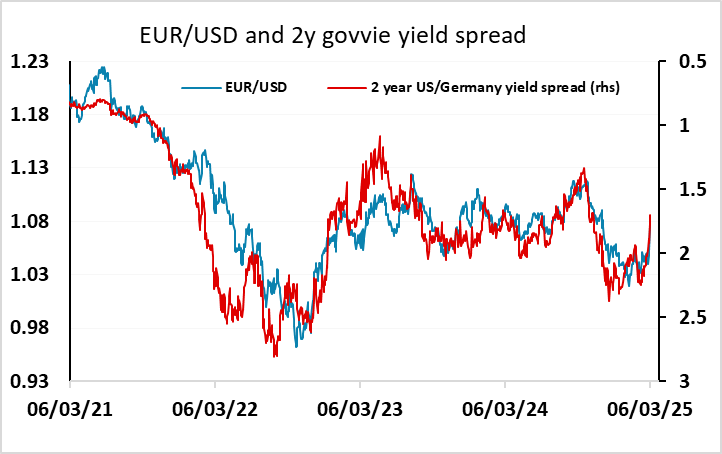

USD, EUR, JPY flows: EUR marginally fimer after ECB, USD remains under pressure

ECB rate cut as expected, statement and comments broadly neutral. USD still under pressure

The ECB is always reluctant to give too much away, but the initial market reaction to the 25bp rate cut and the new set of forecasts saw the EUR edge a little higher. But we wouldn’t see the statement and Lagarde’s subsequent comments as supporting a more hawkish view. The growth risks are still seen to be on the downside, even though Lagarde admits that increased defence and infrastructure spending could add to growth and inflation, while tariffs are expected to weaken growth. And while policy has become “meaningfully less restrictive” according to the statement, this doesn’t mean a great deal for the scope for further easing with only a further 50bps of easing priced in. Front end EUR yields are not significantly changed on the statement, and EUR gains are modest. The EUR should struggle to make further independent gains, although the USD remains under general pressure.

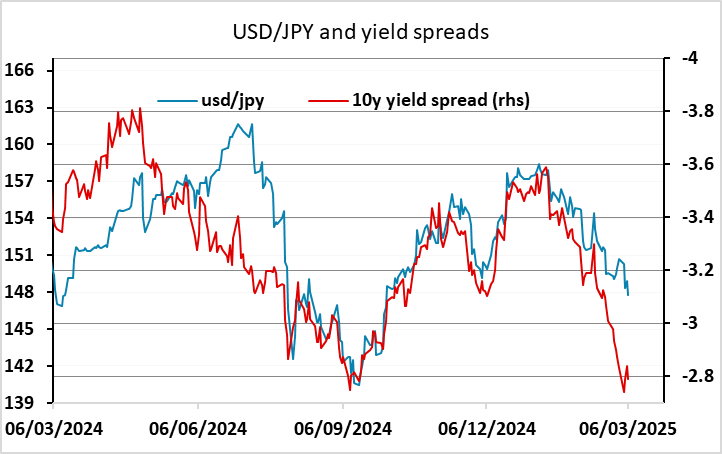

The US initial claims data dipped back to its trend level, but continuing claims rose and the trade deficit went out to a new record level, which will tend to increase the preference of the Trump administration both for tariffs and a lower USD. With equities mostly on the back foot, the JPY continues to have the most potential for gains.