GBP flows: GBP suffering from expected productivity downgrade

EUR/GBP extends gains to new highs for the year as OBR expected to reduce prodictivity growth projection.

GBP has fallen back in the last few sessions on reports that the UK Office of Budget Responsibility (OBR) will reduce their projection for productivity growth by 0.3% ahead of the Budget on November 26. A cut of 0.1% or 0.2% was expected, but a 0.3% cut is likely to add around GBP20bn to the fiscal deficit by 2030, GBP10bn more than had been expected from a 0.1%-0.2% cut. Other factors, like the failure of the government to pass welfare cuts, have also created a budget shortfall, so Chancellor Reeves is seen to be facing a need to cut around GBP30bn in the November Budget over the next few years.

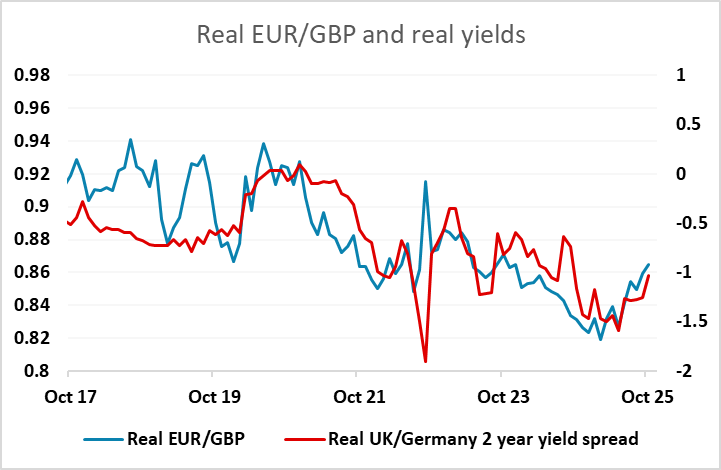

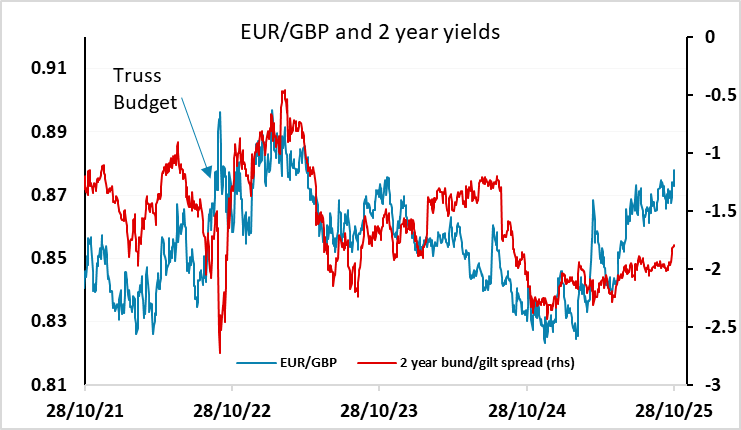

The decline in GBP looks to be a direct response to concerns about the UK budget position rather than reflecting an increased expectation of BoE easing, as there has only been a very modest decline in rate expectations in response to the news. However, if the Chancellor does announce tax rises or spending increases in the Budget to take effect in the coming year, the BoE MPC are likely to take a more dovish stance, as their current projections are based on the current fiscal stance. The decline in GBP therefore makes sense, as either rates will fall after the Budget, or the Chancellor will not properly address the fiscal problems, in which case GBP could be expected to suffer from a lack of confidence in the fiscal position. We continue to see a gradual EUR/GBP move towards 0.90 in the coming year as real GBP short term yields converge with the Eurozone, but moves are likely to be more rapid if the market loses confidence in UK fiscal management, as was the case after the Truss/Kwarteng budget in 2022.