AUD flows: AUD boosted by RBA, equities

A relatively hawkish RBA and a strong bounce in Chinese equities points the AUD higher

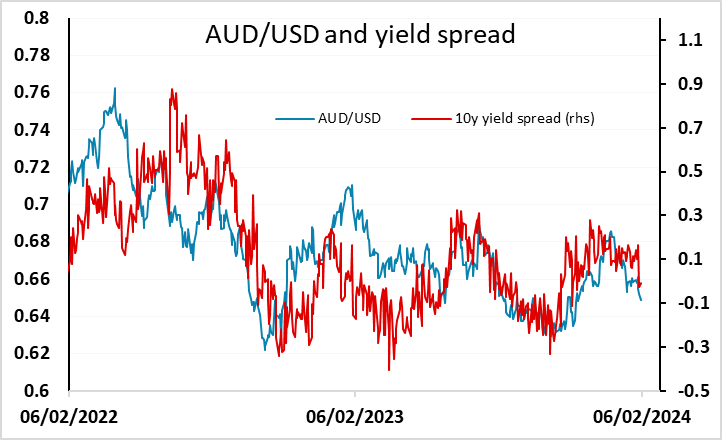

The USD is generally softer overnight, mainly due to a stronger performance from Chinese equities, although the AUD also got support from what was perceived as a slightly hawkish RBA stance. The rise in Chinese equities was triggered by reports that President Xi would discuss the stock market with financial regulators, triggering the largest one day gain in Chinese equities since 2022. This helped the AUD and the other risky currencies, but the AUD also benefited from the RBA meeting. The RBA left rates unchanged as expected, but the key forward guidance statement of "Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks." has changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out.". Market participants read this change in forward guidance to be hawkish, but the market impact on AUD yields has been quite modest, with 2 year yields still below where they were at the beginning of last week. Nevertheless, with the AUD starting from a point that looked a little cheap relative to yield spreads, there is some scope for the AUD to edge up further in a risk positive environment.