U.S. Initial Claims unchanged, January trade deficit incrases

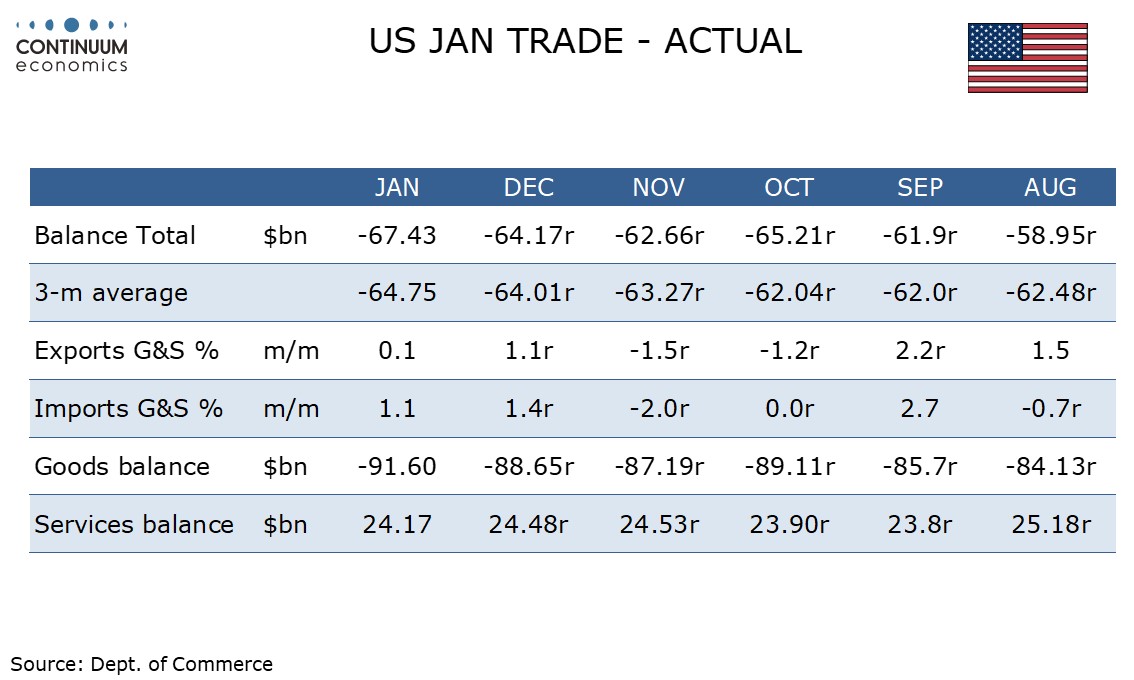

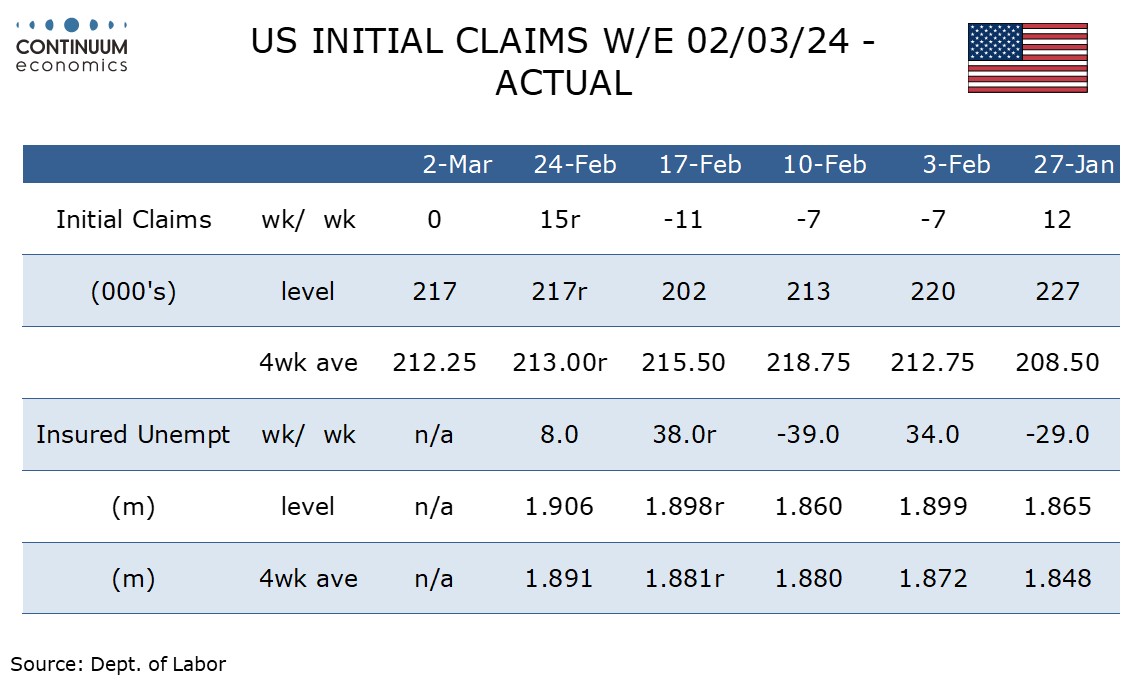

The initial claims picture remains stable and consistent with a tight labor market, unchanged at 217k with the preceding week revised marginally higher from 215k. A wider than expected January trade deficit of $67.4bn from $64.2bn however presents some downside risk to Q1 GDP.

The continued claims picture also looks stable, 1.906m in the latest week up from 1.898m which was revised from 1.905m, meaning little net change. February’s payroll was surveyed two weeks before this week’s initial claims data and one week before that for continued claims.

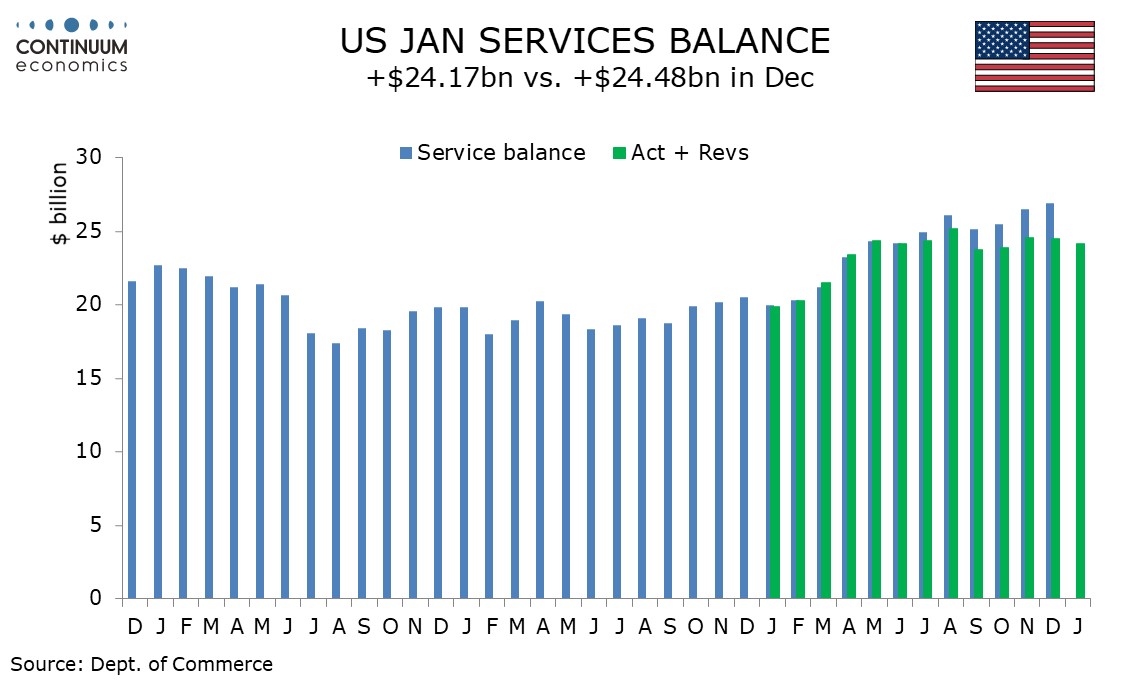

The trade deficit is the highest since April and almost $4bn above consensus, an unusually large surprise given that we have already seen advance goods data. Services led the surprise with service exports up only 0.2% while service imports rose by 0.8%, while back month revisions saw recent services surpluses revised significantly lower. December’s overall deficit was revised up to $64.4bn from $62.2bn.

Goods data showed exports up by 0.1% and imports up by 1.2%, compared to advance results of 0.2% and 1.1% respectively. In real terms exports fell by 0.2% and imports rose by 1.0%.