospitality rose by 20k, leaving private services weak elsewhere. Goods were resilient with a rise of 6k with construction up by 15k but manufacturing down by a modest 7k. A fall in weekly initial claims to 233k from 237k suggests a recent increase there has peaked, hinting that we should not expect weakness in July payrolls.

The USD has taken a breather after a month long slide. Apart from technical rebound, the rise in yields are a key support for the USD. The previous speculation of Trump firing Powell also lacked follow through. The last spike in the greenback could be stimulated by Trump's beginning of sending his tariff letters towards those countries that did not make a trade deal in time. Yet, in a medium term, with Trump's tilt towards weaker USD, the greenback is unliekly to see strong bids.

On the chart, there is little change, as prices extend cautious trade above strong support at the 96.38 current year low of 1 July. Intraday studies are under pressure, suggesting room for a pullback from current levels. But rising daily readings are expected to limit initial scope in renewed buying interest above 96.38, before bearish longer-term charts prompt a break. A later close beneath here will add weight to sentiment and open up congestion around 96.00, with room for extension of September 2022 losses towards the 95.25 Fibonacci retracement. Meanwhile, resistance remains at the 97.60 weekly low of 12 June and extends to congestion around 98.00. A close above here, if seen, will help to stabilise price action and give way to consolidation beneath 99.00.

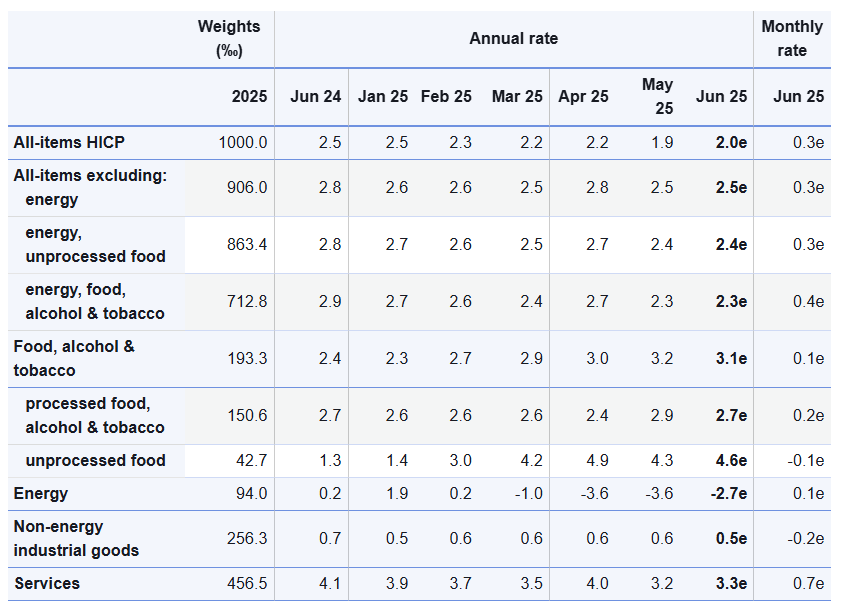

Figure: Headline Back Below Target as Services Rise Reverses

Despite its updated its monetary policy strategy detailed yesterday, inflation – now at target – is very much a side issue for the ECB at present, albeit with oil prices possibly accentuating Council divides. Admittedly, the flash June HICP rose a notch to 2.0% matching the -consensus, but up from May’s eight-month low and below-target 1.9% (Figure 1). More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting airfares and holiday costs, services inflation fell back to a 27-mth low of 3.2%, mirroring a similar Easter effect in 2019, Indeed, as a result, the core rate dropped to 2.3%, the lowest since Oct 2021. However, adverse energy basis effects and a further calendar distortion pull services back up in June (again temporarily), this factor too explaining what looks like fresh price pressures in seasonally adjusted short-term m/m movements. But the core stayed at 2.3%!