Published: 2024-11-20T14:00:02.000Z

Preview: Due November 21 - U.S. October Existing Home Sales - Pending home sales suggest a rise

2

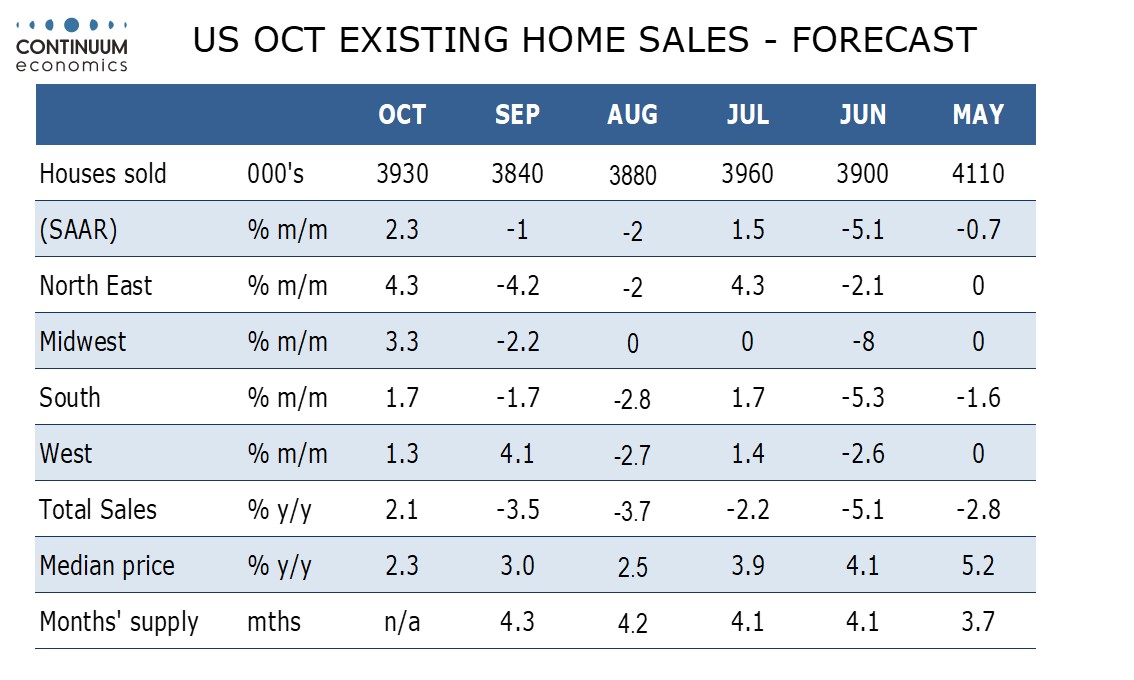

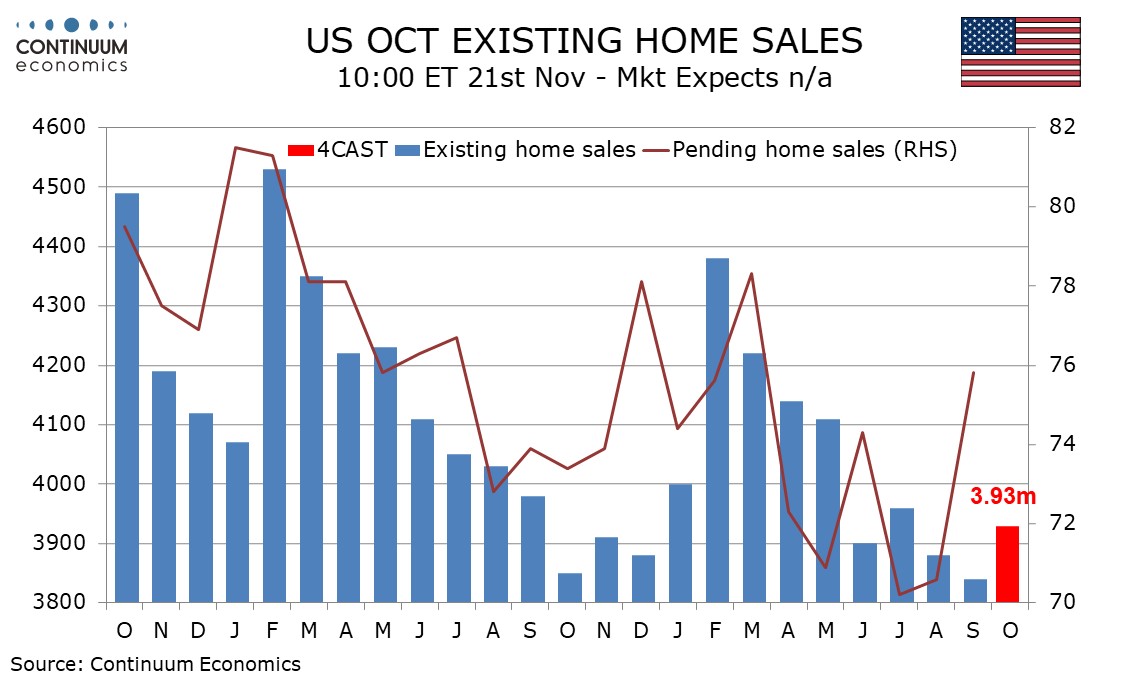

We expect a 2.3% increase in October existing home sales to 3.93m, a moderate rise after declines of 1.0% in September and 2.0% in August, but sufficient to move yr/yr data above zero at 2.1% for the first time since July 2021.

Pending home sales, designed to predict existing home sales, saw a sharp 7.4% bounce in September while survey evidence from the NAHB and MBA also picked up in September in response to the start of Fed easing. However we do not expect existing home sales to rise as sharply as pending home sales and it is too early to conclude that recent positive signals mark a turning in trend.

We expect sales to increase in all four regions though hurricanes may provide some restraint in the South. We expect the median price to show fourth straight decline on the month, by 1.0%, seeing yr/yr growth slip to 2.3% from 3.0%, reaching its lowest since July 2023.