Published: 2024-01-03T14:53:25.000Z

USD flows: USD firm after Barkin comments

Senior FX Strategist

-

Barkin comments look consistent with recent more dovish Fed talk, but market taking them as slightly hawkish. USD firm, but upside limited from here. JPY oversold.

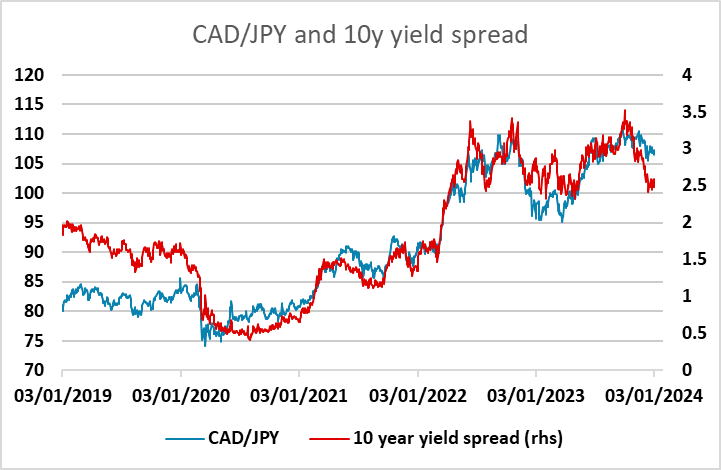

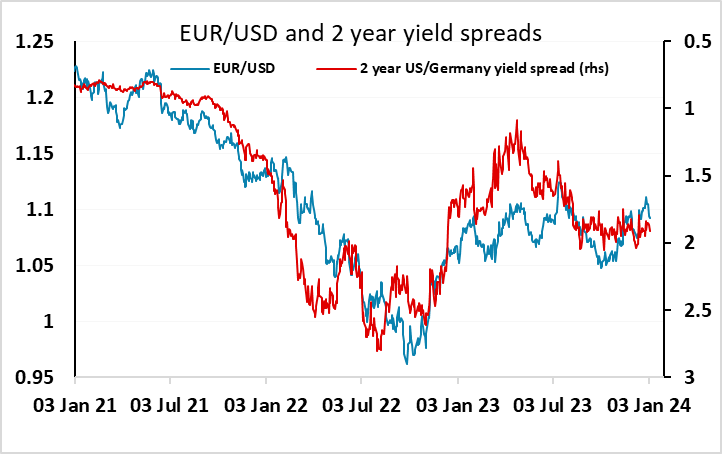

Higher yields and a steeper curve have been seen after the comments from Barkin, but we wouldn’t see his comments as particularly hawkish. Indeed, he sounds quite optimistic on inflation remaining low, even if he also seems reasonably positive on growth. Still, with nearly 150bps of easing priced in for this year, the risks are probably weighted towards higher yields on anything other than outright dovish commentary. The USD is modestly higher in the wake of his comments, with the JPY suffering the most, even though equities are also softer on the day. JPY crosses are looking extended here, especially if Japanese yields rise in Asia in response to the US yield rise today. EUR/USD looks likely to hold near 1.09 unless the ISM or JOLTS data provide a surprise.