Preview: Due January 24 - U.S. January S&P PMIs - Manufacturing to pick up, Services to slip

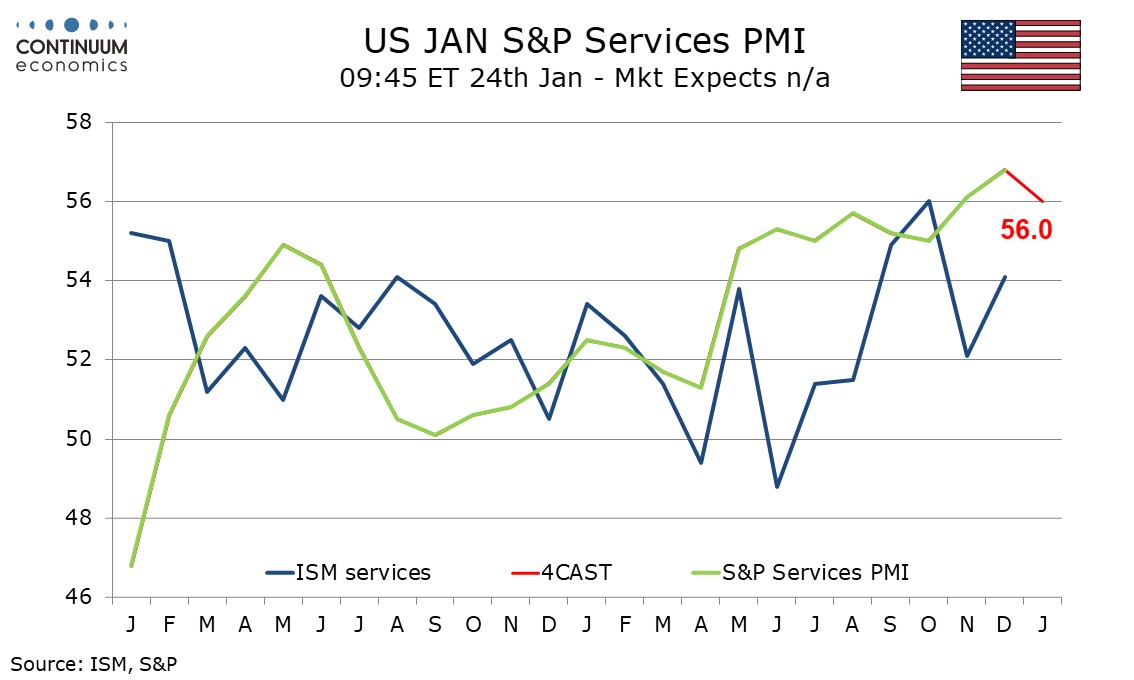

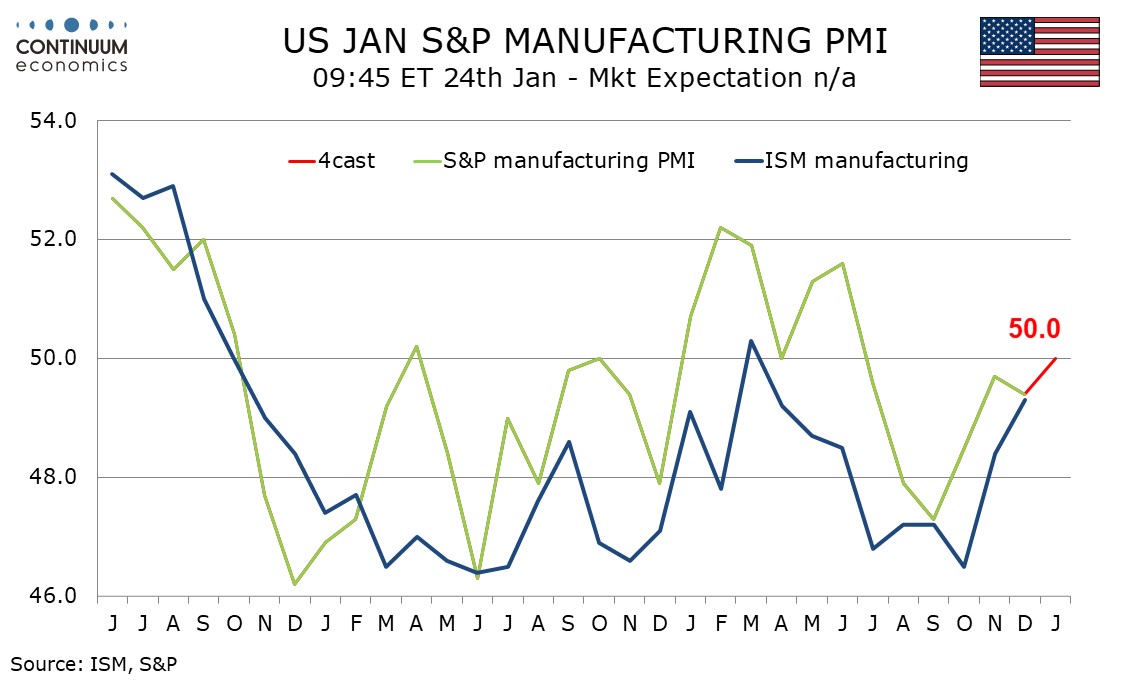

We expect January’s S and P PMIs to show a modest rise in manufacturing, to 50.0 from 49.4, but slippage in services, to 56.0 from 56.8. That December data showed manufacturing stronger than its preliminary reading of 48.3 but services weaker than its preliminary reading of 58.5 may say something about momentum entering January.

The S and P manufacturing index in December was still, even after the upward revision, slightly weaker than November’s 49.7, and only marginally above an improved ISM manufacturing index of 49.3. Given that the S and P manufacturing index usually outperforms the ISM index by more, this argues for a rise in the S and P index in January. Still, tariff concerns may limit the upside potential.

The S and P service indices may be vulnerable to bad weather, both the fires in Los Angeles and exceptionally cold weather in much of the country in early January. Services are more vulnerable to weather than manufacturing. This means some downside risk in services but the picture is likely to remain healthy. ISM services data showed some improvement in December but remained below the S and P’s, and the relationship between the two series is weaker for services than for manufacturing..