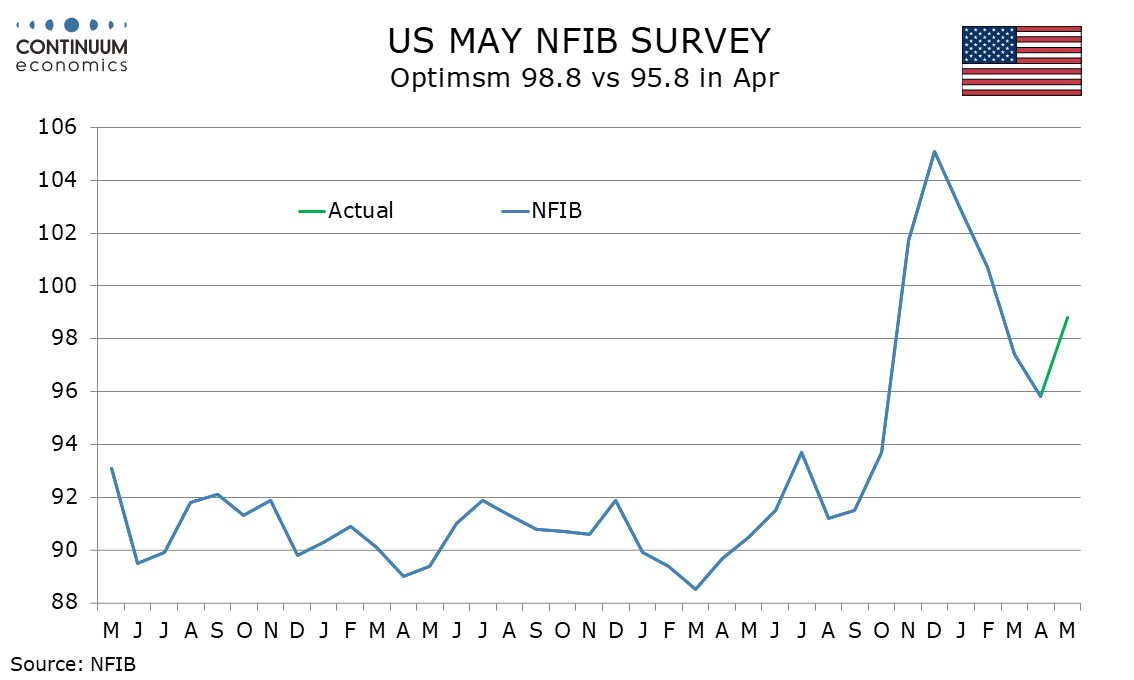

U.S. May NFIB survey suggests tariff worries are easing

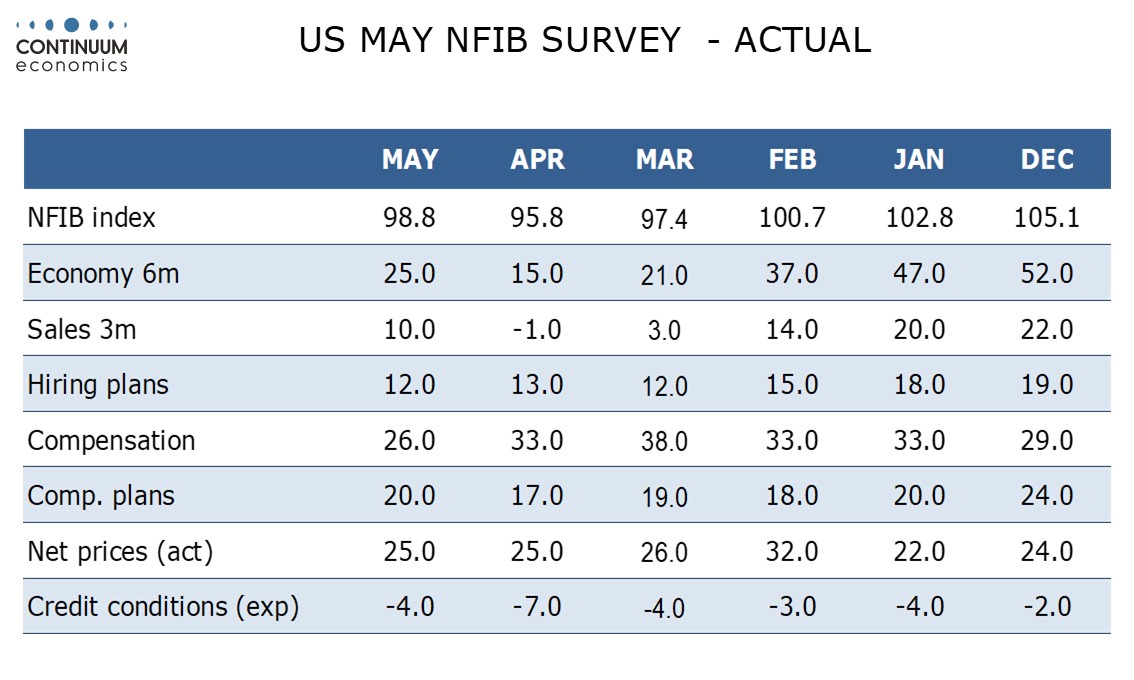

May’s NFIB index of Small Business Optimism at 98.8 from 95.8 corrected from four straight declines brought about by tariff concerns, the reversal of the tariff escalation with China probably significant. These straight declines from December’s 105.1 failed to fully reverse the post-election bounce from October’s 93.7.

A slowdown does persist in hiring plans, which at 12 from 13 returned to March’s level which was the weakest since April 2024. Compensation is also subdued, at 26 from 33 the lowest since February 2021, though compensation plans at 20 from 17 are at a 4-month high.

There is still little evidence of tariffs feeding into inflation with an unchanged net prices index of 25 though expectations for net prices picked up to 31 from 28, reaching their highest since March 2024. If optimism on growth sustains its bounce, forms may find it easier to pass on higher costs.