Published: 2025-01-28T15:49:41.000Z

Preview: Due February 3 - U.S. January ISM Manufacturing - A marginal improvement, not quite to neutral

4

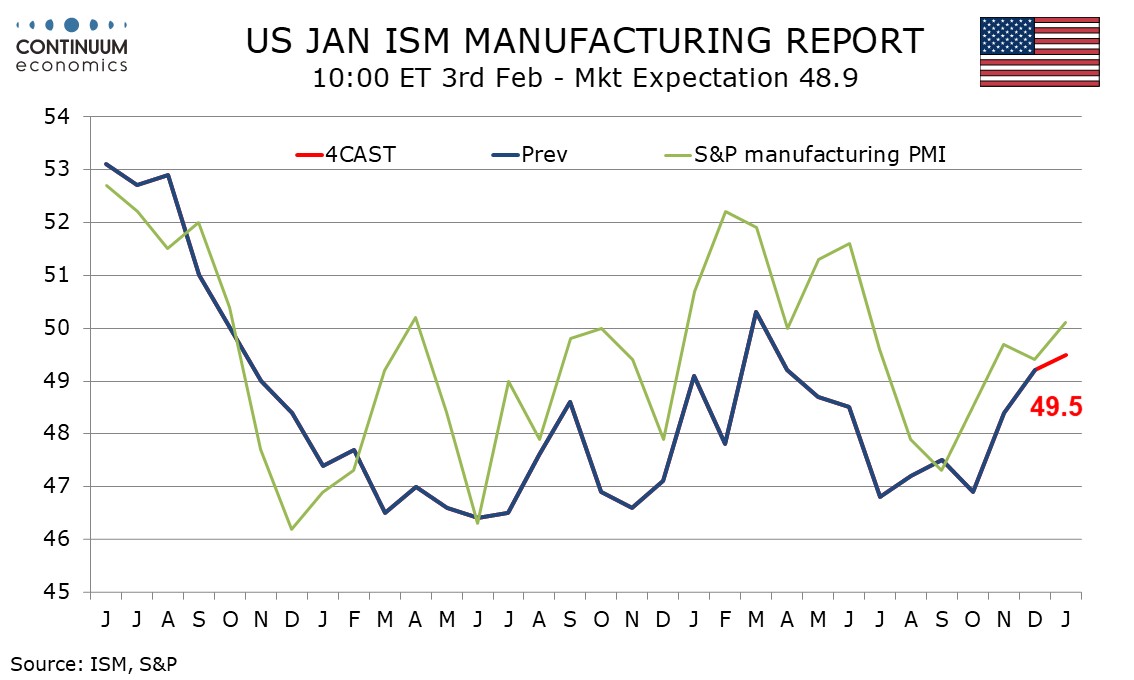

We expect a January 1SM manufacturing index of 49.5 from 49.2 in December, which would be the highest since March 2024 briefly moved above the neutral 50 level.

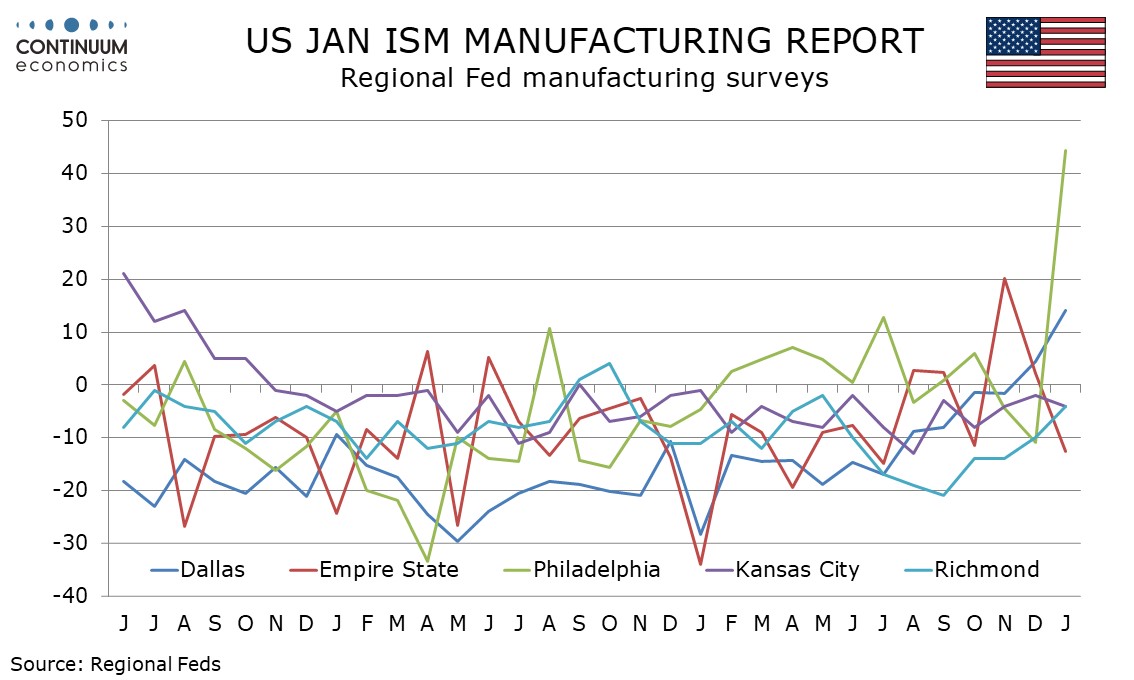

Signals from other surveys are mostly improved, with the S and P manufacturing index nudging above neutral and regional manufacturing surveys on a balance improved, though a very strong Philly Fed survey looks like an outlier.

Against that we note that seasonal adjustments this January are tougher than both those seen in December and January 2023. Bad weather is another downside risk, though probably a minor one for manufacturing. We expect only a modest rise overall.

We expect corrections lower in new orders, and inventories, little change in production, and gains in employment and delivery times to complete the composite breakdown. Prices paid do not contribute to the composite, and here we expect a modest dip to 51.0 after a stronger December reading of 52.5.