U.S. Initial Claims slip in payroll survey week and September Philly Fed turns positive

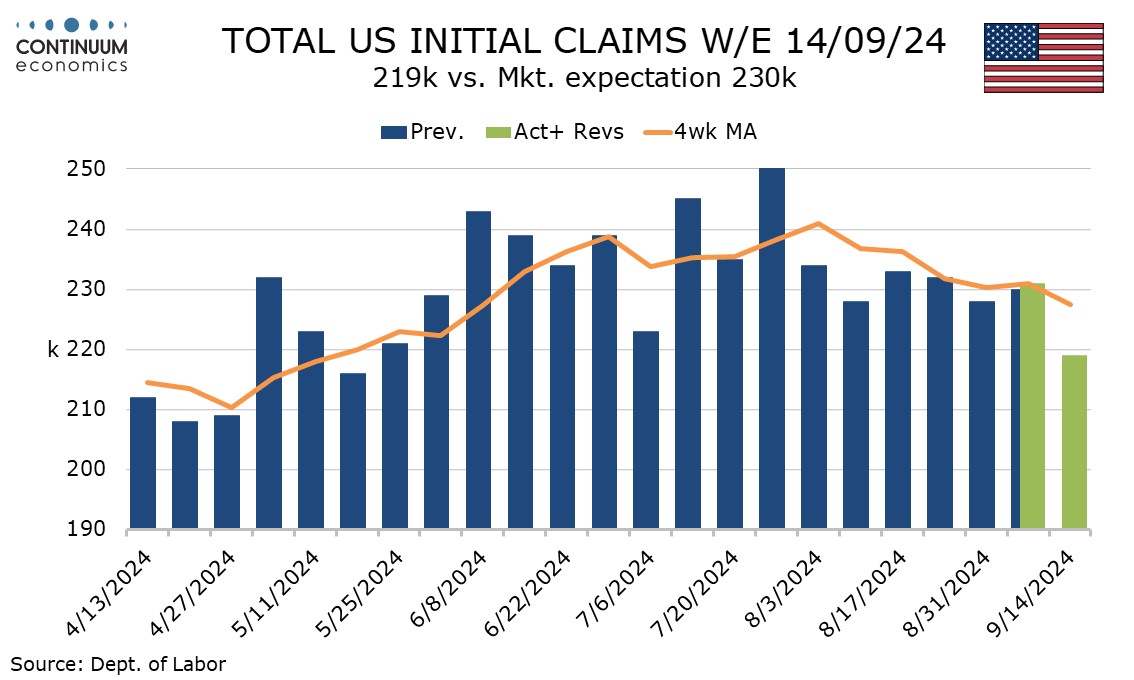

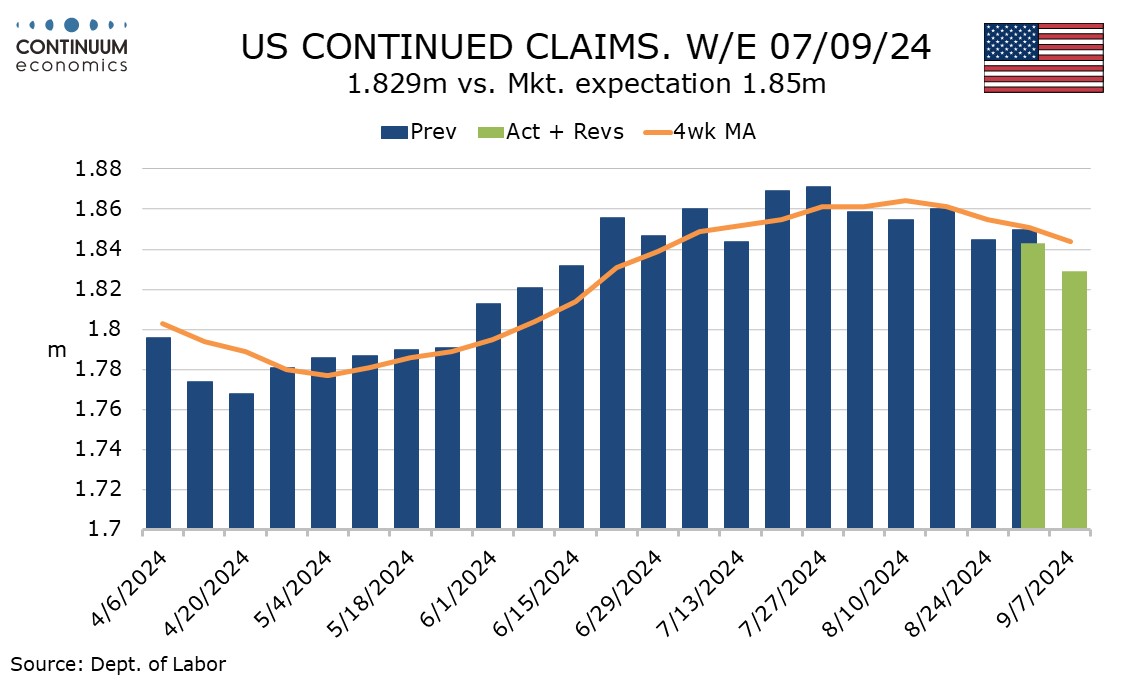

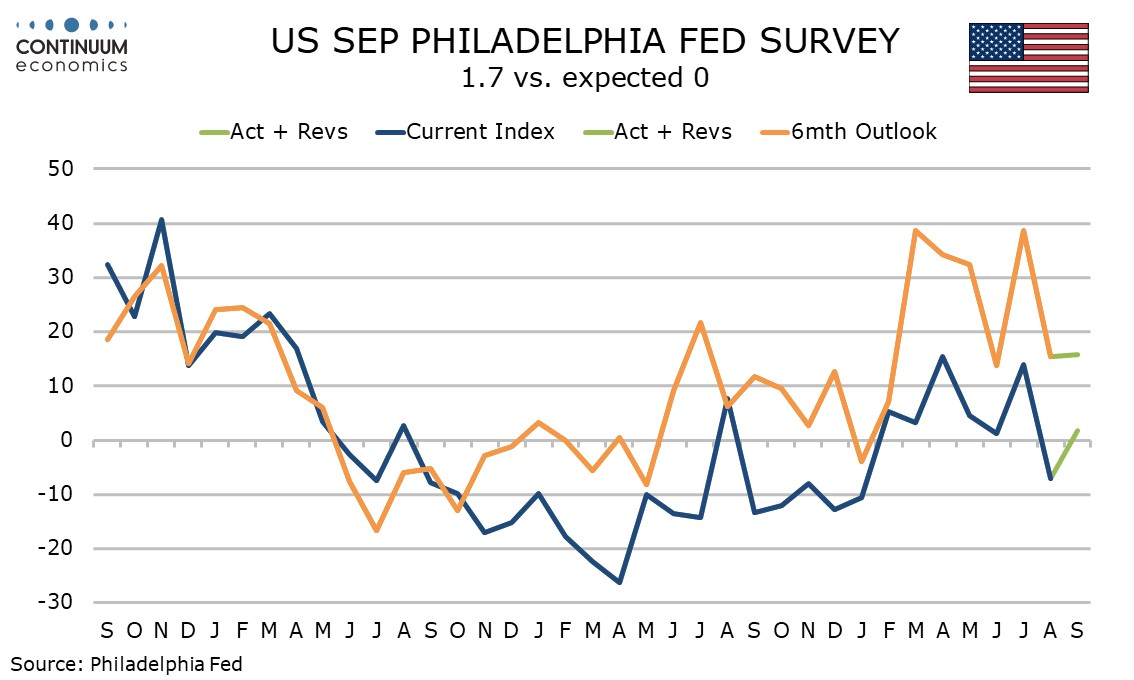

Initial claims at 219k from 231k have fallen to their lowest level since May 18, and this data covers the survey week for September’s non-farm payroll. Continued claims, covering the week before initial claims, at 1.829m from 1.843m are at their lowest since June 8. A positive September Philly Fed manufacturing survey of 1.7 from -7.0 is also marginally stronger than expected.

The initial claims 4-week average of 227.5k compares to 236.25k in the survey week for August’s non-farm payroll, 235.25k in July’s and 233k in June’s, giving hints that September’s payroll could show some improvement from recent disappointing releases.

The continued claims 4-week average is the lowest since June 29.

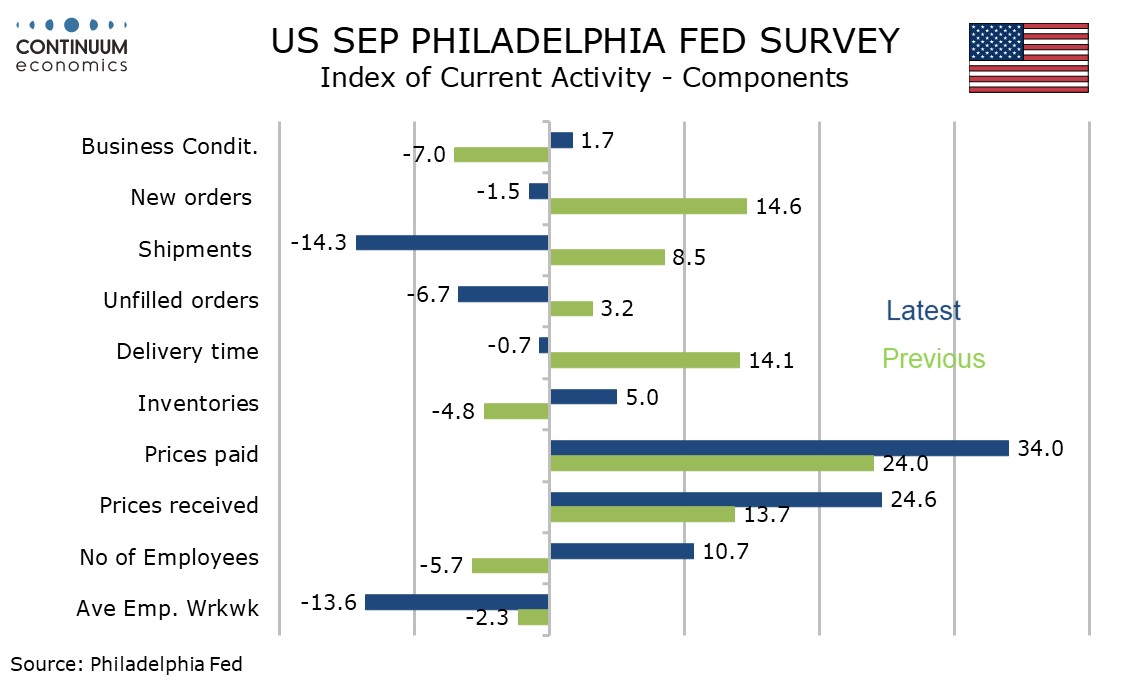

The Philly Fed index has moved back above zero after slipping below in August for the first time since January. The data is less of a break in trend than September’s Empire State survey, which was the first positive since November, but both surveys are improved in September and this follows stronger than expected August manufacturing output.

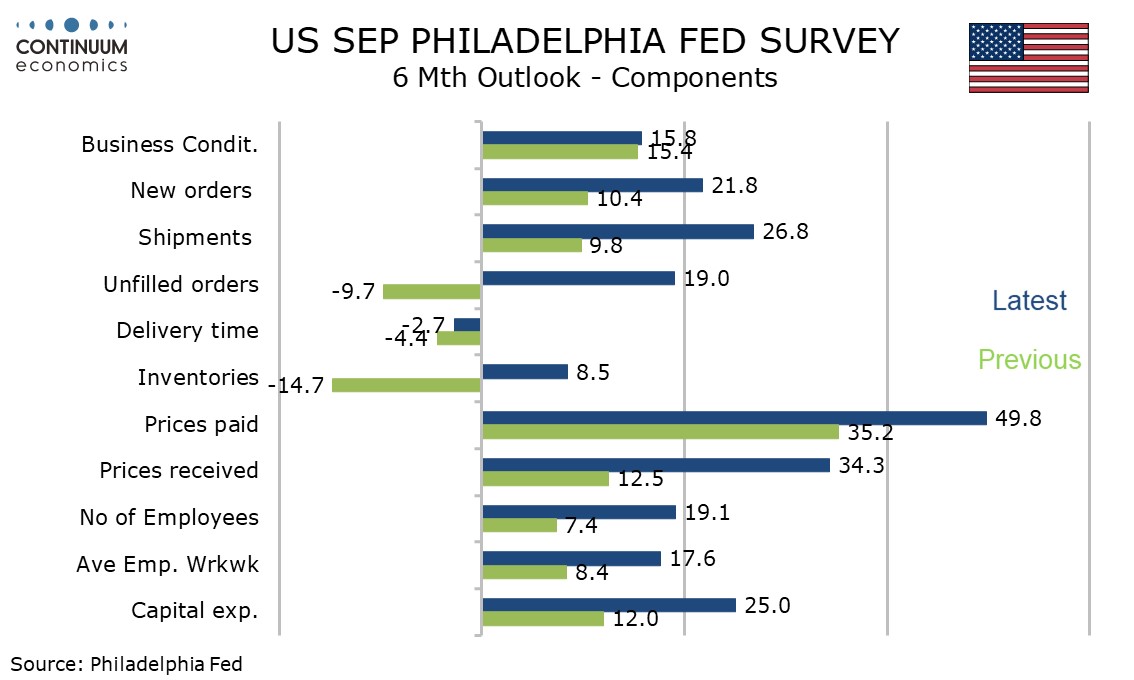

The Philly Fed details are not so impressive with new orders turning negative at -1.5 from 14.6 and the workweek increasingly so at -13.6 from -2.3. Employment however saw a significant bounce to 10.7 from -5.7. Six month expectations are little changed at 15.8 from 15.4.

Price data was firmer, current month prices paid at 49.8 from 35.2 and prices received at 24.6 from 13.7, the firmer the highest since December 2022 and the latter the highest since January 2023. 6-month price expectations also increased, though neither fully erased slowings seen in August.

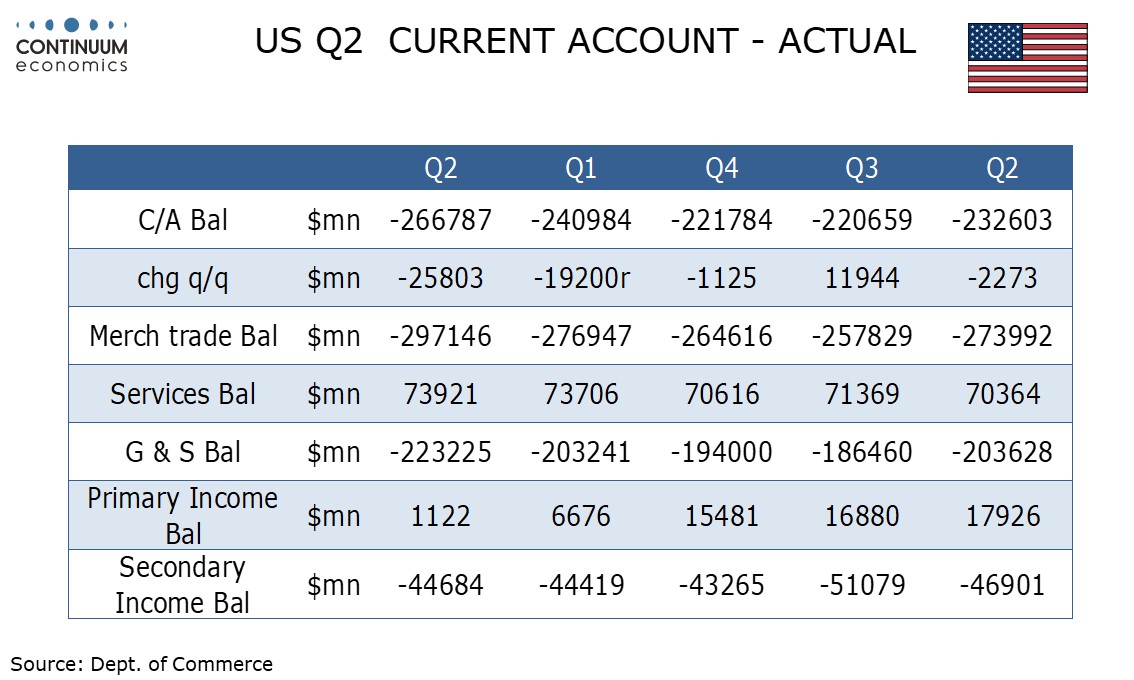

The Q2 current account deficit of $266.8bn from $241bn in Q1 is the widest since Q1 2022 and wider than expected, a fall in the primary (investment) income surplus adding to already released increase in the trade deficit.