Published: 2024-03-20T13:47:18.000Z

Preview: Due March 21 - U.S. March S&P PMIs - Modest slippage but still positive

Senior Economist , North America

3

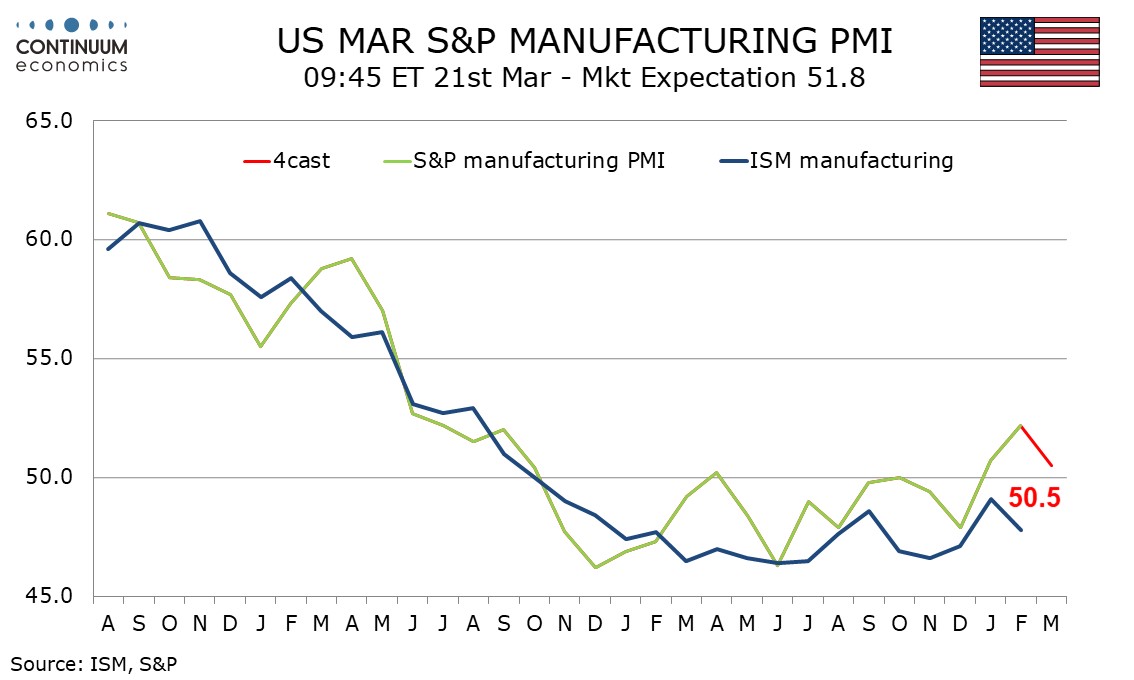

We expect modest slippage in March’s S and P PMIs, with manufacturing correcting to 50.5 from February’s 19-month high of 52.2, and services seeing a second straight marginal decline to 52.0 from 52.3.

February’s manufacturing acceleration significantly outperformed the ISM manufacturing index and will be hard to sustain, though the ISM index underperformed the regional surveys, which were mostly improved. While most remained below neutral, we expect the S and P index to remain positive.

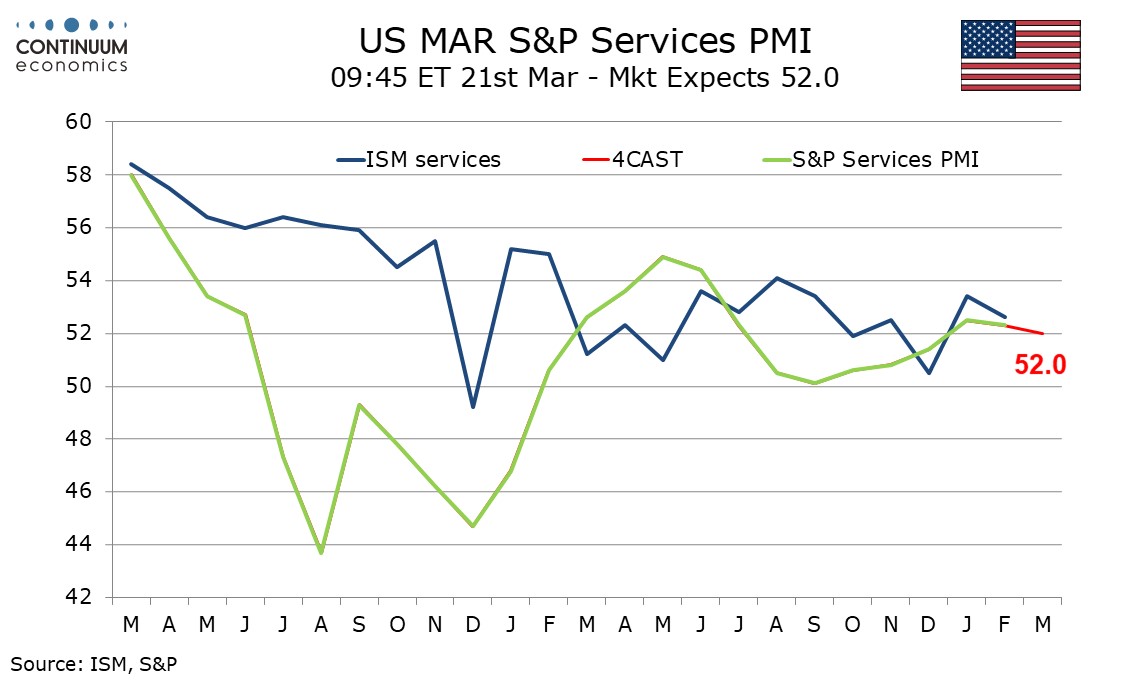

The ISM and S and P services indices are less correlated than the manufacturing indices. The S and P services survey has a reasonable correlation with bond yields, with the improvement from September’s 50.1 low to January’s 52.5 probably having peaked, though that February’s final reading of 52.3 was above the preliminary 51.3 suggests March did not start with downward momentum.