Canada May Retail Sales - Cleary weak

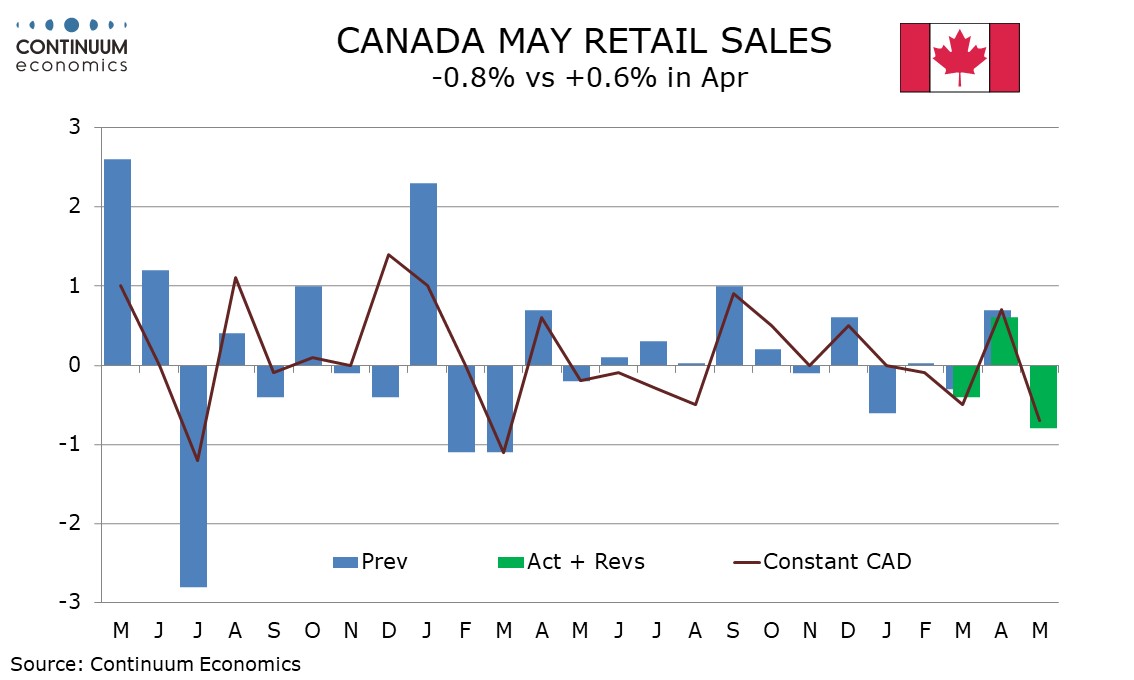

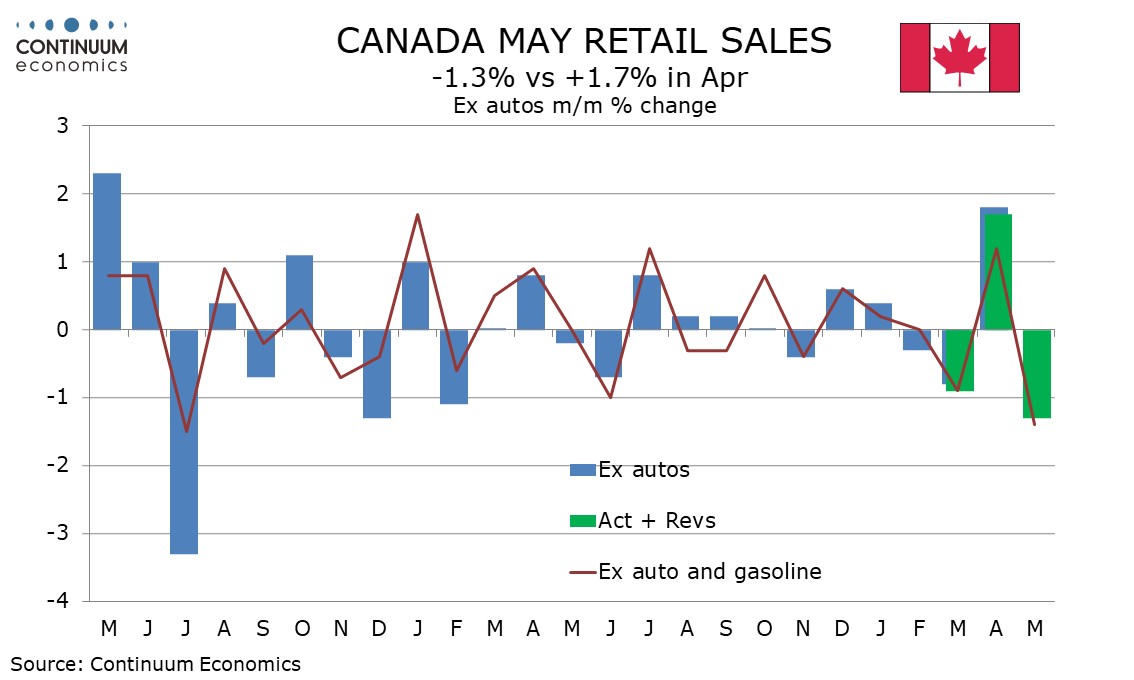

Canada’s May retail sales data is unambiguously weak, with a 0.8% decline overall compared to an advance estimate of -0.6%, a 1.3% fall ex autos, a 1.4% fall ex autos and gasoline, and a 0.7% decline in real terms. The advance estimate for June is also negative at -0.3%.

The data restores a weak trend after April’s stronger data followed a weak March. The July 24 Bank of Canada decision is a close one between a second straight 25bps easing and leaving rates unchanged at 4.75%. We lean towards the latter given limited progress on inflation since the easing seen on June 5, but this data could be used by those arguing for easing.

May’s detail shows broad based weakness outside a 0.8% increase in autos with building materials and food particularly soft at -2.7% and -1.9% respectively. Gasoline showed a 0.6% decline in nominal terms but a 1.0% increase in real terms.