U.S. Initial Claims correct lower, Unit Labor Costs see a strong quarter

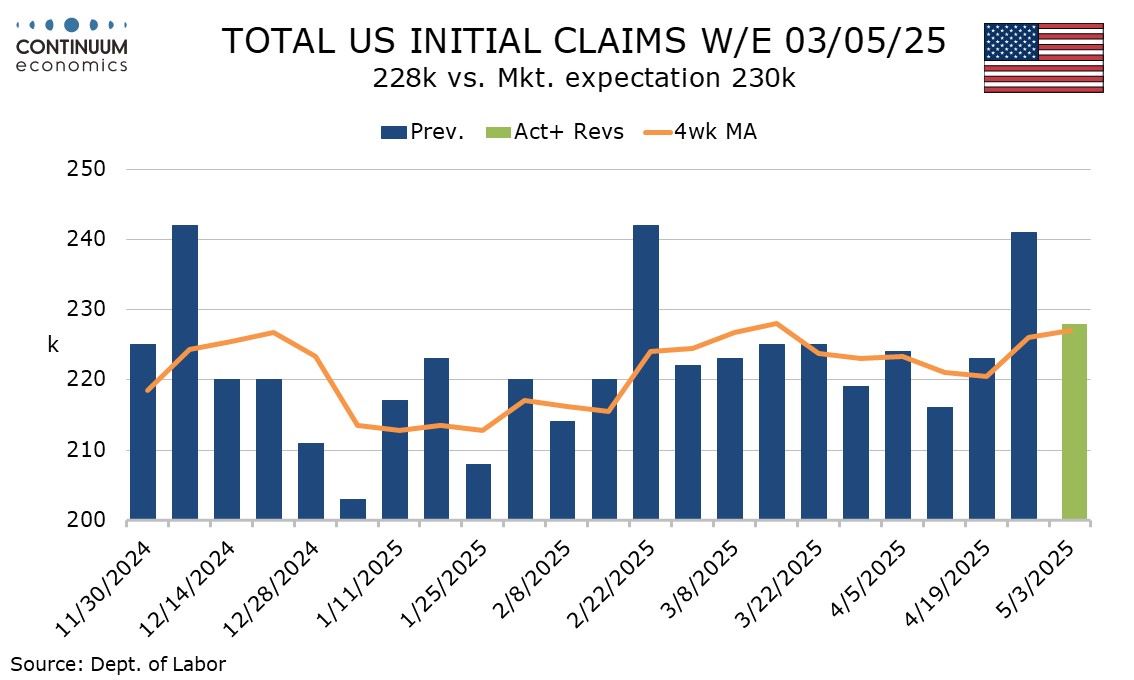

Initial claims at 227k from 241k have reversed most but not all of a spike last week blamed on temporary factors in New York, while continued claims have seen only a partial correction of a sharp preceding rise. A 5.7% increase in Q1 unit labor costs is stronger than expected but above trend.

Last week’s rise in initial claims was seen largely in New York, and seen as largely on temporary layoffs connected to an Easter school break. The latest number is down from that week but otherwise the highest since another holiday influenced week, 22 February which included Presidents’ Day. The latest initial claims number thus suggests some marginal labor market slowing, but not an alarming one.

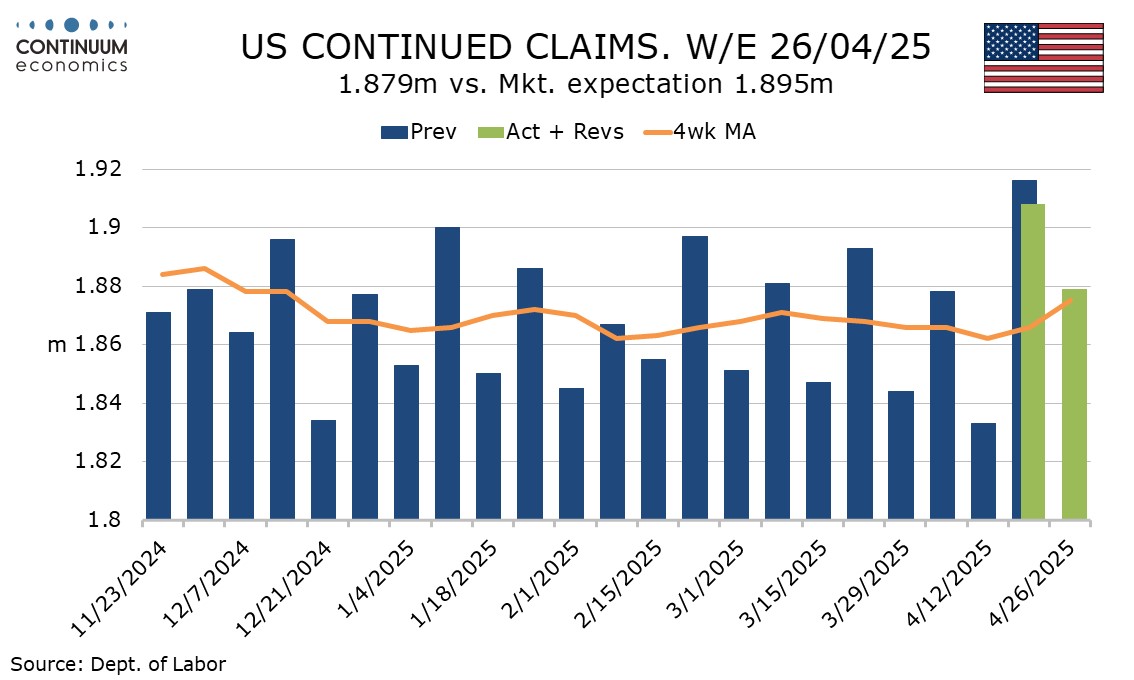

Continued claims cover the week before initial claims and maintain a pattern of alternating direction which has now persisted since December. However a 29k decline to 1.879m after a 75k rise is a modest correction lower, and has the 4-week average starting to move higher after having previously been stable. The 4-week average of 1.875m is the highest since 14 December.

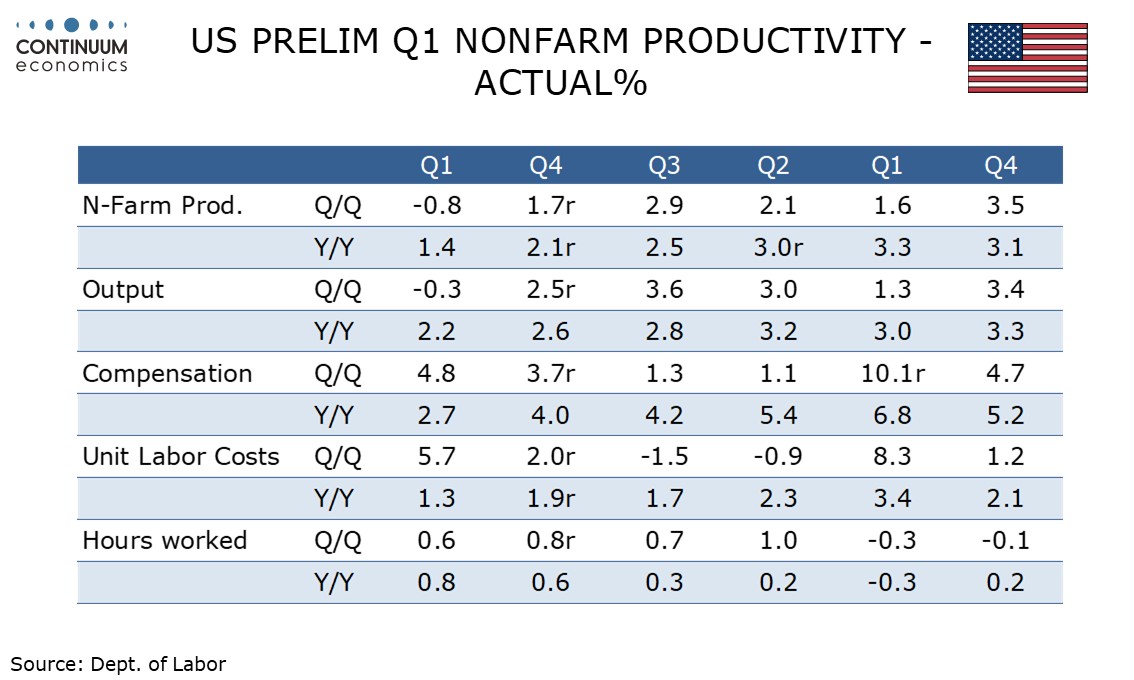

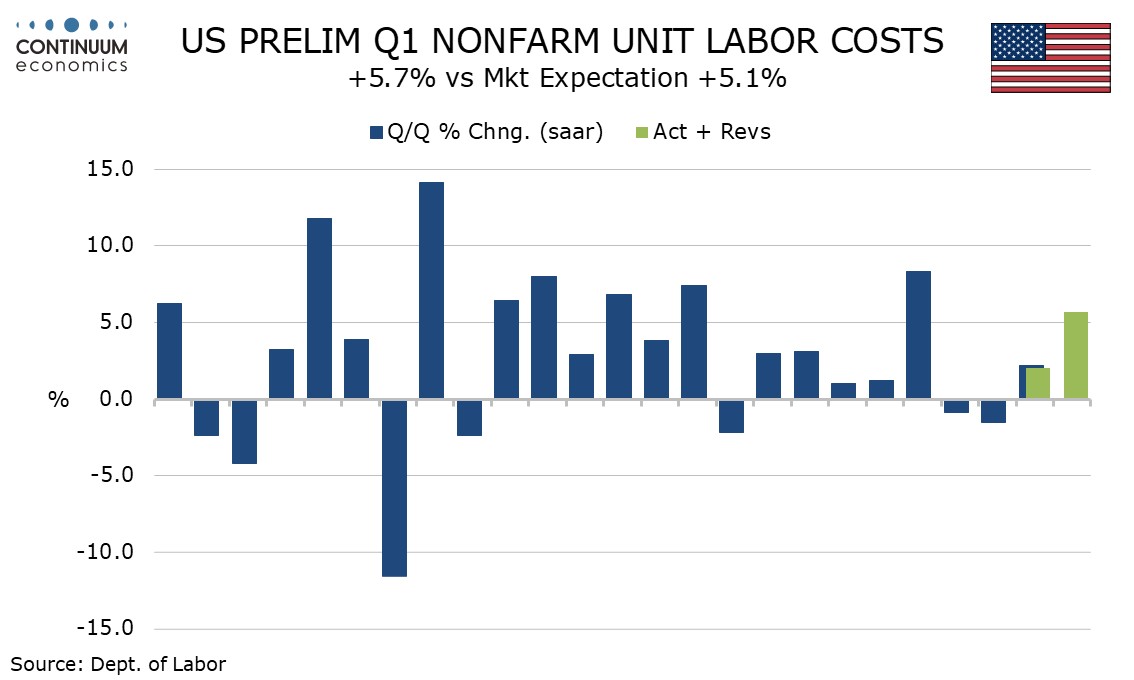

A 0.8% decline in Q1 non-farm productivity is in line with market expectations and comes from a 0.3% decline in non-farm output as implied by GDP data and a moderate 0.6% increase in aggregate hours worked. The upside surprise in unit labor costs, rising by 5.7%, reflects an acceleration in hourly compensation to 4.8%, a 4-quarter high.

Non-labor costs were subdued with a 0.9% increase leaving a 3.5% rise in the overall deflator. That leaves the overall deflator at 2.2%, up from 1.9% in Q4 but broadly consistent with the Fed’s 2.0% inflation target. It remains to be seen to what extent tariffs will lift non-labor costs. Yr/yr unit labor costs are still modest at 1.3% while yr/yr productivity is up by 1.4%.