GBP flows: GBP dips sharply on weaker than expected CPI

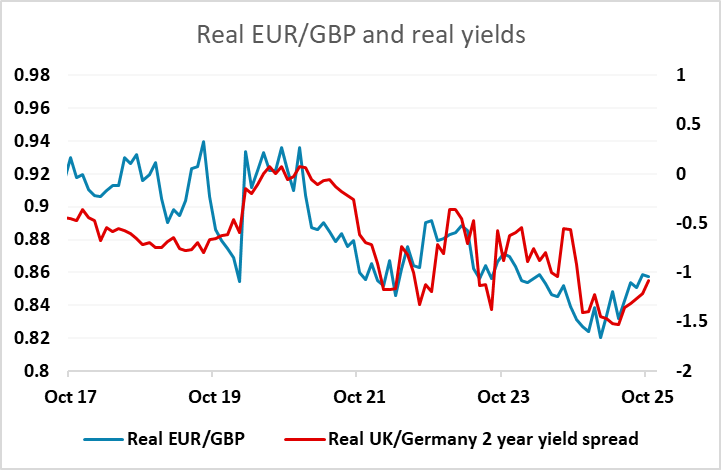

Weaker UK CPI increases chance of earlier UK rate cut and pushes EUR/GBP higher

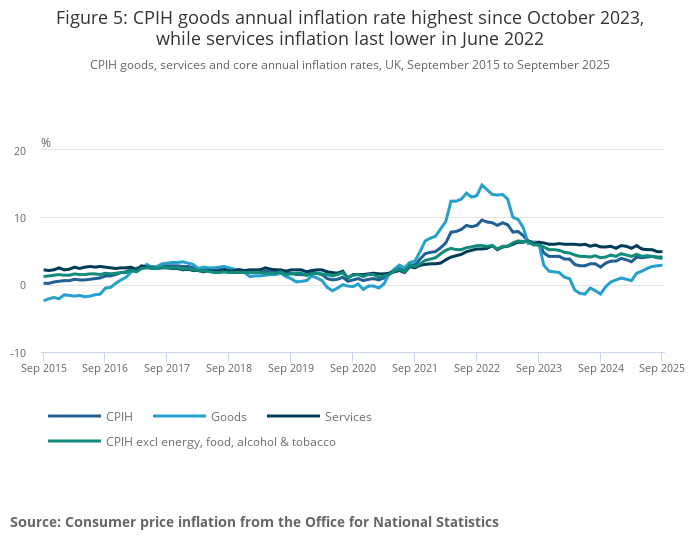

UK September CPI has come in weaker than expected at 3.8% y/y, with the core down to 3.5% y/y, both 0.2% below the market consensus. EUR/GBP has risen 30 pips in response, as markets price in the possibility of an earlier cut in UK rates than was previously expected. However, while this data and the labour market data last week have been on the soft side of expectations, they are still unlikely to be weak enough to convince the hawks at the BoE that a November rate cut is justified. A cut is currently priced as around a 35% chance, up from 15% before the data, but a cut is now seen as a 75% chance by year end.

Nevertheless, UK yields haven’t fallen quite enough to suggest that EUR/GBP will break above the year’s high of 0.8763. The BoE will likely want to see the Budget at the end of November before deciding to cut again, but if this is as contractionary as expected, a December cut looks very likely, and EUR/GBP should be trading on an 0.88 handle by year end.