JPY flows: Options for the BoJ

The best plan for the BoJ would be to get the US support to stabilise the JPY. Failing that, intervention is needed soon.

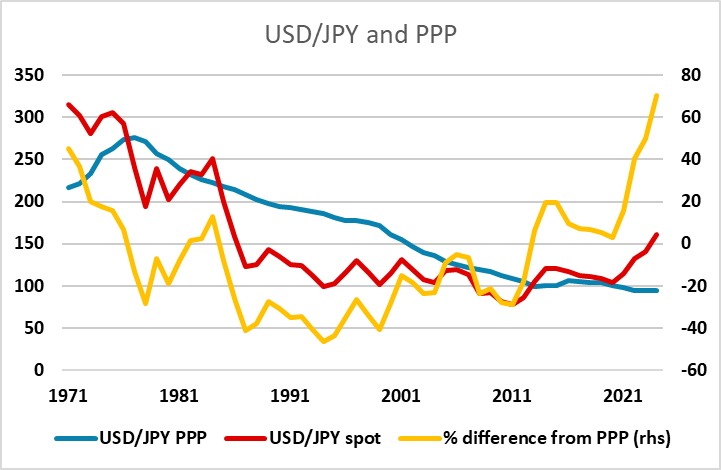

Another fairly quiet overnight session with the market still waiting for some Bank of Japan action in response to the new 38 year high in USD/JPY (and the new 32 year high in EUR/JPY) recorded on Wednesday. Of course, as we have pointed out before, this still seriously understates how weak the JPY is, as in real terms we are at all time lows.

However, the BoJ/Japanese authorities have several issues to consider. First of all, what do they want? From an FX perspective, they would ideally like a stable JPY at fair levels, but that now looks unachievable, as with USD/JPY around 70% above fair value, fair value will involve a very large JPY appreciation. In the end, USD/JPY is likely to return to something close to fair value, so the BoJ’s objective must be to ensure that doesn’t happen in too disruptive a manner. While aggressive intervention might reverse a lot of the recent JPY weakness, it could cause undesirably rapid JPY appreciation. Nevertheless, with USD/JPY up almost 15% this year, an initial sharp USD/JPY decline of 10% or more would not be a concern.

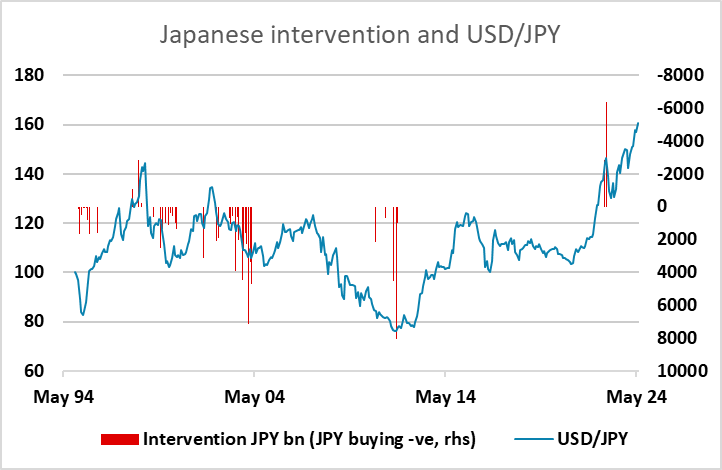

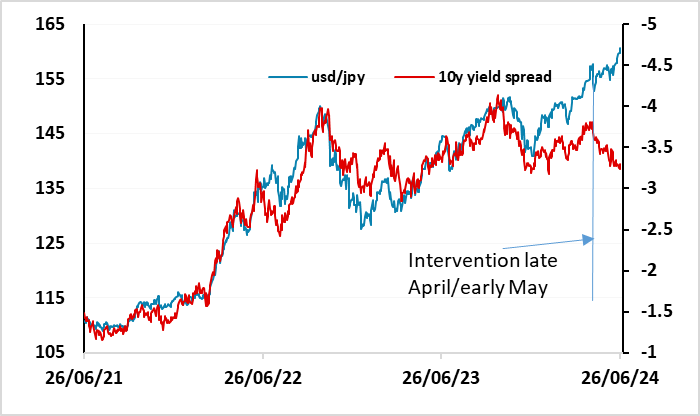

But how effective would intervention be? History suggests that it would be a lot more effective if they could get the Fed involved. While the BoJ have effectively unlimited ammunition, in practice it has always had more impact when there has been co-ordinated intervention from the central banks, especially when the central bank of the stronger currency gets involved. The last intervention in late April/early May appears to have had the opposite effect to that desired. While USD/JPY was being driven higher by widening yield spreads before that intervention, it has subsequently continued higher with yield spreads narrowing. The BoJ may therefore be concerned that more intervention could do more harm than good, unless they are prepared to get involved in very regular intervention.

So ideally, they would like to see the market return to more normal behaviour involving USD/JPY moving with yield spreads. That should allow a substantial initial JPY recovery (as yield spreads point to USD/JPY below 150) and more gradual longer term JPY gains. But at the moment they are doing little to achieve that, and inaction which allows further JPY depreciation will only mean a more disorderly eventual JPY recovery. The ideal solution would probably be to get Yellen and others to offer at least verbal support. Failing that, intervention is needed to shock the market.