U.S. May ISM Services - Above trend month after a below trend month

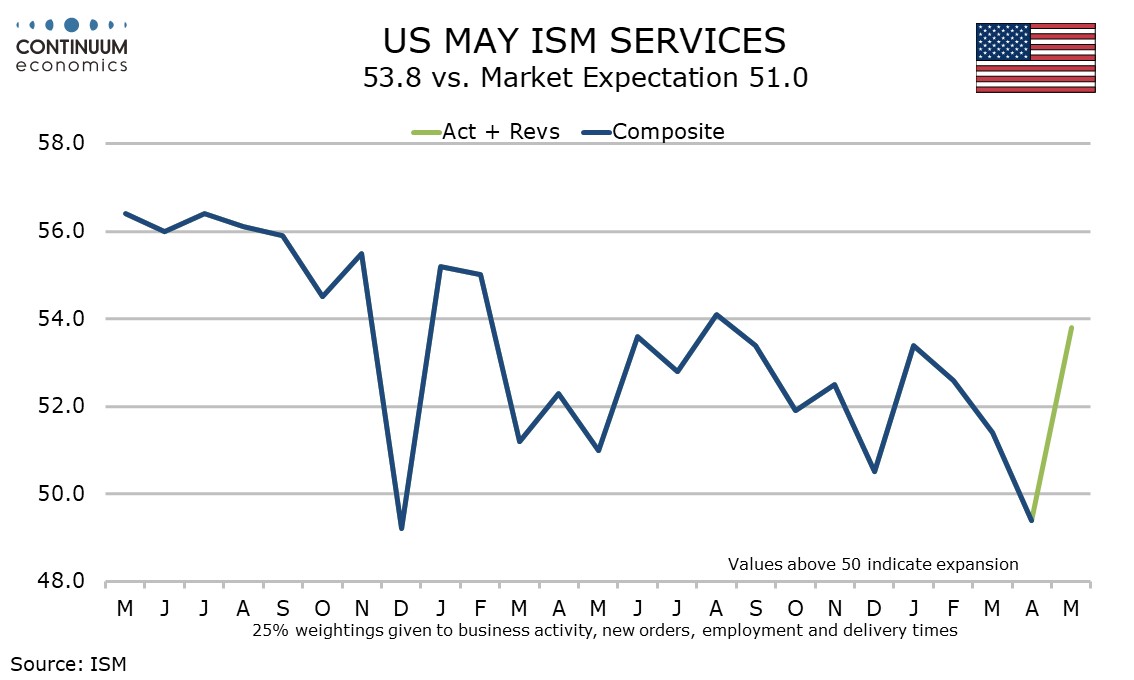

Like May’s S and P services index (unrevised at 54.8), May’s ISM services index has also exceeded expectations, rising to 53.8, its highest since August 2023, from a weak 49.4 in April. Probably not too much should be made of an above trend number in May or the below trend number in April.

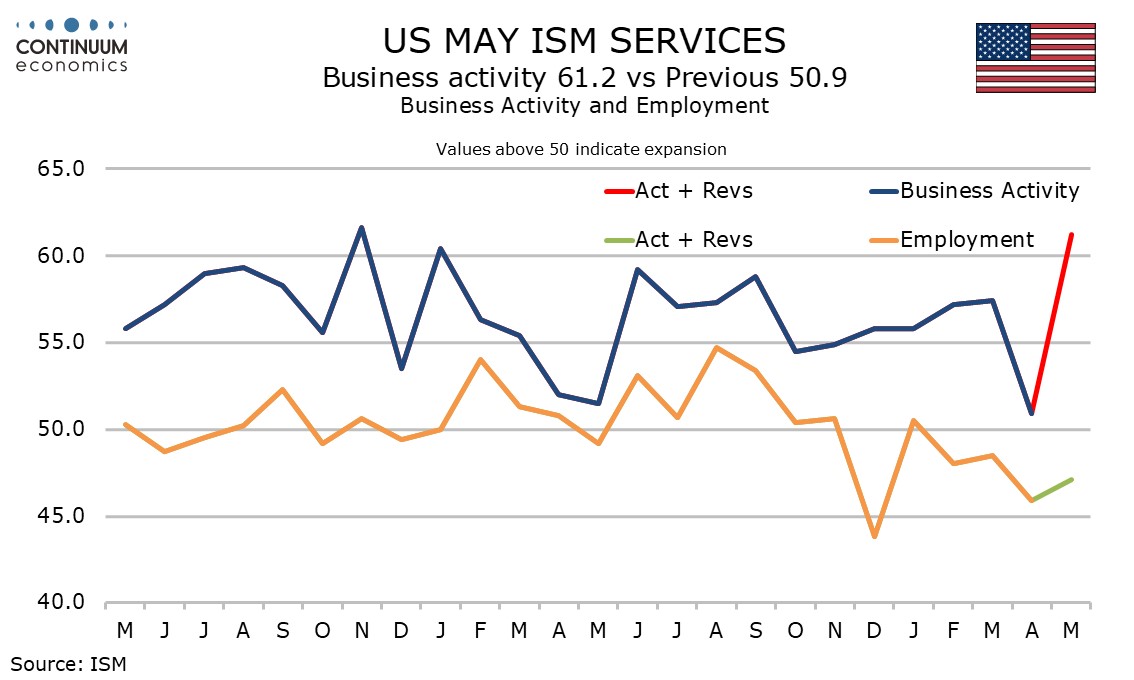

April’s outcome as the weakest since December 2022. The biggest contrast was business activity, weak in April at 50.9 but strong in May at 61.2.

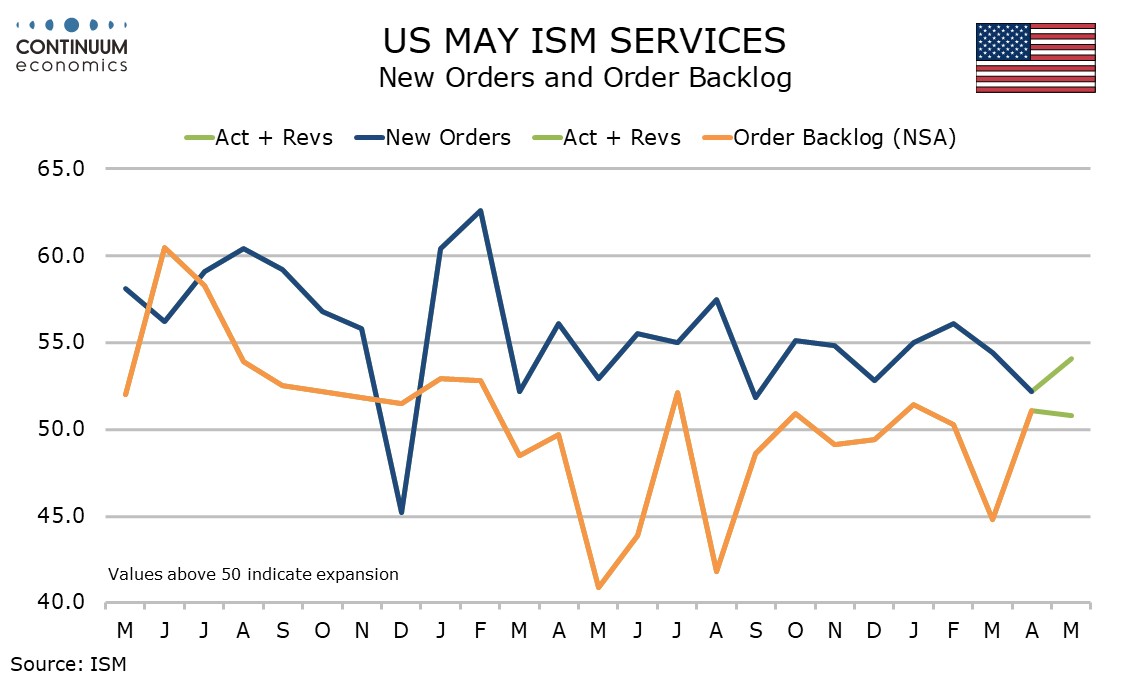

New orders at 54.1 from 52.2 are improved but not sharply, remaining below each monthly outcome in Q1.

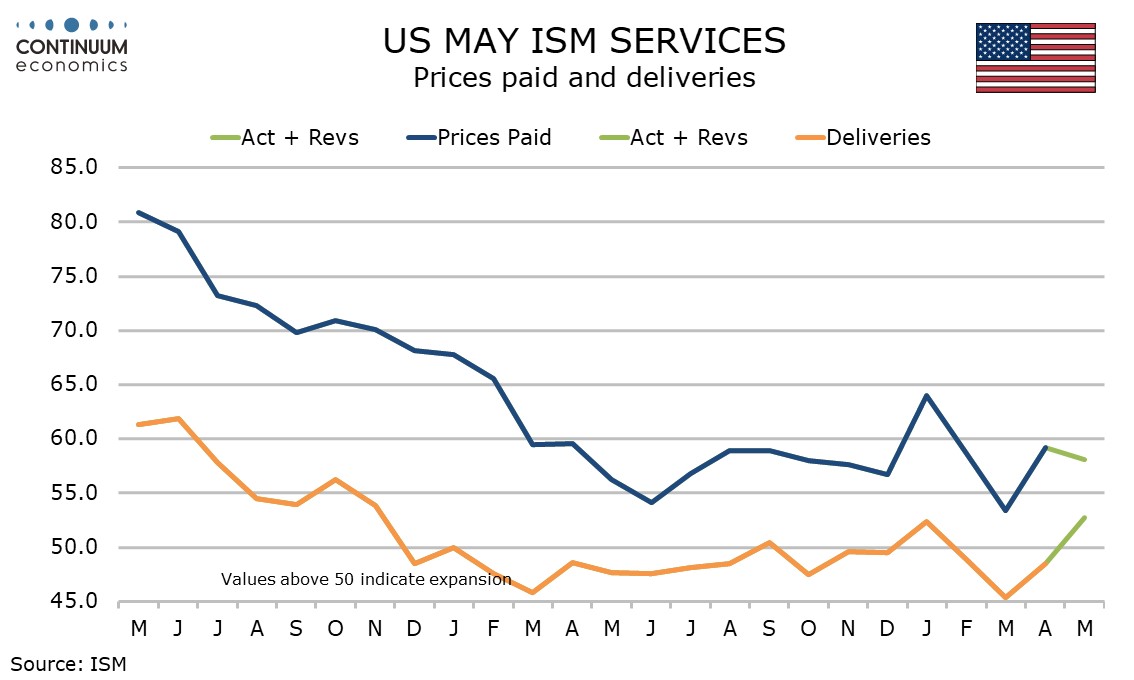

Employment improved to 47.1 from 45.9 but remains quite weak. Deliveries completed the composite breakdown with a more significant increase to 52.7 from 48.5.

Prices paid do not contribute to the composite and corrected lower to 58.1 from 59.2. May’s outcome is similar to February’s though we saw a strong January and weak March. Prices paid do not have any clear trend.