USD, JPY flows: JPY weaker after UMich data

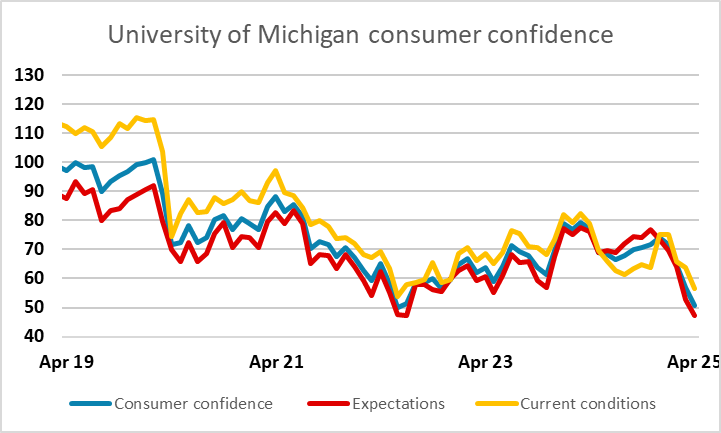

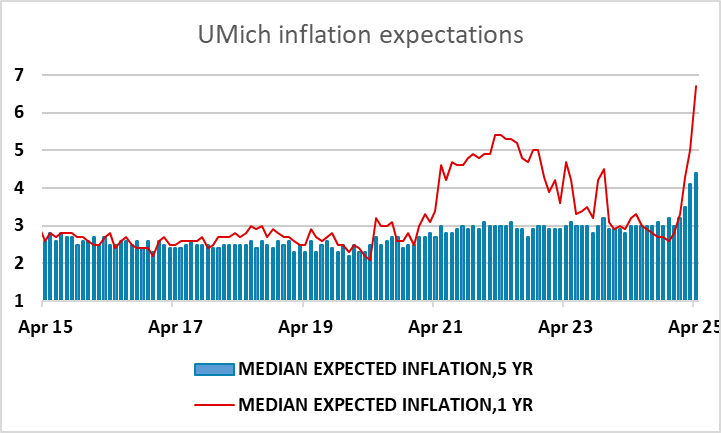

University of Michigan sentiment data shows further weakness in confidence and further rise in inflation expectations, but moves slightly smaller than expected. JPY correction lower looks near complete

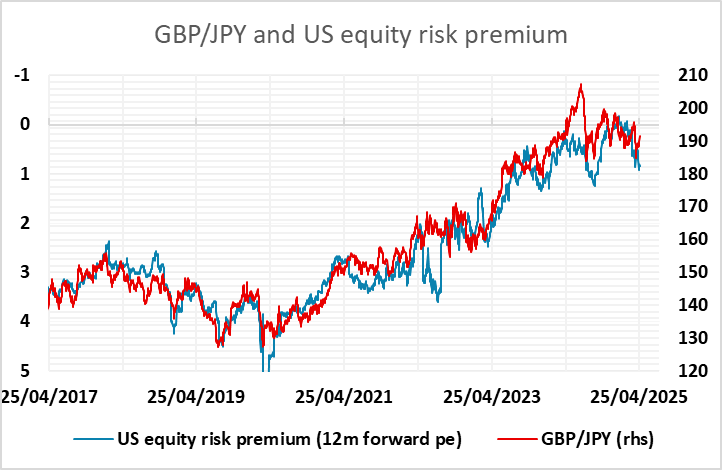

The University of Michigan consumer confidence index continued to decline in April, and inflation expectations continued to rise, but the decline in confidence was slightly less than expected, as was the rise in inflation expectations. This is small comfort, but seems to have helped risk appetite, as equities have edged higher and the JPY has fallen across the board, building on the weakness seen at the cash equity market open.

However, it’s hard to interpret this data as anything other than negative from a big picture perspective, and we would see the JPY decline as providing a selling opportunity, completing the corrective phase seem since the break below 140 this week. JPY crosses also look to be key retracement levels and ripe for a turn.