GBP, JPY, EUR flows: JPY cross gains extend

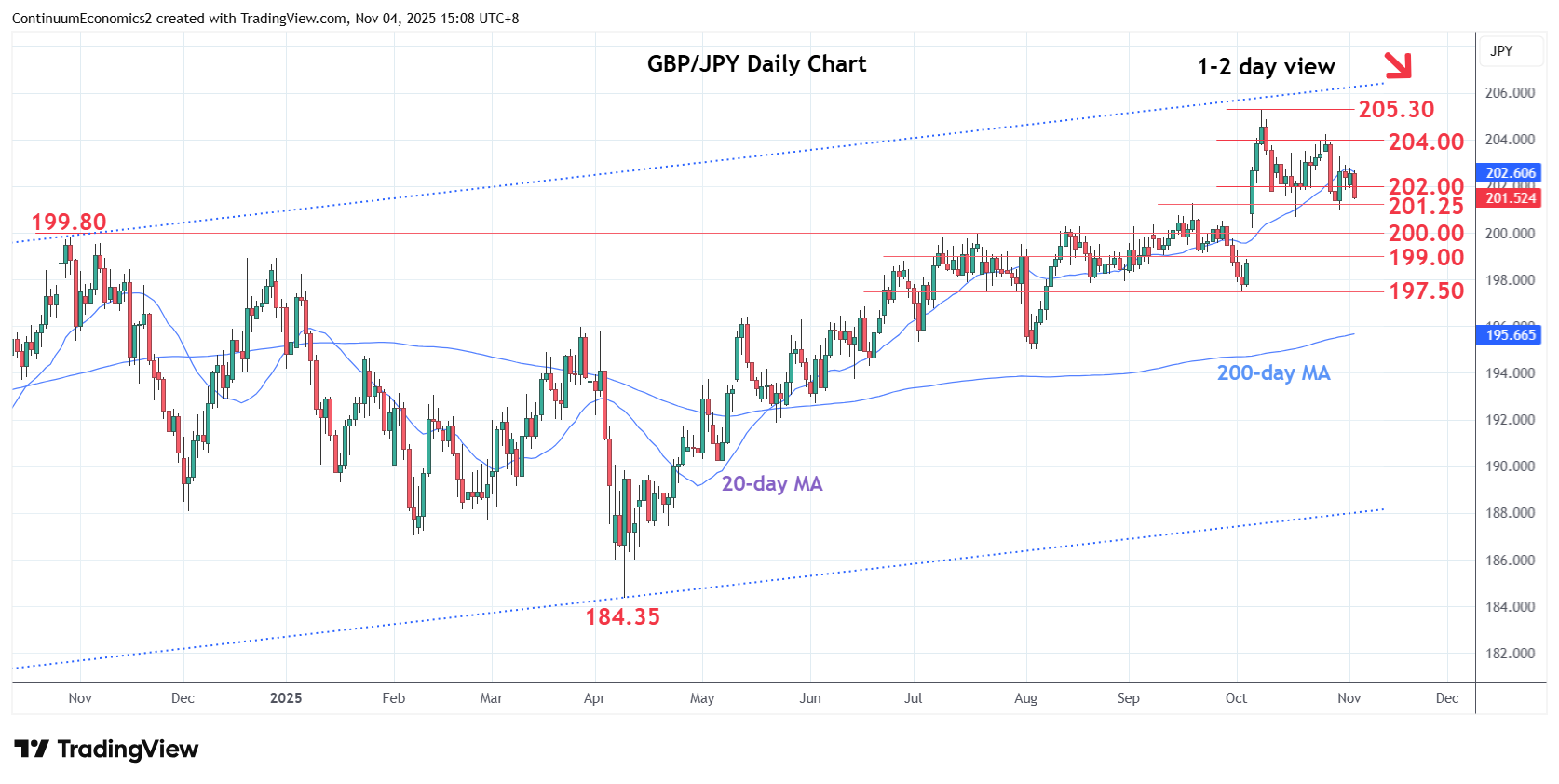

GBP/JPY filling the gap?

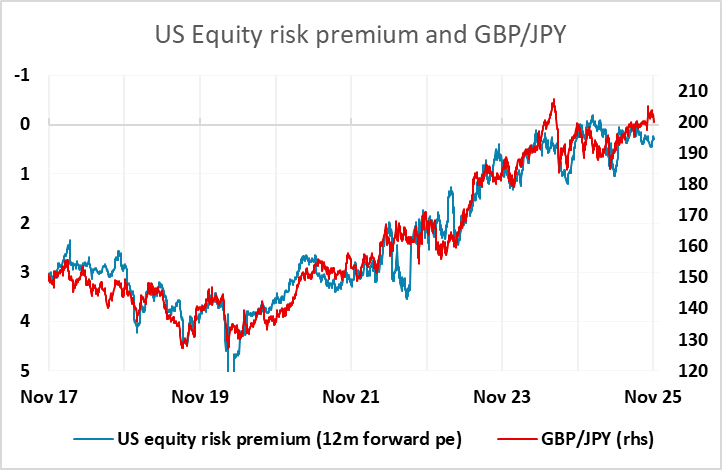

The JPY recovery on the crosses is extending, with EUR/JPY at its lowest in two weeks and GBP/JPY moving into the gap created at the election of Takaichi as LDP leader. In recent weeks, EUR/JPY has moved fairly closely with US equity indices, but previously – in the last 8 years or so – JPY crosses had been closely correlated with US equity risk premia rather than equity prices. Arguably, this makes more sense, although this too has little fundamental basis. In any case, the relationship with risk premia started to break down around August, but saw a clearer break on the election of Takaichi. The closest correlation was with GBP/JPY, and today’s decline takes this cross closer to the old relationship, but there could still be scope for a move to the mid-190s. A more fundamental assessment focusing on yield spreads would suggest scope for much greater declines. However, this would likely require a bigger turn in risk sentiment. For now a move down to the bottom of the “Takaichi gap” at 198.80 should be the initial target.