US November PPI - Trend slowing further

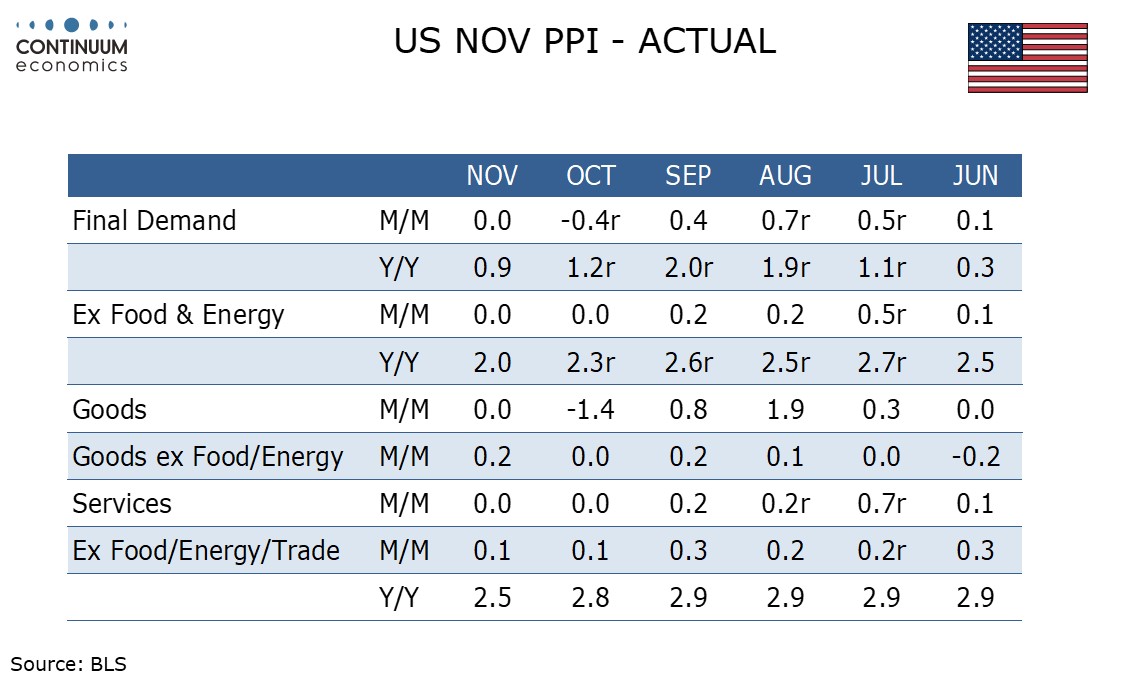

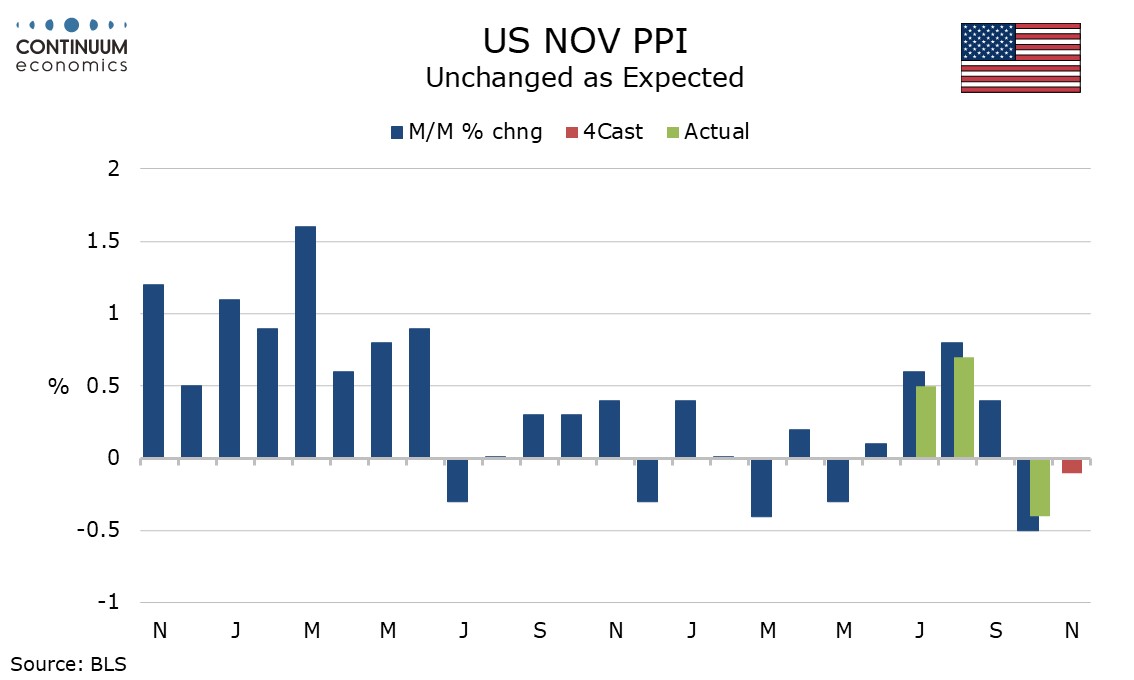

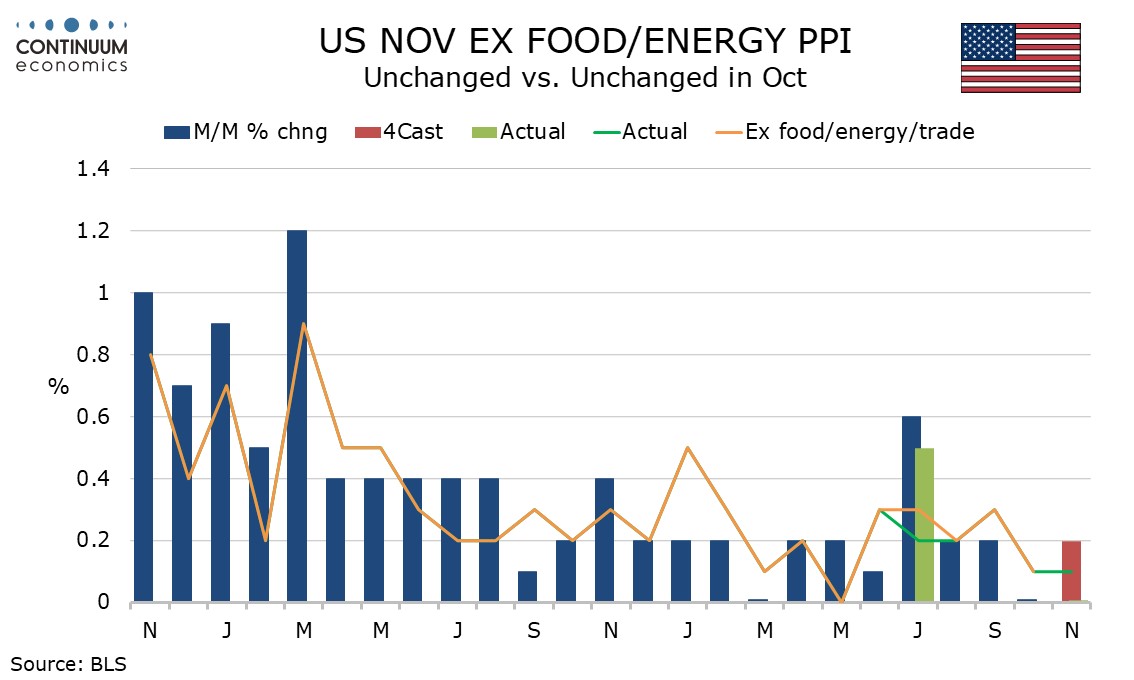

November PPI is as expected at unchanged overall, but weaker than expected in the core rates, ex food and energy also unchanged and ex food and energy and trade up by 0.1%, both matching their October outcomes. Trend, already subdued, appears to have slowed further.

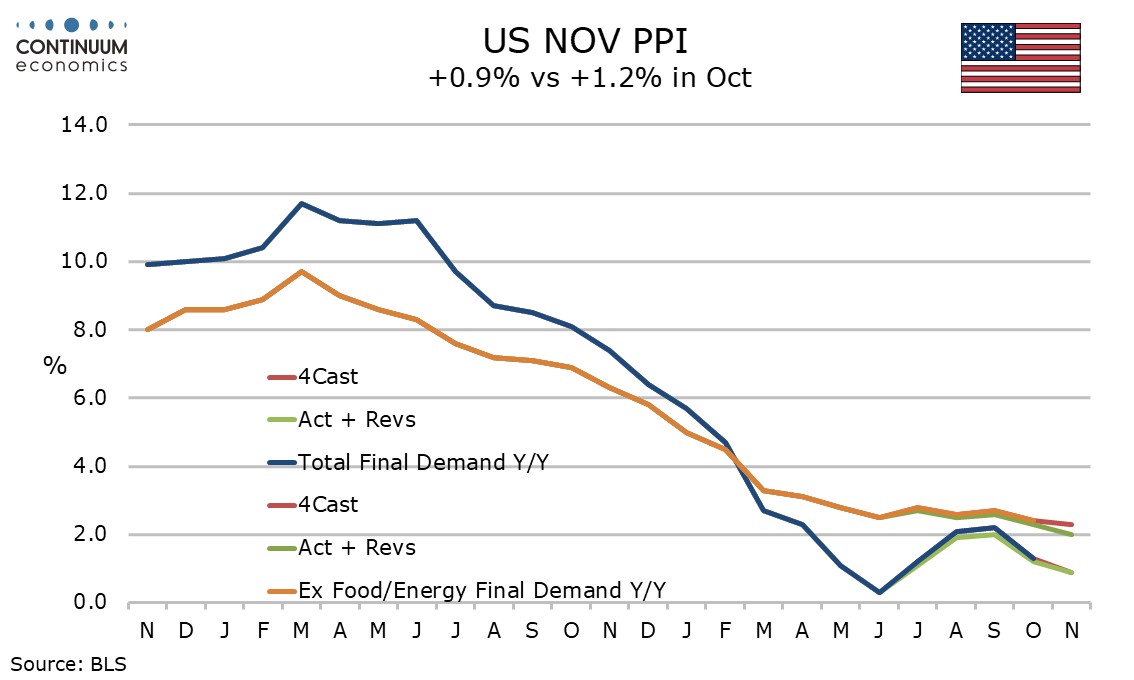

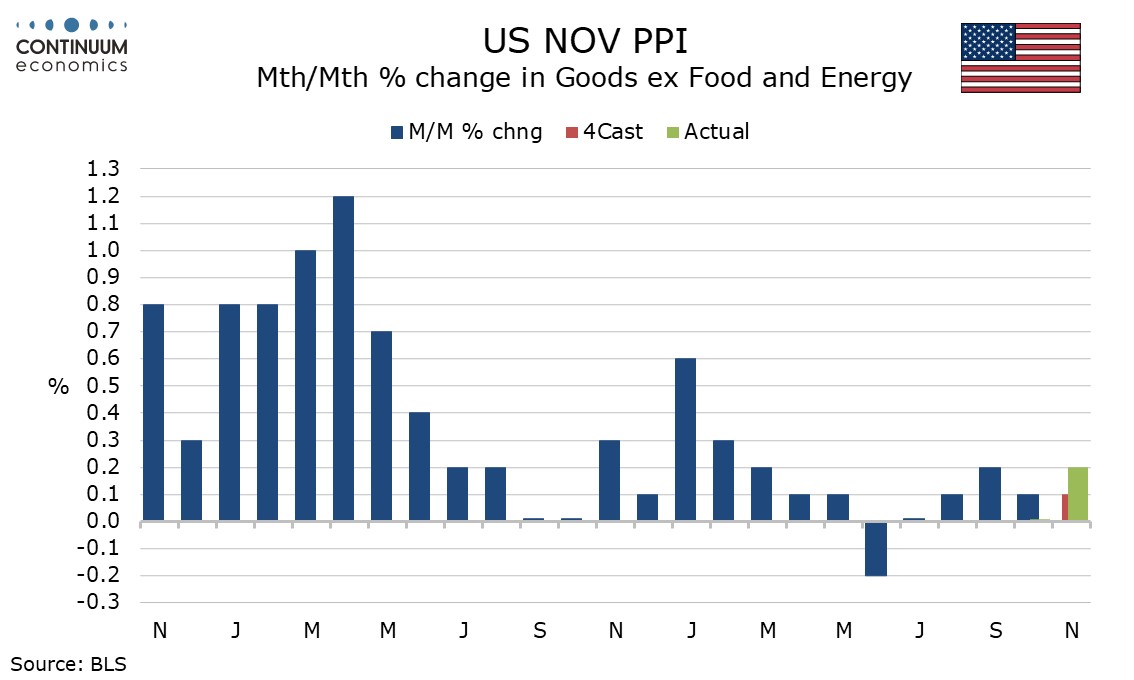

Trend in core PPI, which was running around 0.4% per month in 2022 and was stronger still in 2021, has been running around 0.2% through most of 2023 and now appears to be slowing further. This is an encouraging sign given that PPI led the slowing in CPI which started around mid-2023.\

Yr/yr growth fell to 0.9% from 1.2% overall, still above a June low of 0.3%, but ex food and energy at 2.0% yr/yr from 2.3% is the lowest since January 2021 and ex food, energy and trade at 2.5% from 2.8% is the lowest since February 2021.

Energy fell by 1.2% with weakness in gasoline partially offset by a rise in natural gas while food saw a rise of 0.6%. Goods ex food and energy rose by 0.2% while services were unchanged, with transport and warehousing, usually the strongest component in recent months, down by 0.5%.

Intermediate data was mostly soft, services up by 0.2%, processed goods unchanged and down 0.2% ex food and energy, while unprocessed goods fell by 1.4% but with a 0.7% rise ex food and energy.