U.S. Decmember Industrial Production - Business equipment leading, autos weak

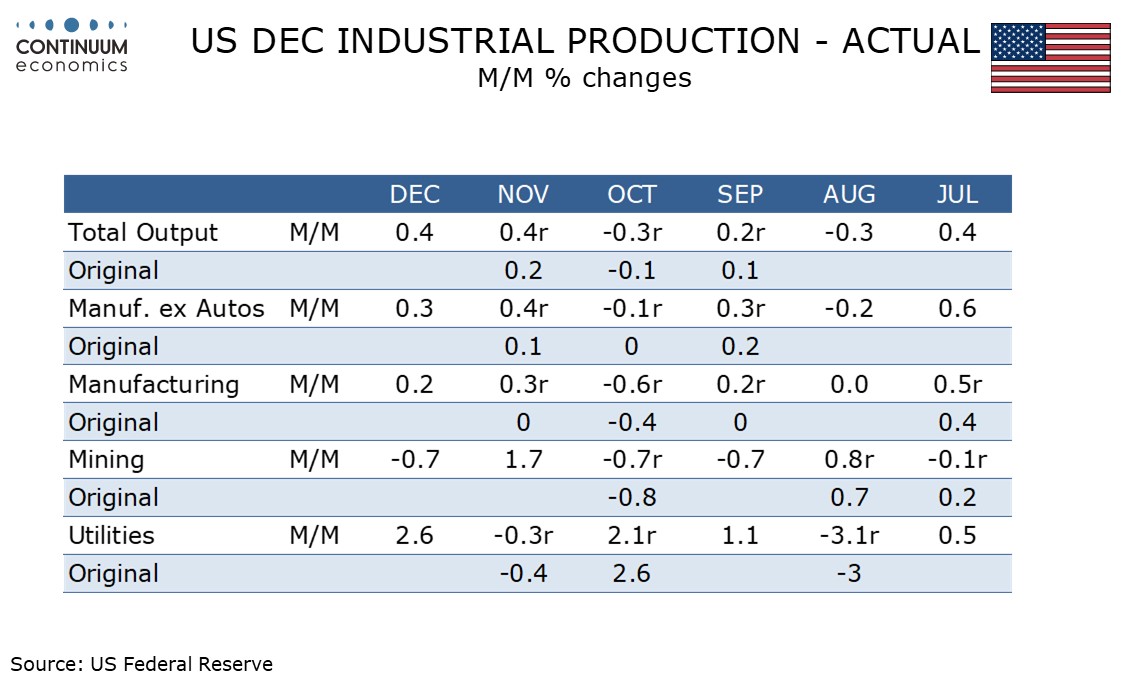

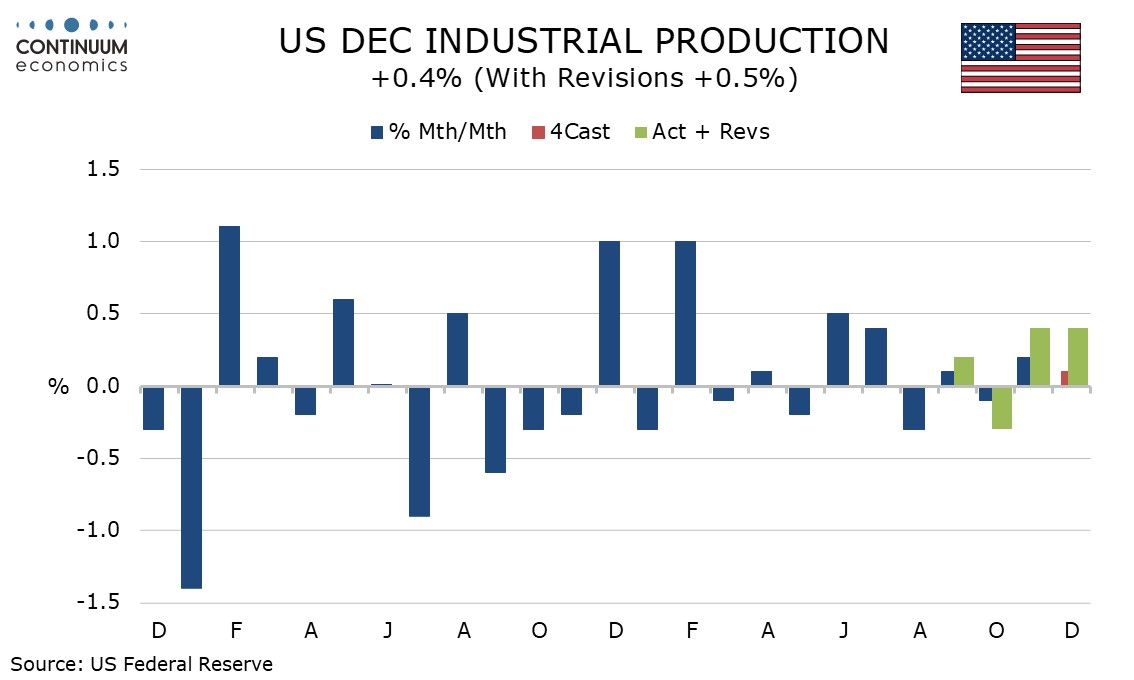

December industrial production is stronger than expected with a 0.4% increase with November revised up to 0.4% from 0.2%, though October was revised down to -0.3% from -0.1%. Manufacturing rose by 0.2%, following an upwardly revised 0.3% in November, but has still not fully erased a downwardly revised 0.6% decline in October. Manufacturing looks firmer excluding autos.

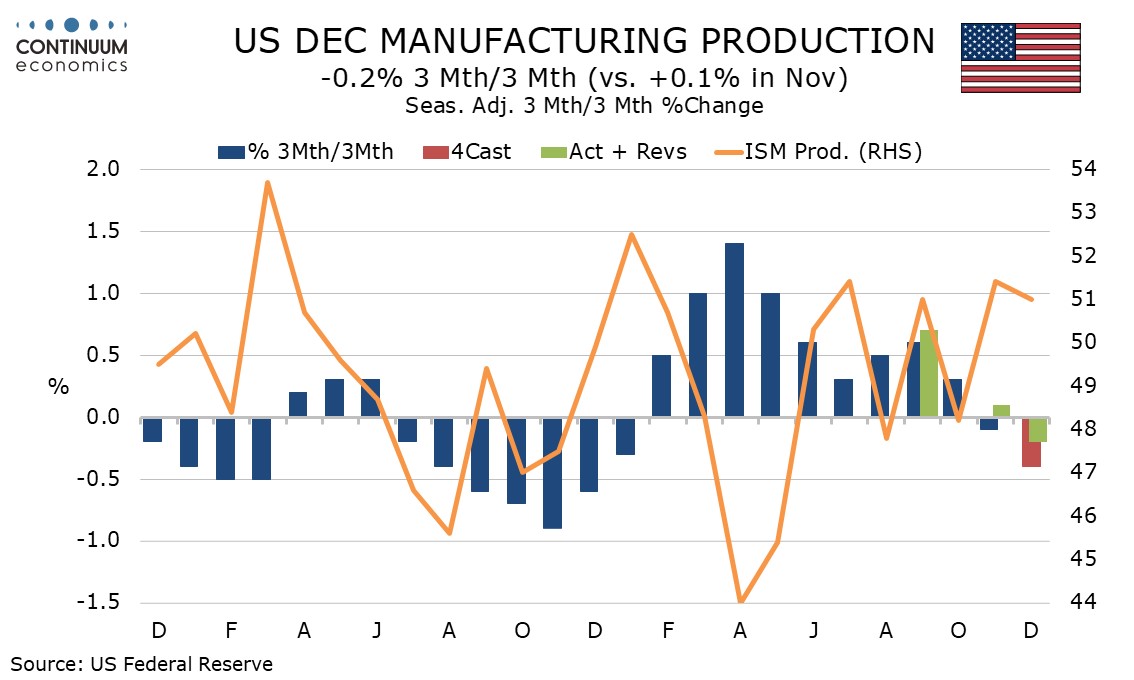

In Q4 industrial production rose by 0.7% annualized, the slowest of four straight gains which left 2025 up by 1.3%, more than fully erasing modest declines in 2023 and 2024. Manufacturing however fell by 0.7% annualized in Q4 though rose by 1.0% in 2025 after a decline of 1.0% in 2024.

December’s monthly gain was led by a 2.6% rise in weather-sensitive utilities which outweighed a 0.7% decline in mining.

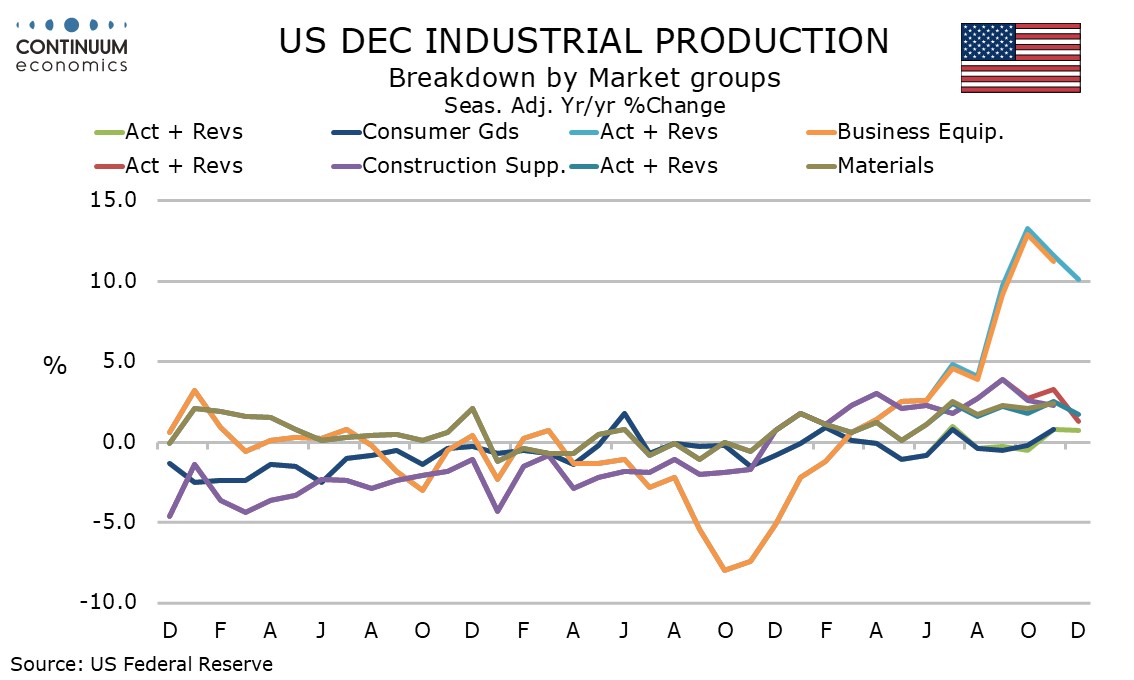

The manufacturing data looks firmer when a fourth straight decline in auto output is excluded, with December up by 0.3% after a rise of 0.4% in November and a decline of only 0.1% in October. Business equipment is particularly firm, up by 0.8% in December and up by 10.1% yr/yr compared to a ruse of only 2.0% yr/yr for overall manufacturing.

The underlying manufacturing picture appears modestly positive, though this appears more due to strong business investment than tariffs. Autos, which are underperforming, have seen plenty of protectionist support, which may have disrupted supply chains linked to Canada and Mexico.