Canada December CPI - Still stubbornly high

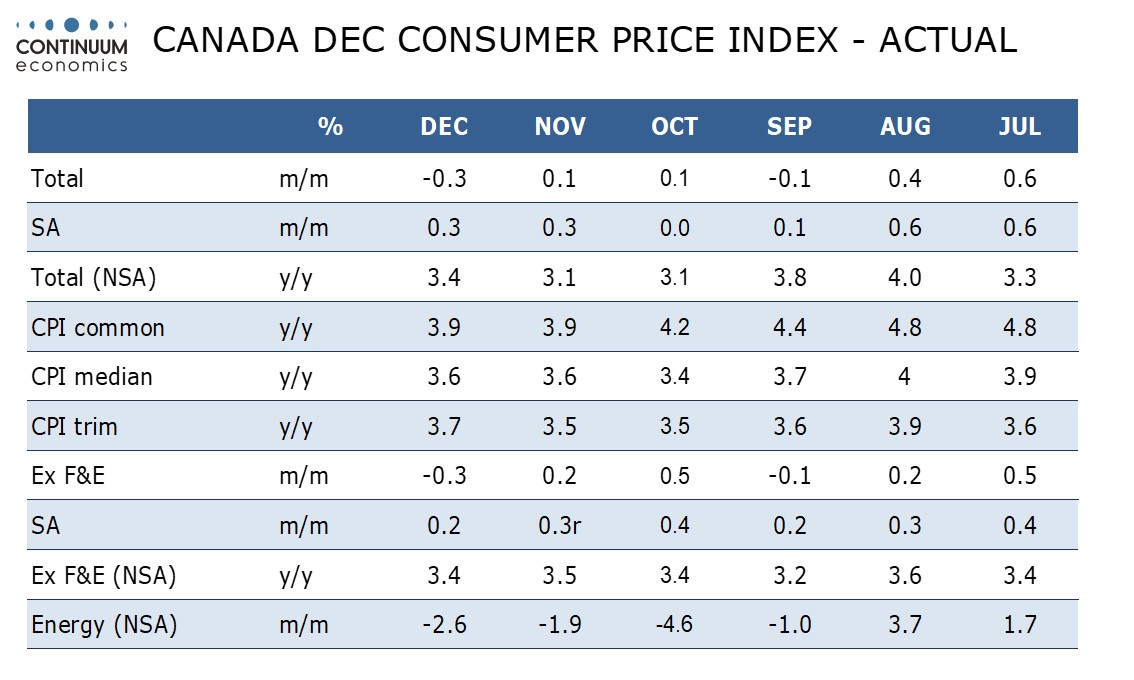

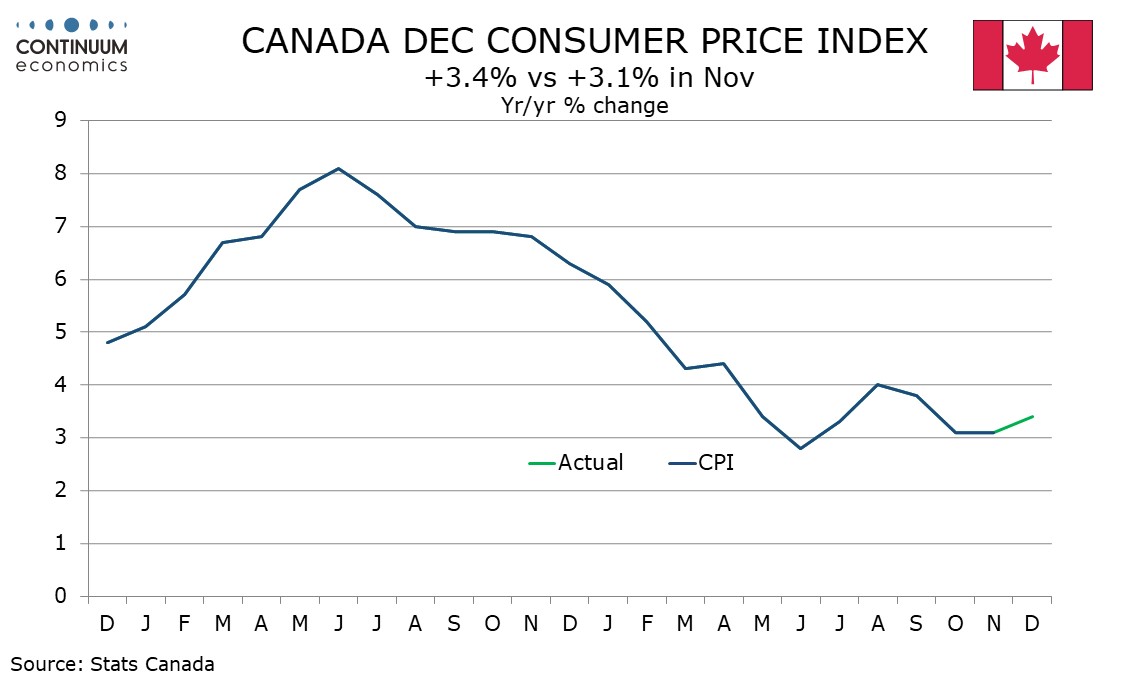

December’s Canadian CPI is spot on expectations but at 3.4% yr/yr accelerated from 3.1%, with disappointment seen in the BoC’s core rates. Despite a near flat economy, Canadian inflation remains stubbornly high.

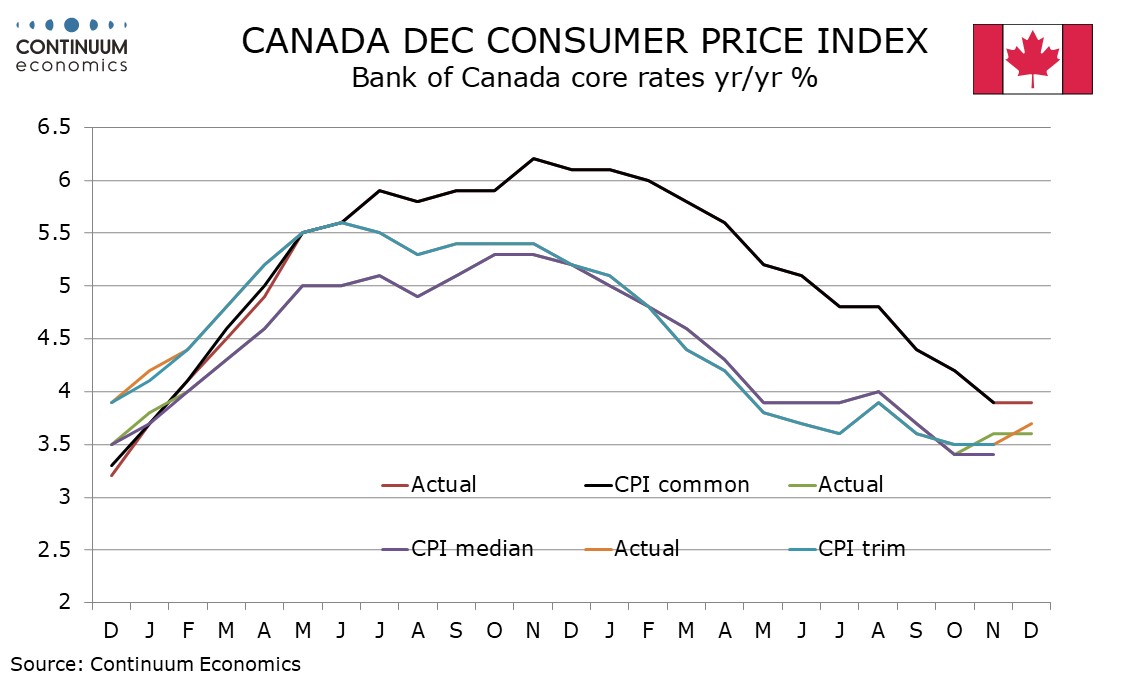

The BoC’s core rates show CPI-common unchanged at 3.9% yr/yr and CPI-median unchanged at 3.6%, but with November revised up from 3.4%. CPI-trim accelerated to 3.7% from 3.5%. The Bank of Canada has been clear that it has concerns that inflationary pressures, while off their peak, may stabilize above the 2% target.

The monthly data shows a 0.3% decline on the month both overall and ex food and energy but this decline is seasonal, with the seasonally adjusted data up by 0.3% overall and 0.2% ex food and energy.

The latter number can be seen as mildly encouraging, being softer than in October and November, but each month of Q4 and Q3 saw seasonally adjusted ex food and energy data with one month at 0.2%, one at 0.3% and one at 0.4%. A 0.3% trend is too high, and consistent with where the BoC’s core rates are on a yr/yr basis. Ex food and energy CPI is not one of the BoC’s core rates, but gives useful insight on the monthly trend.