GBP flows: Labour market data marginally GBP negative

Most of the UK labour market data is broadly in line with consensus, but slightly softer wage data from the HMRC could support expectations of a May rate cut from the BoE

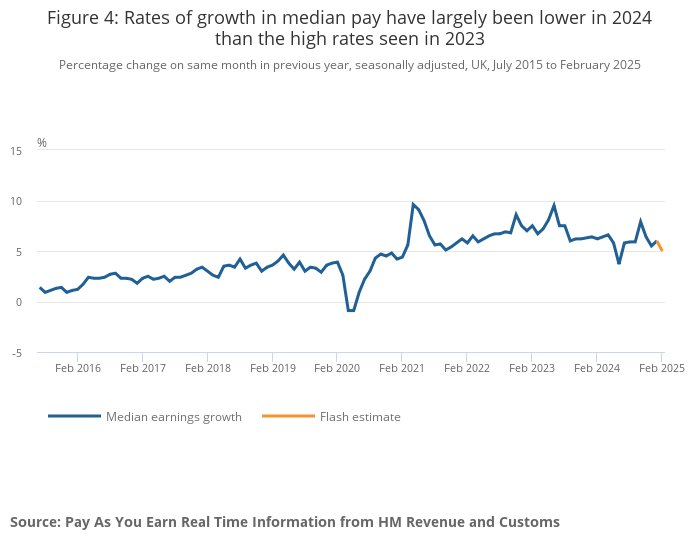

UK labour market data is broadly in line with expectations. The official average earnings data showed the expected 5.8% y/y rise in the 3 months to January, but the more up to date HMRC data on earnings showed a drop to 5.0% y/y in February. The employment data was slightly stronger than expected, with the ONS data showing a rise of 144k in the 3 months to January, and the HMRC data showing a modest 21k m/m rise in February, albeit with a downward revision to the January numbers. However, the claimant count measure showed a 44k rise in February, the highest since August, suggesting some weakness, although these numbers are choppy and attract little attention.

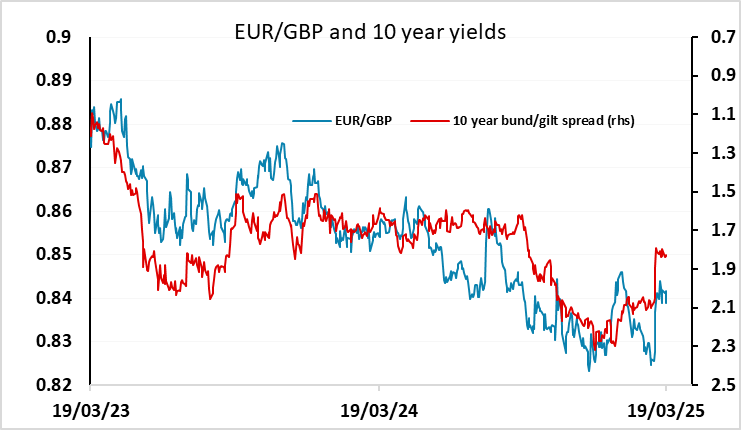

With this generally mixed data there has unsurprisingly been little impact on GBP. The numbers won’t impact the BoE MPC decision later. But if anything the drop to 5.0% in the HMRC wage data will be seen as mildly encouraging for the prospects of a rate cut at the May meeting, so we maintain the view that the risks for GBP are mainly on the downside.