U.S. October Philly Fed - Details more encouraging than the weak headline

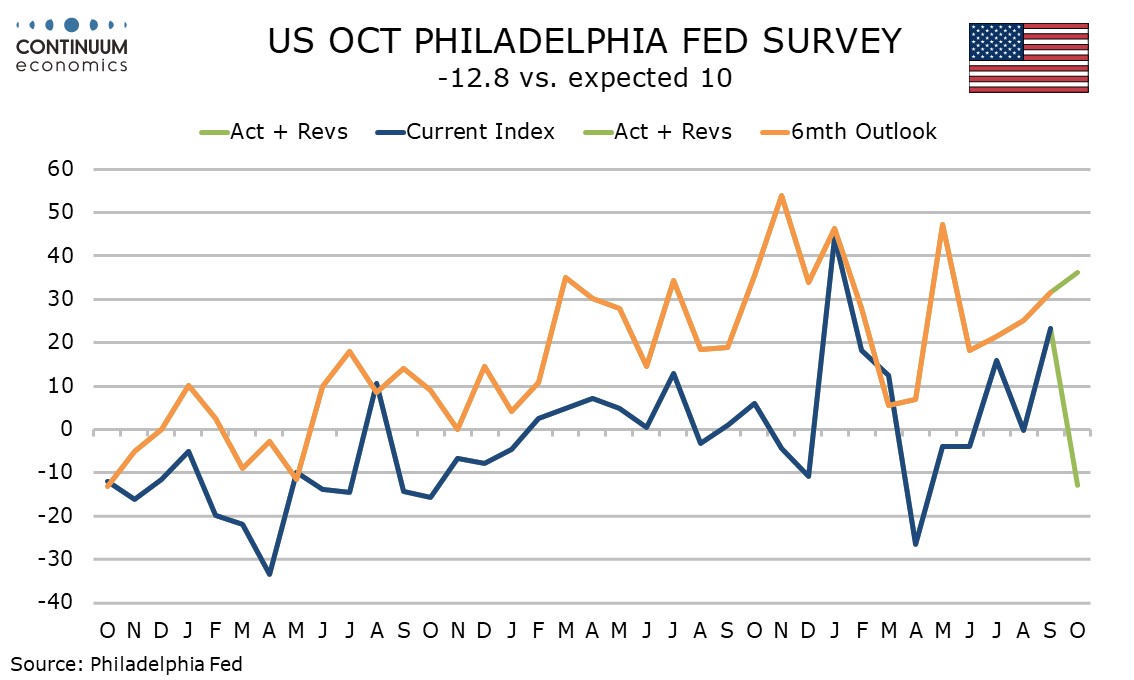

October’s Philly Fed manufacturing index of -12.8 has fallen unexpectedly sharply from the surprisingly strong September reading of 22.3 and is the weakest since April when tariff worries were at their peak. Detail in the report is however more positive.

October’s Empire State manufacturing survey picked up from a weak September. October’s Philly Fed index slipped back from a strong September. The net picture is more balanced, but in both surveys the underlying picture has improved a little from earlier in the year.

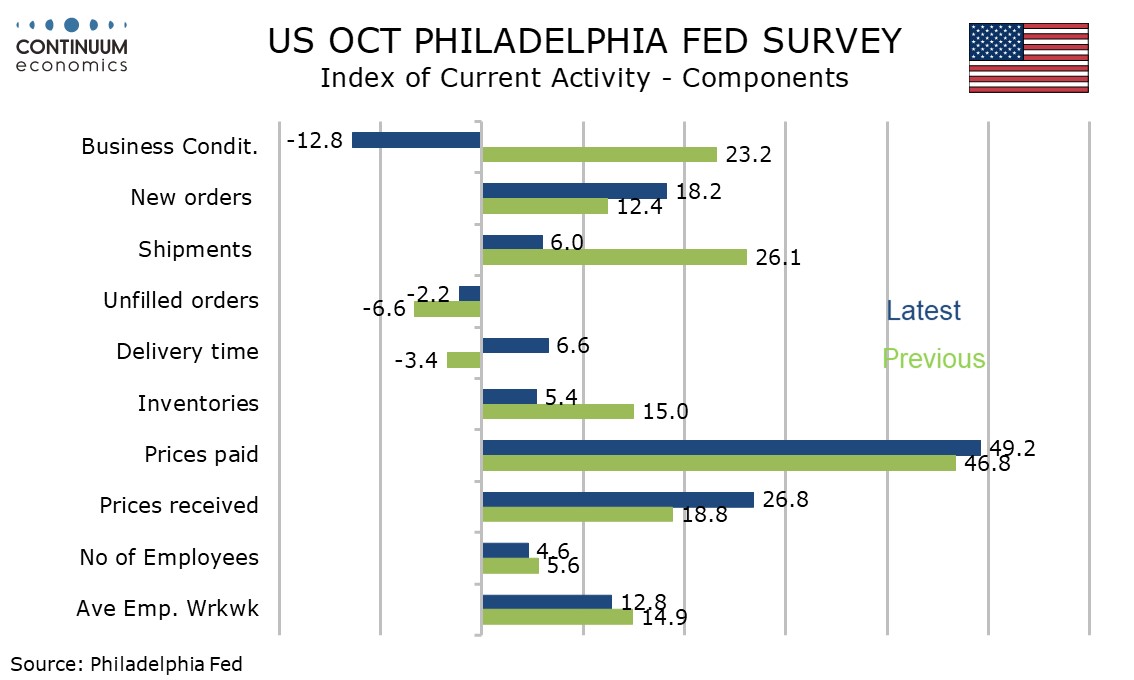

While the Philly Fed headline is weaker new orders present an unusual contrast, actually increasing to 18.2 from 12.4. Employment at 4.6 from 5.6 and the workweek at 12.8 from 14.9 are slower, but still positive. Six month expectations for activity at 36.2 from 31.5 are the strongest since May.

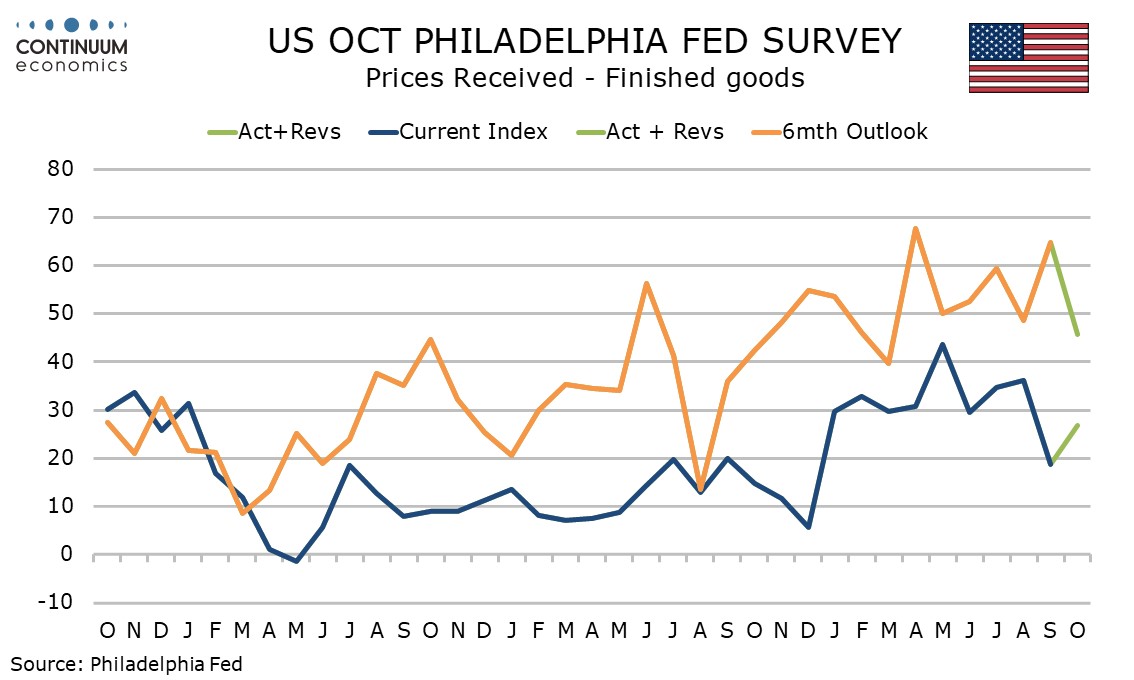

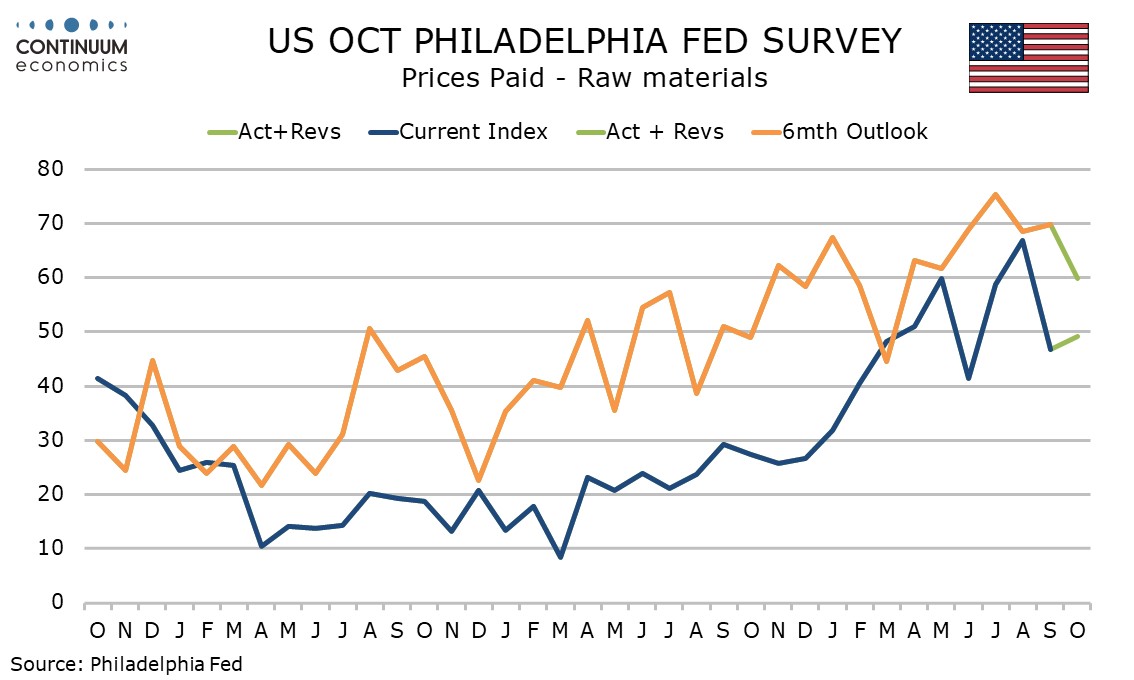

Empire State price data was stronger across the board. The Philly Fed’s is less worrying. Prices paid at 49.2 from 46.8 are stronger, and prices received at 26.8 from 18.8 significantly so, but both are below their respective August readings of 66.8 and 36.1.

Six month expectations for prices slowed, paid to 59.8 from 69.8 and received to 45.7 from 64.8, both their slowest since March. This suggests that plans to raise prices following April’s tariff announcement are now fading.