This week's five highlights

FOMC Minutes Suggest Caution for Easing

A Slate of U.S. Data and NFP

USD/JPY Rebound in the first week of New Year

German Headline CPI Jumps On Energy Base Effects

UK Softer Wage Signs Increasingly Evident

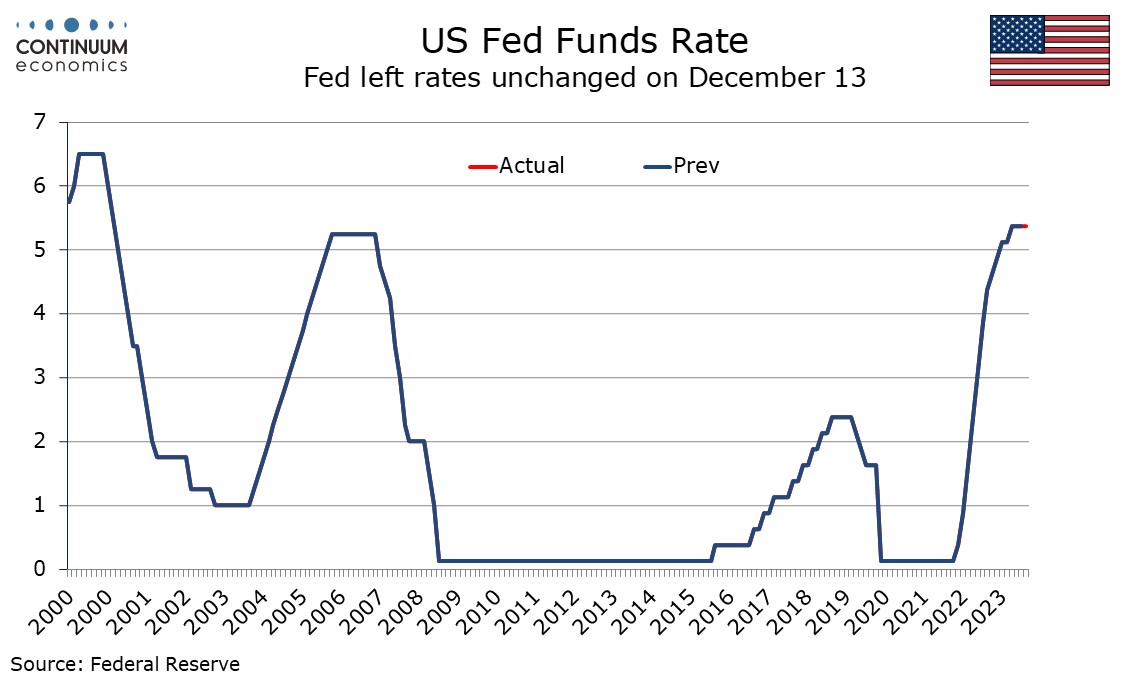

FOMC minutes from December 13 show that while almost all participants expect lower rates to be seen by the end of 2024, they want forecasts to be treated cautiously at this point. Caution over easing and increased confidence that progress is being made on inflation are however both clear in the minutes. If progress on inflation continues, the Fed will start to consider easing, with timing data-dependent. Participants noted unusually elevated uncertainty and that the economy could evolve in a way that made further tightening appropriate, even though participants agreed rates were likely near or at their peak. Several observed that circumstances might warrant keeping rates at the current level for longer than expected. They reaffirmed the need to keep policy restrictive for some time until inflation was clearly moving down sustainably towards target.

Given that upside risks to inflation were seen as having diminished this gives scope for the FOMC to start contemplating easing should progress on inflation continue, though for now concern that progress on inflation could stall persists. Some did point to downside economic risks associated with potentially overly restrictive policy, though downside economic surprises would not automatically bring easing, with a few concerned with a potential tradeoff between the Fed’s dual mandate goals. All agreed clear progress had been made on inflation but more evidence was needed before they could feel confident of a return to the 2% target. Uneven progress across components was a concern with core services still elevated, though there was some confidence that a more balanced labor market was easing wage pressures. The minutes reiterate the view seen in the post-meeting statement that Q4 GDP was seen slowing from a strong Q3, but also note uncertainty on the outlook, noting upside risks as well as potential downside ones. Notable were the possibility that momentum may be stronger than assessed and the possibility of easing financial conditions making the inflation goal harder to achieve. Reducing the balance sheet was seen as an important part of the Fed’s overall approach though several remarked that plans indicated easing and stopping the decline in the balance sheet when reserve balances are somewhat above the level consistent with ample reserves. It was suggested that the FOMC would discuss the technical factors that would guide such a decision well before such a decision is reached.

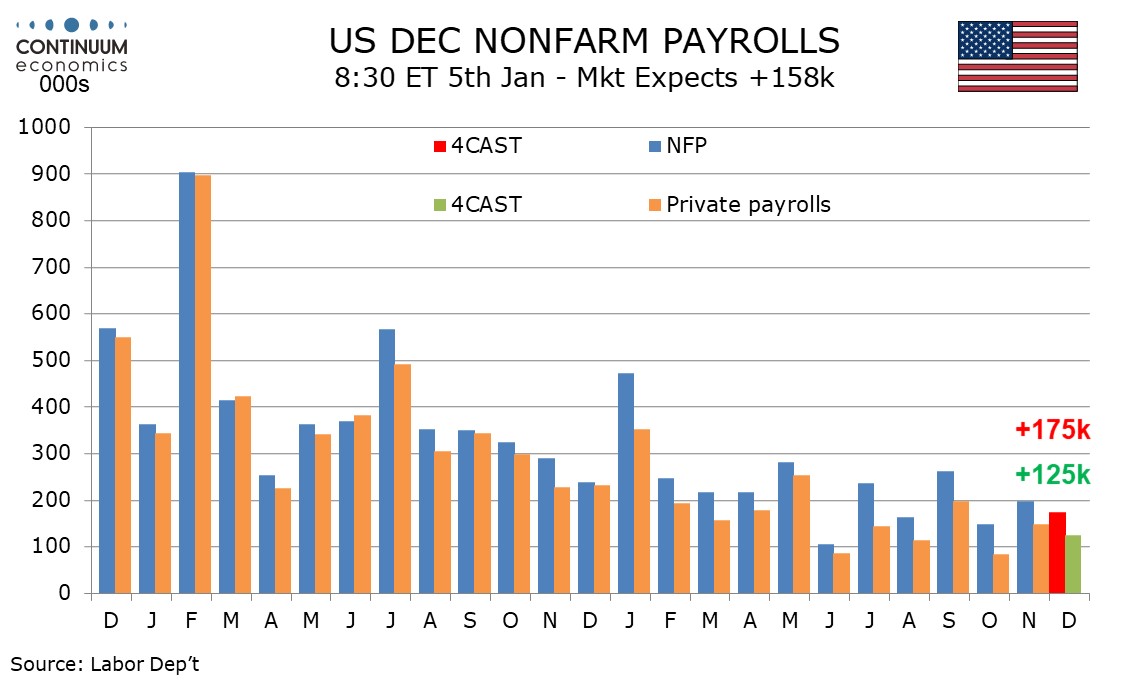

The data highlight of the first week of 2024 will be December non-farm payrolls on Friday. We expect no change in trend, with a 175k increase in non-farm payrolls, 125k in the private sector, a 0.3% increase in average hourly earnings and an unchanged unemployment rate of 3.7%. ADP’s estimate of private sector employment growth is due on Thursday. We expect a rise of 110k, marginally underperforming private sector payrolls. Other labor market indicators due are November’s JOLTS report on job openings on Wednesday and weekly jobless claims on Thursday. Also important will be FOMC minutes from December 13 on Wednesday. We expect increased confidence that inflation is falling but still enough caution to mean easing is not on the near term agenda. We expect slightly firmer ISM indices for December, with manufacturing on Wednesday rising to 47.5 from 46.7 and services on Friday rising to 53.0 from 52.7. Other releases scheduled are November construction spending on Tuesday, and on Friday November’s trade balance and factory orders.

A 175k payroll increase would be slower than November’s 199k though November was lifted by the return of strikers, 25k in autos and 16k in motion pictures. October’s 150k increase was restrained by the start of the auto strike. Government looks set to maintain a firm picture. A 125k increase in private sector payrolls would compare to 150k in November and 85k and October but would be slightly stronger than both excluding the impact of strikes. Hinting at upside risk are a stalling of an upmove in initial claims, and more supportive seasonal adjustments.

Average hourly earnings trend has been gradually losing momentum with trend now on the low side of 0.3%, and we expect a rise of 0.26% in December before rounding. This would follow an above trend 0.35% in November which was resumed up to 0.4%, which corrected a below trend 0.21% increase in October. Yr/yr growth would then slip to 3.9% from 4.0%. There is extra uncertainty on unemployment in December with historical revisions due, though we expect any changes to be marginal. Historical revisions for non-farm payrolls data come with January’s report. We expect an unchanged rate of 3.7% assuming November is unrevised, with employment and the workforce seen delivering similar moderate gains, contrasting sharp bounced in both in November which corrected declines in October.

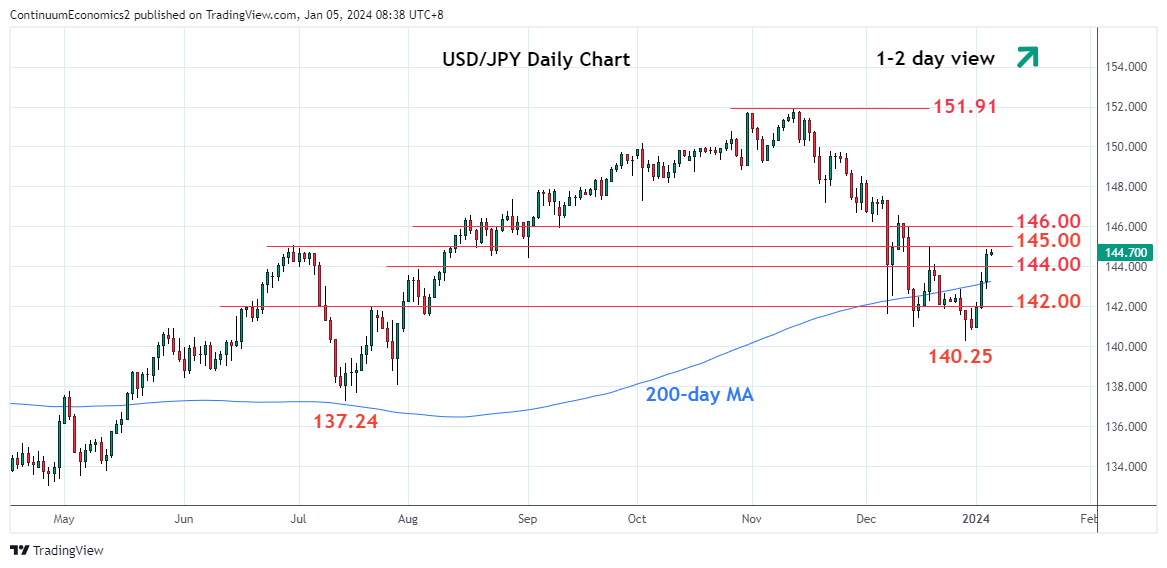

USD/JPY has rebounded strongly since the beginning of new year as USD rose on higher Treasury yields for the FOMC minutes seems to suggest the magnitude and pace of easing is slower. Haven bids for the greenback also arise with geopolitical tension flares up. Geopolitical uncertainty of potential U.S. military action further pumps up the demand for USD and outbid JPY for JGB yields are downbeat to start the year.

On the chart, the pair is extending bullish run-up from the 140.25 low with break above the 144.00 level shift focus to the strong resistance at the 145.00 level. Stretched intraday studies suggest reaction here likely though the positive daily chart suggest scope for further gains ahead. Clearing the 145.00 level will see room to the 146.00/10 congestion and 50% Fibonacci level. Meanwhile, support is raised to the 144.00/143.73 area then the 142.85 higher low which should now underpin and sustain gains from the 140.25 low.

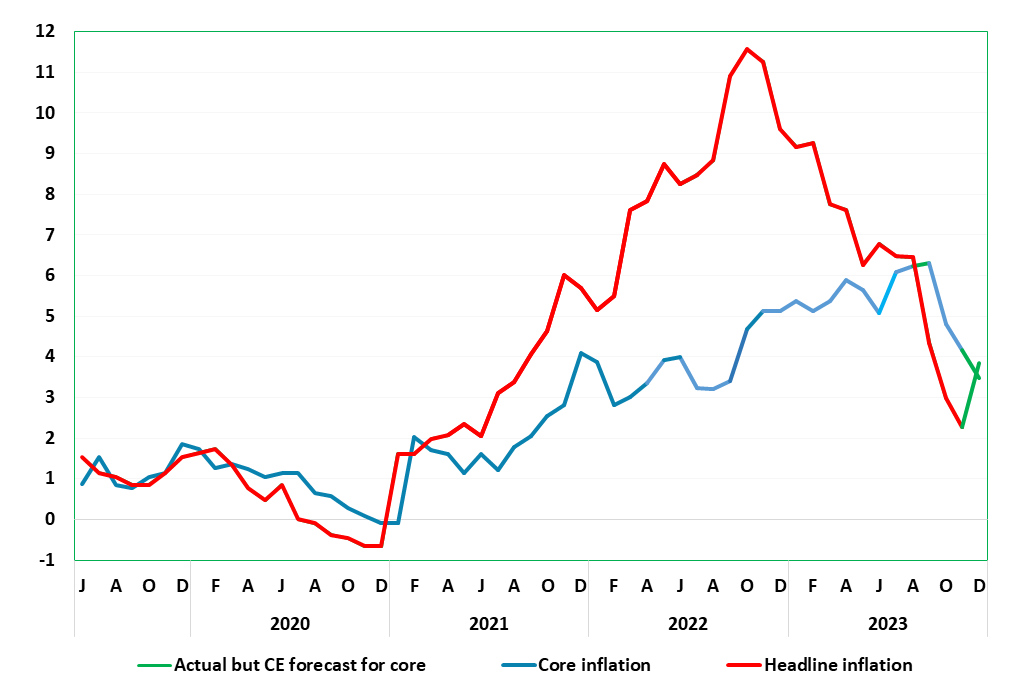

Figure: HICP Inflation Jumps, But Core More Contained

A clear and continued fall in overall German and EZ inflation pressures, initially evident in survey data but spreading to official numbers has been the case for some months. This downtrend was much more evident in the softer-than-expected October and also the November HICP numbers. Indeed, the headline HICP in November eased 0.7 ppt to 2.3%, a 29-month low, with the core dropping by 0.7 ppt to 3.5%. However, last month, and despite a further fall in fuel prices, recreation-sourced and particularly energy-related base effects, pushed up the headline rate back to 3.8%, a little lower than consensus and with the core down further at least for the CPI measure (Figure 1) where the headline for the latter rose by far less. Regardless, the disinflation backdrop is underlined by what may be a softer core seasonally adjusted trend (Figure 2) which may be running close to zero. Regardless, the headline y/y rate may resume a downtrend in the New Year even with some tax rises now due.

Adverse energy related base effects may have affected other EZ countries such as Italy, as well as in France. But progress on core inflation should continue, this very much the case in recently related Spanish numbers. As for the actual EZ HICP due tomorrow (Jan 5), the headline tick higher from November’s 2.4% by 0.4-0.5 ppt, but only on a short-lived basis as the fall will resume into and through 2024. We see the December core steady at 3.5% but with downside risks. As for the ECB, its forecast outlined last month implies a rise of around 0.25 ppt and a slightly higher headline outcome than our expectation.

Regardless, a further insight into the disinflation backdrop is provided by the seasonally adjusted data which we compute – the Bundesbank does its own measurement on this basis. As Figure 2 shows there has also been a clear slowing in the trend m/m changes on an adjusted basis, most notably for the core. This seemingly continued in December albeit with the smoothed (3-mth avg) adjusted rate edging up to just 0.1% m/m

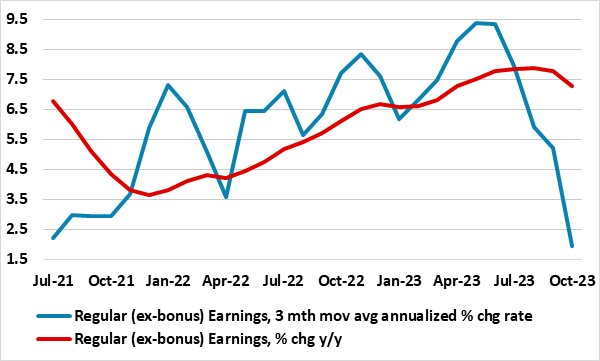

Figure: Adjusted m/m Earnings vs y/y Data

While quite content to assess real economy matters via data presented on a q/q or even m/m basis, DM central bankers seem unwilling to evaluate inflation signals on just about anything but y/y numbers. This is particularly the case in the UK where the BoE’s focus on y/y rates means they are both slaves to what may be aberrant base effects and less able to pinpoint short-term turning points. We have frequently highlighted that seasonally adjusted m/m CPI data are offering a much more benign inflation backdrop. But, as we highlight below, officially computed seasonally adjusted - but m/m presented - earnings data also offer a very much more benign cost picture than y/y numbers (Figure 1) with every likelihood that this may trigger a fresh dose of downward pressure on CPI inflation. Surely, this is likely to temper what is clearly at the core of the BoE’s worries about inflation persistence.

There have been inflation signs of late to reassure the BoE. The Bank may be calmed as various alternative y/y measures of core and underlying inflation have started to fall and where seasonally adjusted core prices eased further in October. However, recent months suggest that this slowing in core m/m adjusted inflation has not intensified, instead with recent underlying inflation remaining close to target on a smoothed m/m adjusted basis. Regardless, it may be that downside economy risks are now taking precedence for the MPC majority but where some on the MPC want to see more convincing evidence that wage inflation is abating, possibly anticipating that the weaker economic outlook will reinforce disinflationary signals, particularly on wages.