U.S. Initial Claims move back down and GDP revised up, but Philly Fed weak

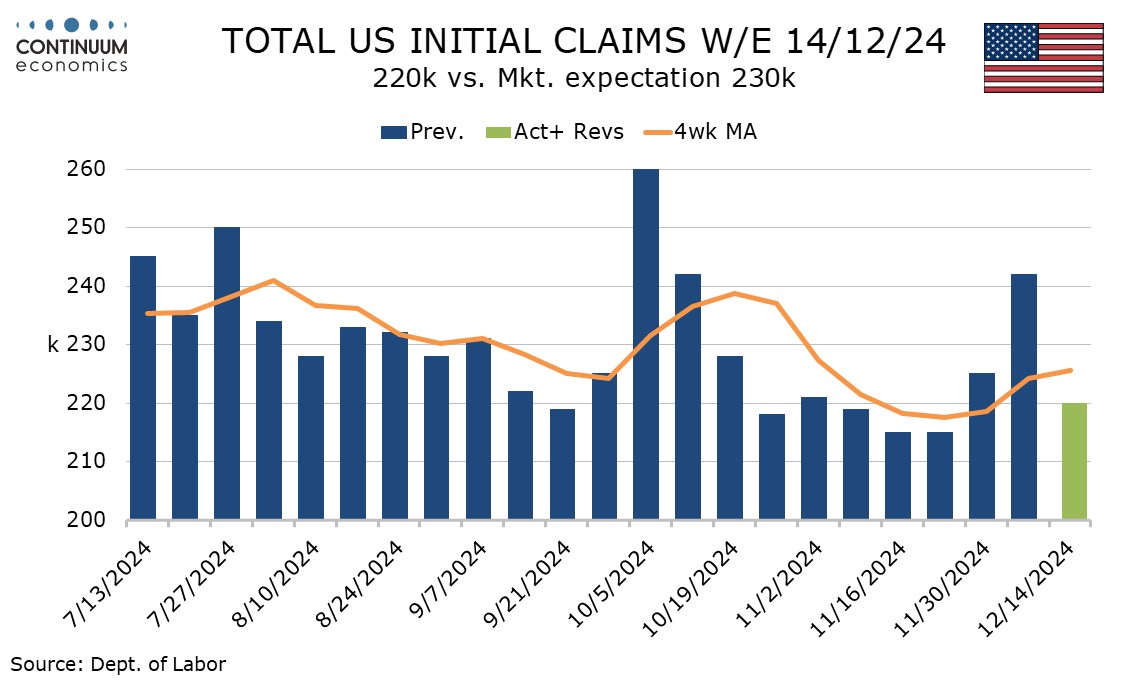

Initial claims at 220k in December’s non-farm payroll survey week have slipped back from last week’s 8-week high and suggest the labor market remains healthy. Q3 GDP has seen an unexpected and broad-based upward revision to 3.1% from 2.8% while the core PCE price index has nudged marginally higher to 2.2% from 2.1%. December’s Philly Fed manufacturing survey at -16.4 from -5.5 is weak.

The 4-week initial claims average of 225.5k is above that for October’s payroll survey week at 218k, but is below the hurricane-inflated 236.5k in October and also 228k in September’s when there were few special factors.

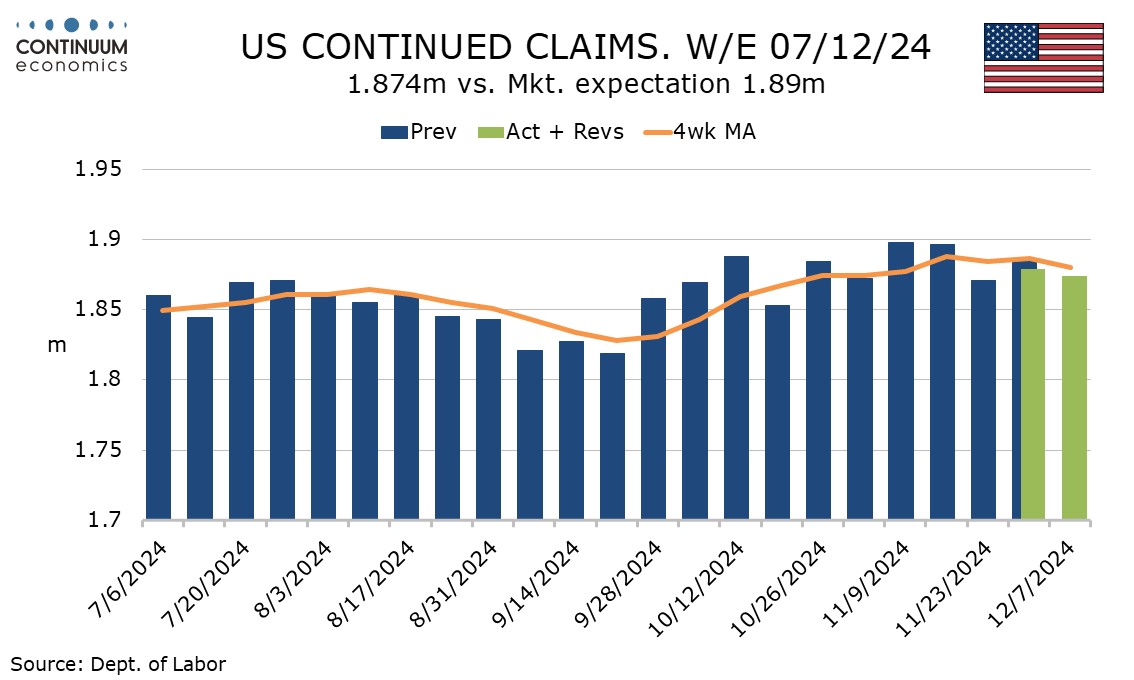

Continued claims cover the week before initial claims and saw a modest 5k decline to 1.874m, correcting last week’s 8k increase. The 4-week average has stopped rising but a recent upturn is showing little sign of reversing, making the continued claims message less positive than that for initial claims.

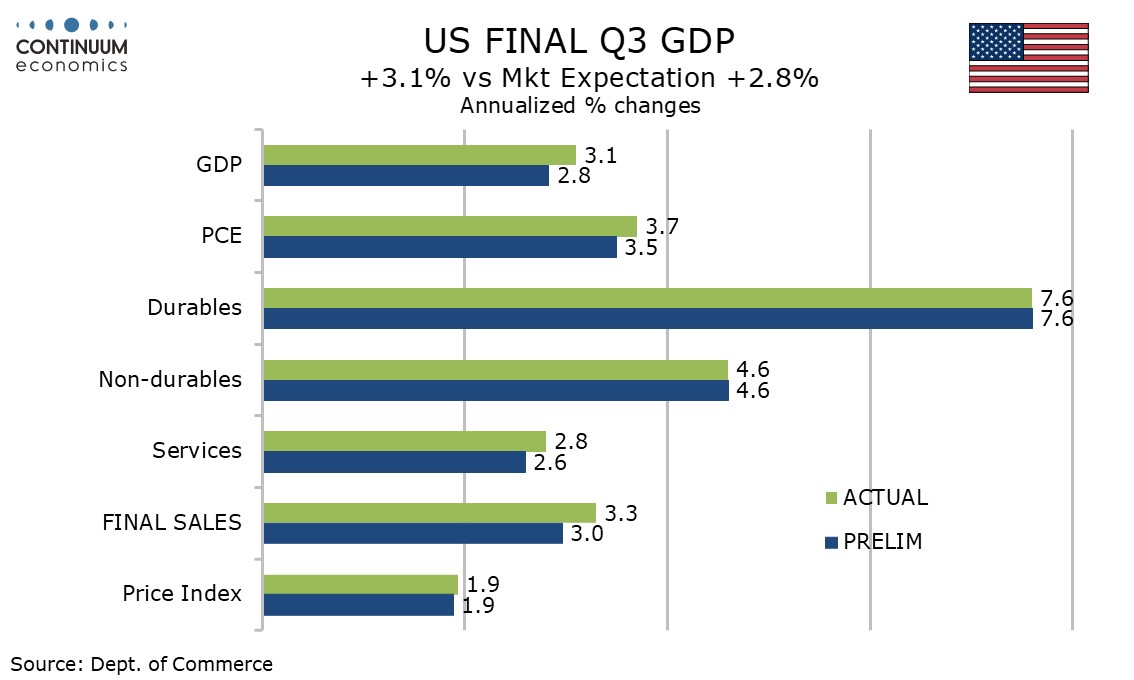

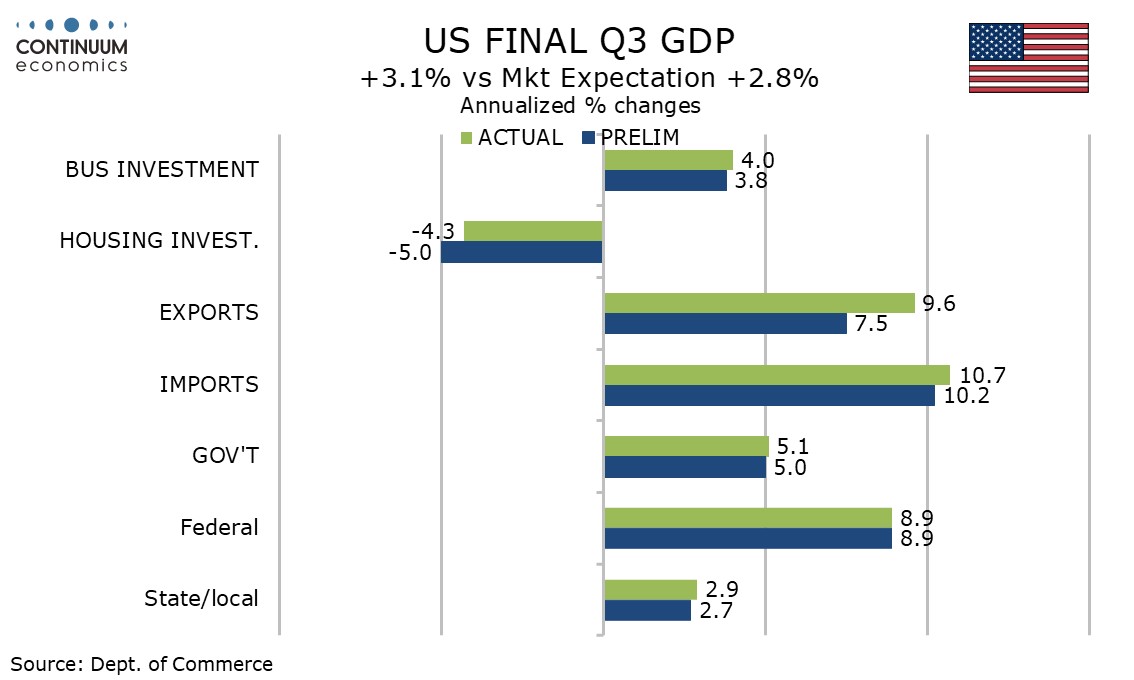

The upward revision to GDP to 3.1% from 2.8% saw consumer spending revised up to 3.7% from 3.5%, fully on services which was revised up to 2.8% from 2.6%. However, excluding a downward revision to inventories, the upward revision was broad based, with business investment, housing and government all revised up while an upward revision to exports outweighed an upward revision to imports.

These details suggest solid momentum going into Q4. Final sales (GDP less inventories) were revised up to 3.3% from 3.0%. The upward resin to the core PCE price index was marginal, but adds to a recent message of disappointment on inflation. The overall GDP price index was however unrevised at 1.9% while the overall PCE price index was unrevised at 1.5%.

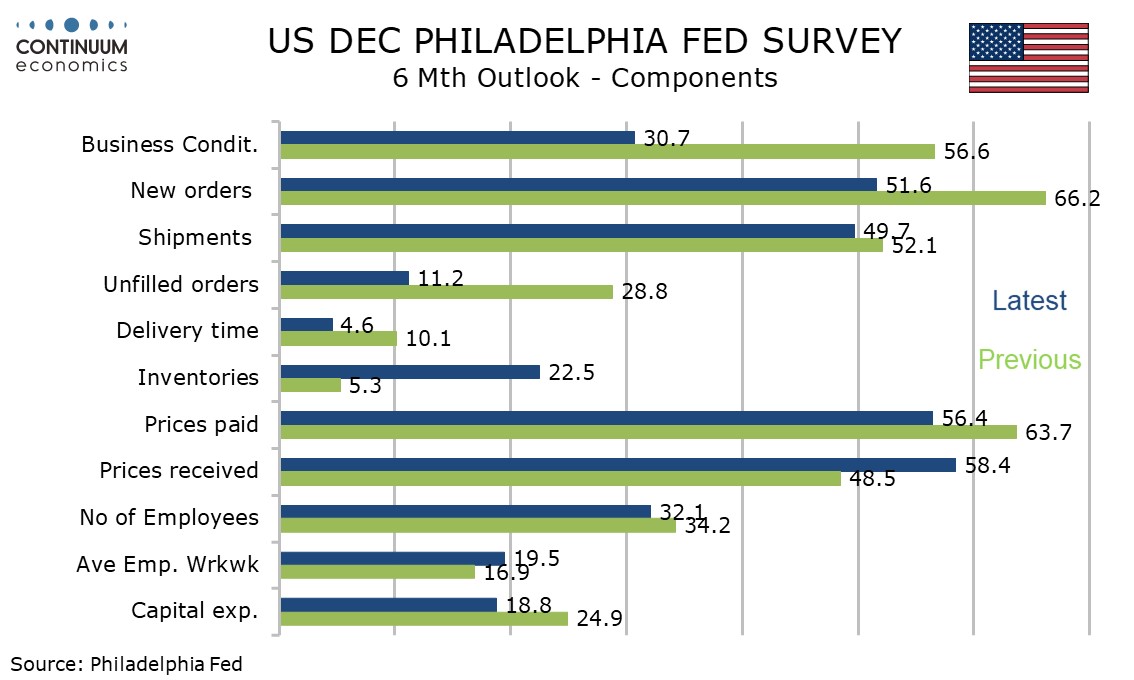

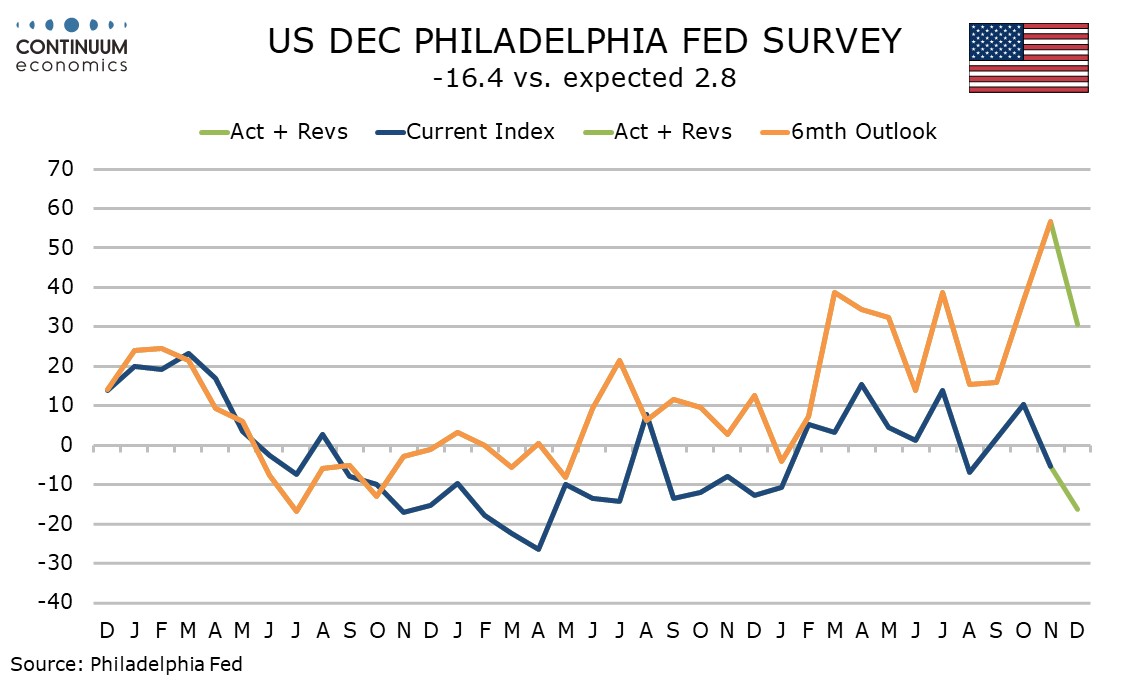

The December Philly Fed index of -16.4 from -5.5 is the weakest since April 2023. While the index is volatile, it is possible tariff concerns are having an impact. December’s Empire State survey also slowed significantly, but remained marginally positive.

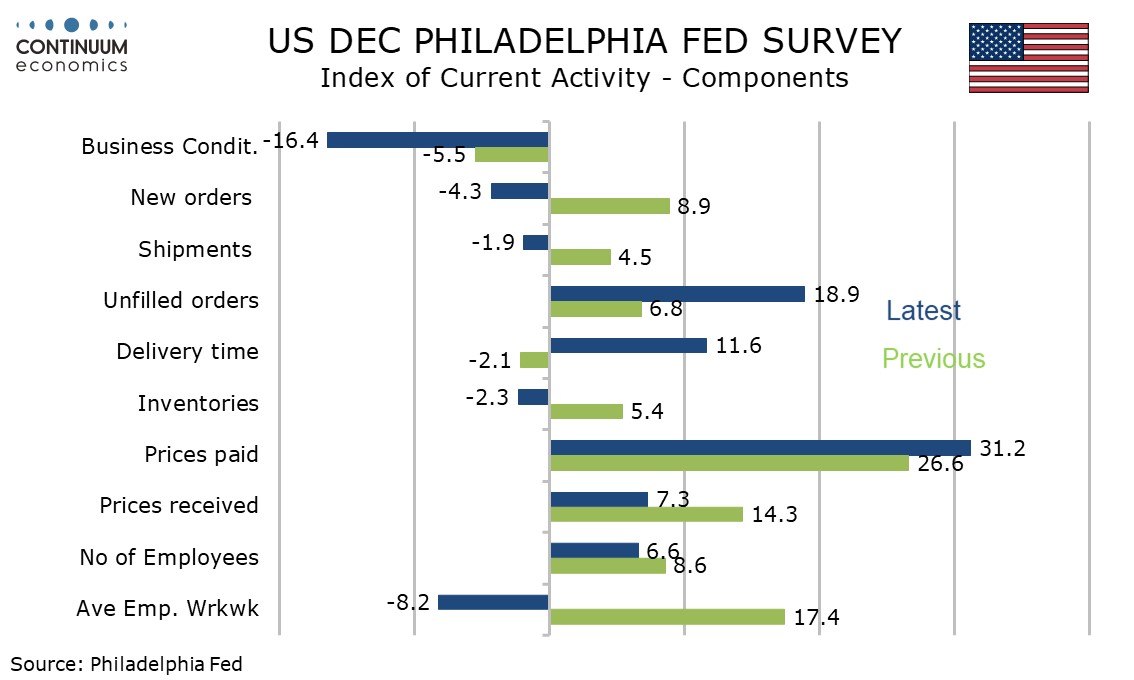

Current month details showed new orders and the workweek turning negative, though employment remained positive if slightly slower. 6-month expectations at 30.7 from 56.6 are at a 3-month low.

Price data was mixed with current month data showing prices paid at a 3-month high of 31.2 but prices received at a 7-month low of 7.3. 6-month price expectations showed prices paid partially correcting a November bounce but prices received at a 6-month high.