SEK, NOK flows: SEK gains on PMI

Better than expected Swedish manufacturing PMI boosts SEK, but NOK remains the more attractive

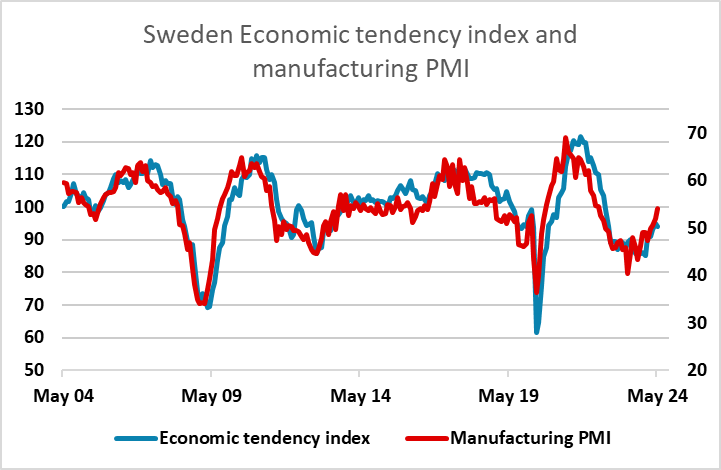

SEK has been boosted by a stronger than expected Swedish manufacturing PMI this morning. This outperformed the economic tendency survey index and manufacturing confidence index reported last week. There is a tendency for the PMI to lead the economic tendency survey, so the numbers are supportive for Swedish growth prospects, although at this stage they are only a first indication, and in any case are unlieklyt o influence Riksbank thinking significantly. But there should be some upside prospects from short term Swedish rates, as the market is currently pricing in around 38% chance of easing at the June 26 meeting, when governor Theeden has indicated that an easing is unlikely. Today’s data only support this view.

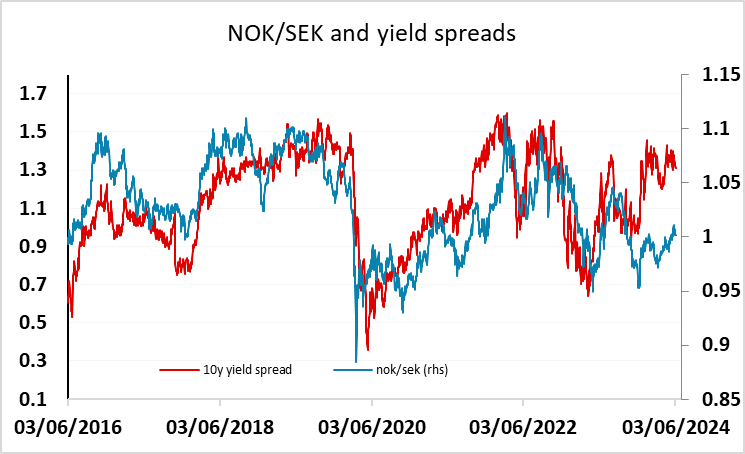

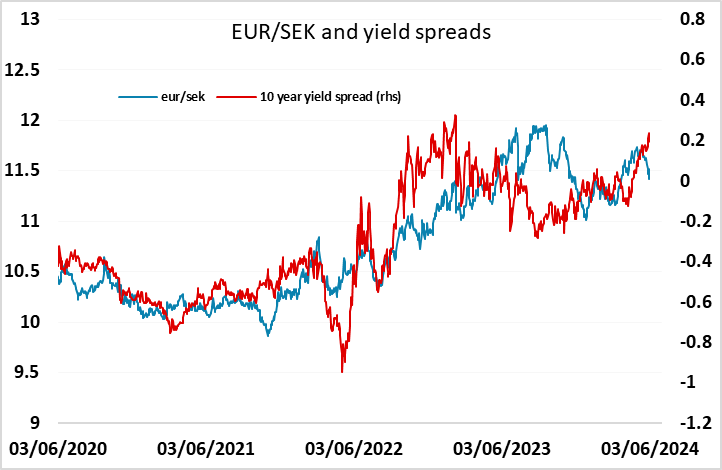

Even so, yield spreads don’t suggest there is a lot of downside here for EUR/SEK, so the 4 figure decline we have seen on the data may be the limit for now. There is still more of case for a decline in EUR/NOK with NOK/SEK looking too low relative to yield spreads.