Published: 2025-11-25T18:23:59.000Z

Preview: Due December 1 - U.S. November ISM Manufacturing - Firmer but still short of neutral

3

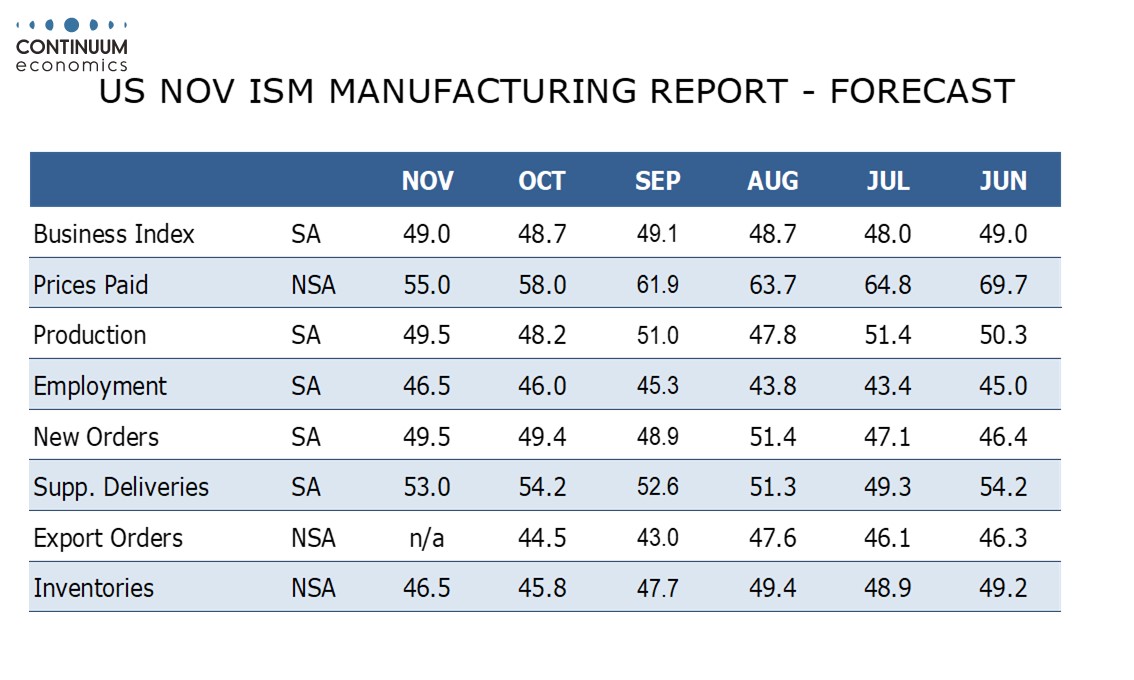

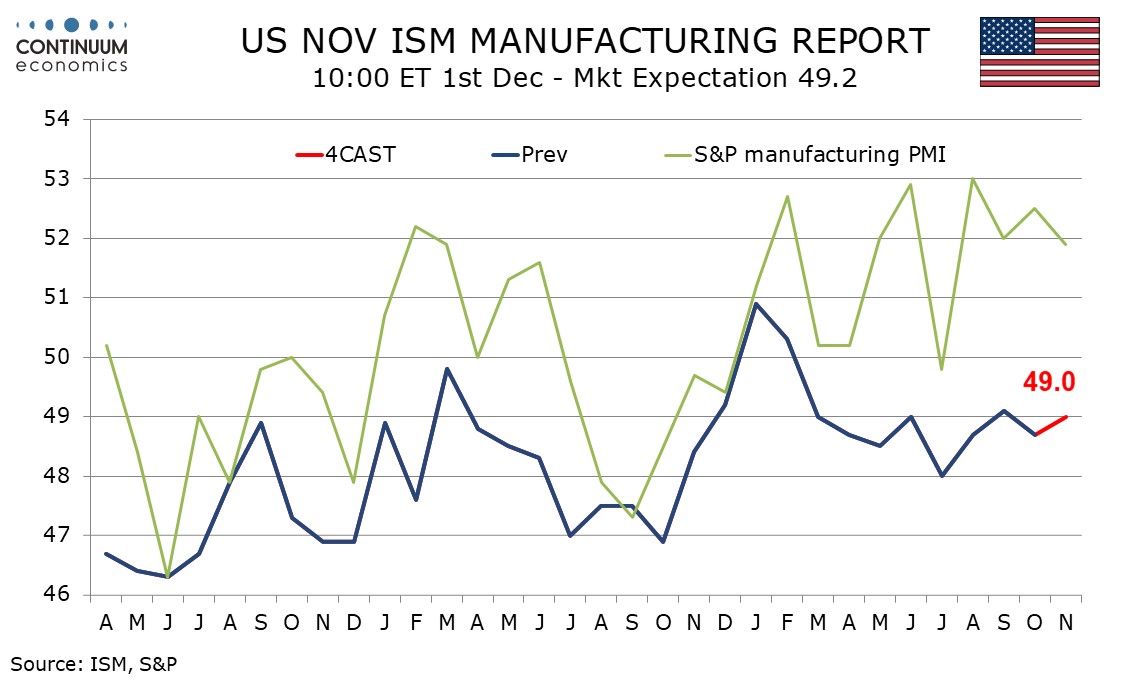

We expect November’s ISM manufacturing index to see a modest increase to 49.0 from 48.7 in October, while remaining slightly below September’s 49.1 and below the neutral 50 level for a ninth straight month.

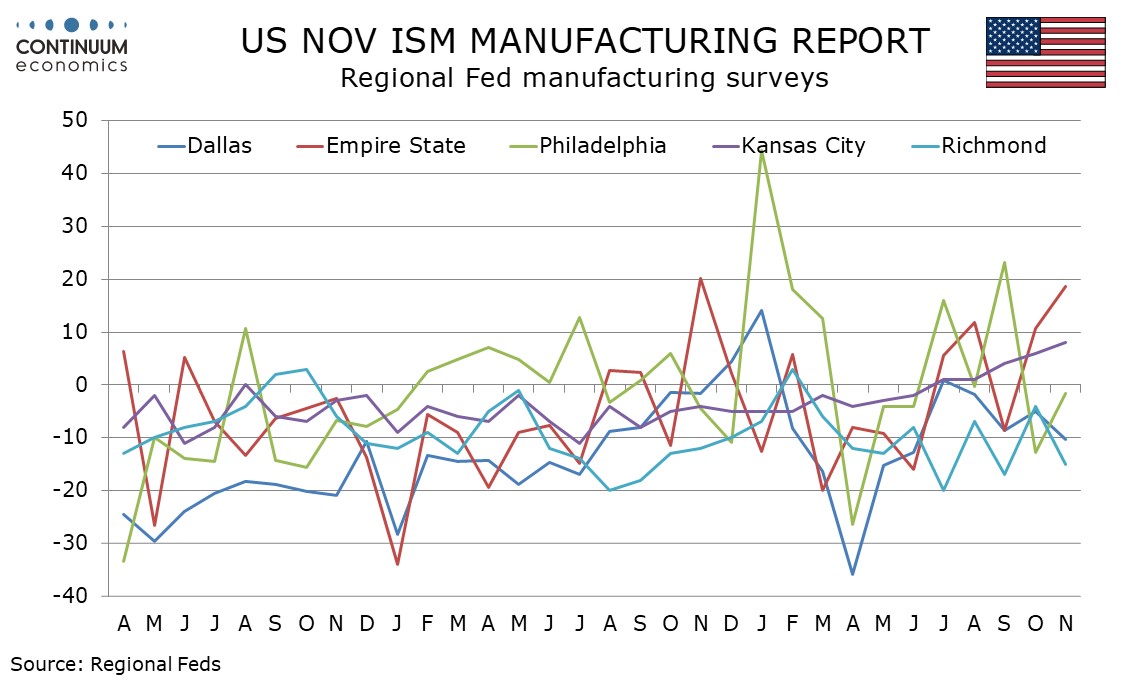

There is little conclusive from other November manufacturing surveys. The S and P index was slightly less positive, the Philly Fed’s slightly less negative, the Kansas City and Empire State indices increasingly positive but the Richmond and Dallas Fed’s increasingly negative.

We expect ISM detail to show new orders little changed at 49.5 but production catching up with new orders from October’s 48.2. We expect a modest improvement in employment to a still weak 46.5 and corrections higher in inventories but lower in delivery times.

Prices paid do not contribute to the composite and here we see a slowing to 55.0 from 58.0. The monthly move will be assisted by oil but will also be a fifth straight decline and the lowest since January, suggesting tariff concerns are fading.