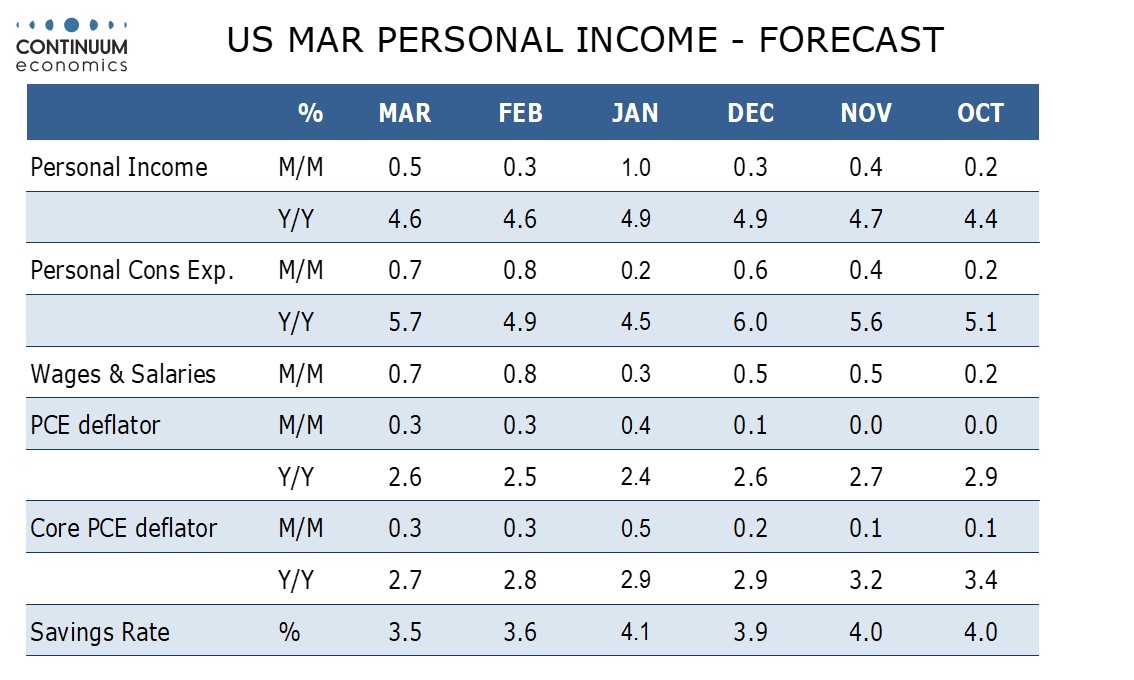

Preview: Due April 26 - U.S. March Personal Income and Spending - Core PCE prices seen less strong than core CPI

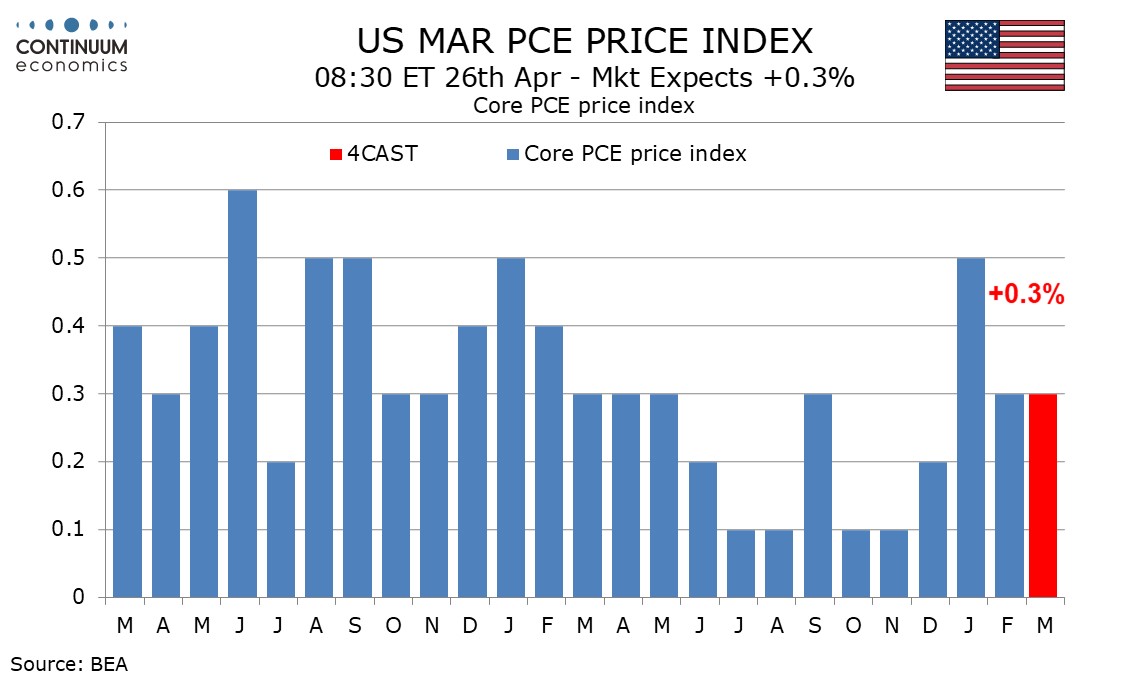

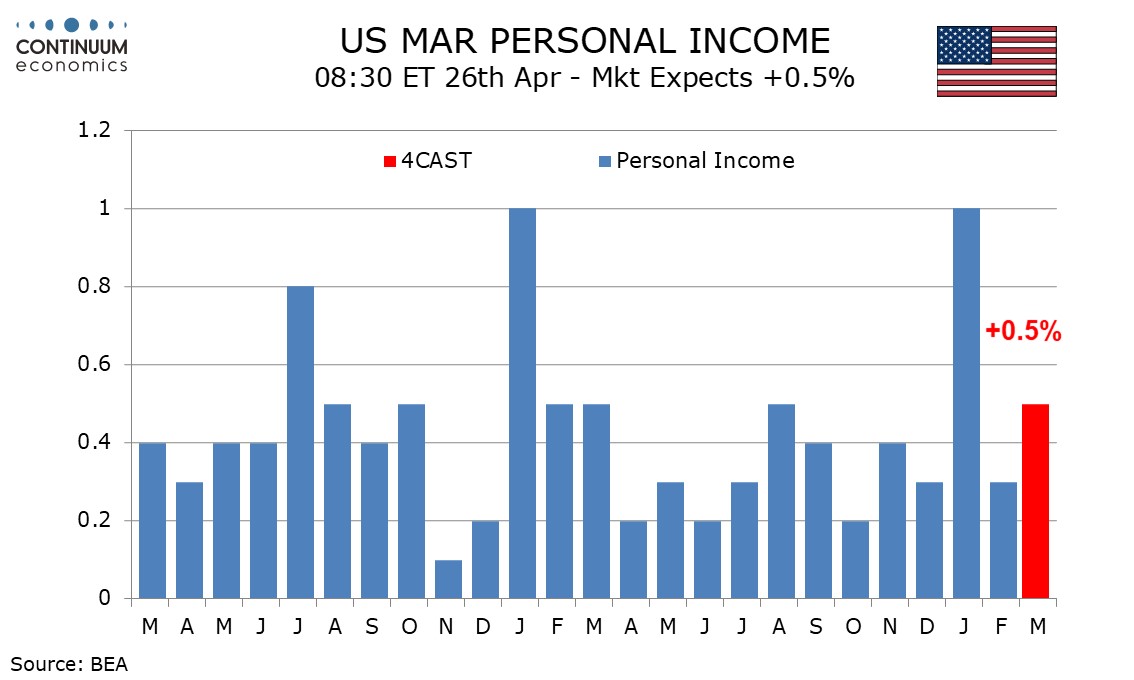

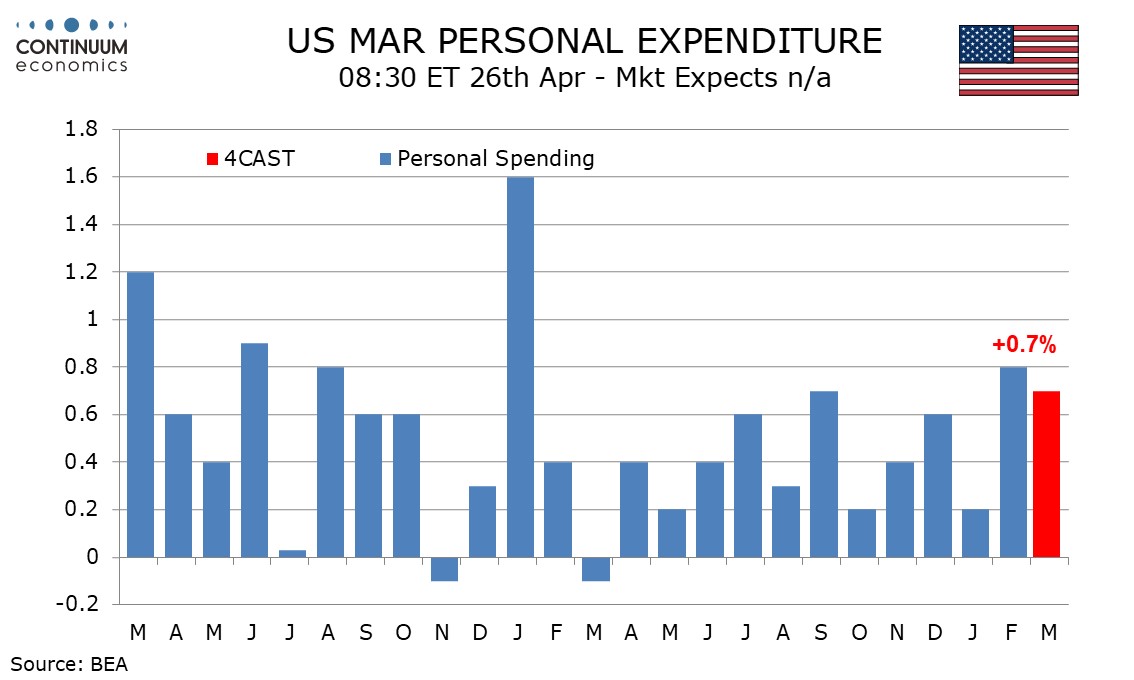

We expect March to deliver a second straight 0.3% increase in the core PCE price index, softer than the third straight 0.4% rise in core CPI, which was up by 0.36% before rounding for a second straight month. We also expect a 0.5% increase in personal income and a 0.7% increase in personal spending.

The data will be largely old news at the time of release, with Q4 totals set to be released with the Q1 GDP report on April 25.

Before rounding we suspect core PCE prices will come in in below 0.3%, similar to a 0.26% increase seen in February. We expect overall PCE prices to also rise by 0.3%, again underperforming a 0.4% increase in overall CPI which was also rounded up. Yr/yr growth would then slip to a 3-year low of 2.7% from 2.8% for core PCE prices but rise to 2.6% from 2.5% for overall PCE prices.

Even with a moderate 0.3% rise in average hourly earnings, a strong rise in employment and a rise in the workweek imply a strong 0.7% increase in wages and salaries. The other components of personal income are unlikely to match this, but we expect a return to trend after February corrected a very strong increase in January, which was inflated by New Year Social Security cost of living adjustments and dividend payments.

Retail sales increased by 0.7% in March and we expect a similar rise from services, though more of the services gain will come from prices than did that of retail sales. Upward revisions to January and February retail sales should further support the Q1 data, though Q1 spending will be led by services with retail sales restrained by a weak and weather-depressed January.