Preview: Due August 22 - U.S. July Existing Home Sales - Pause after a steep decline

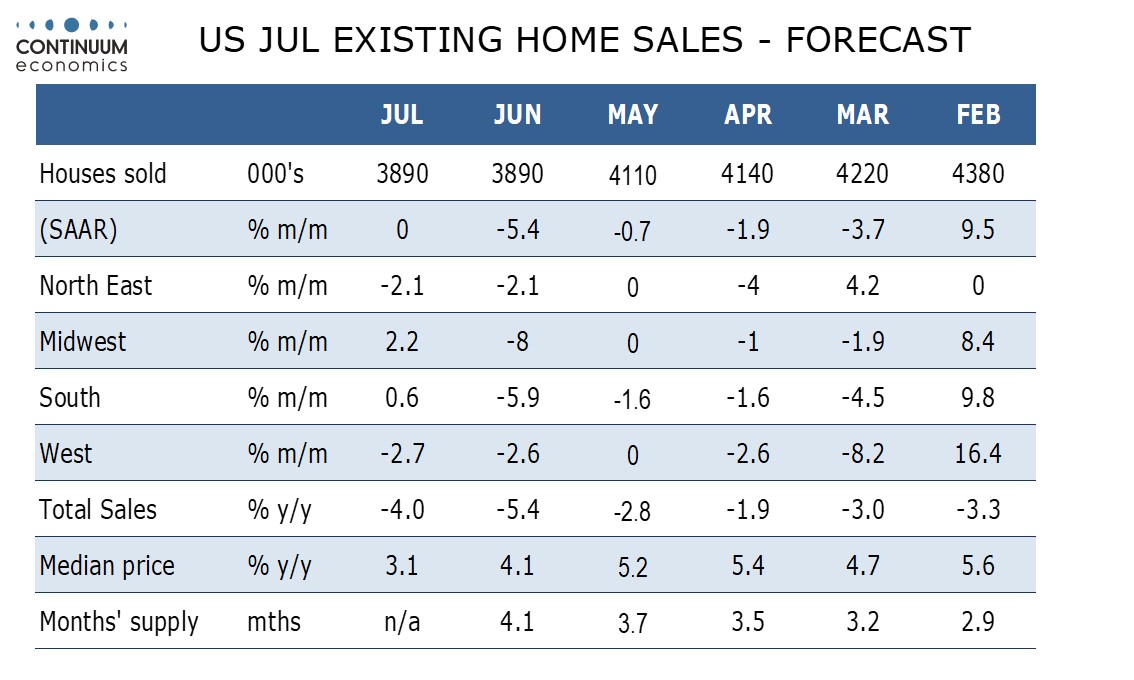

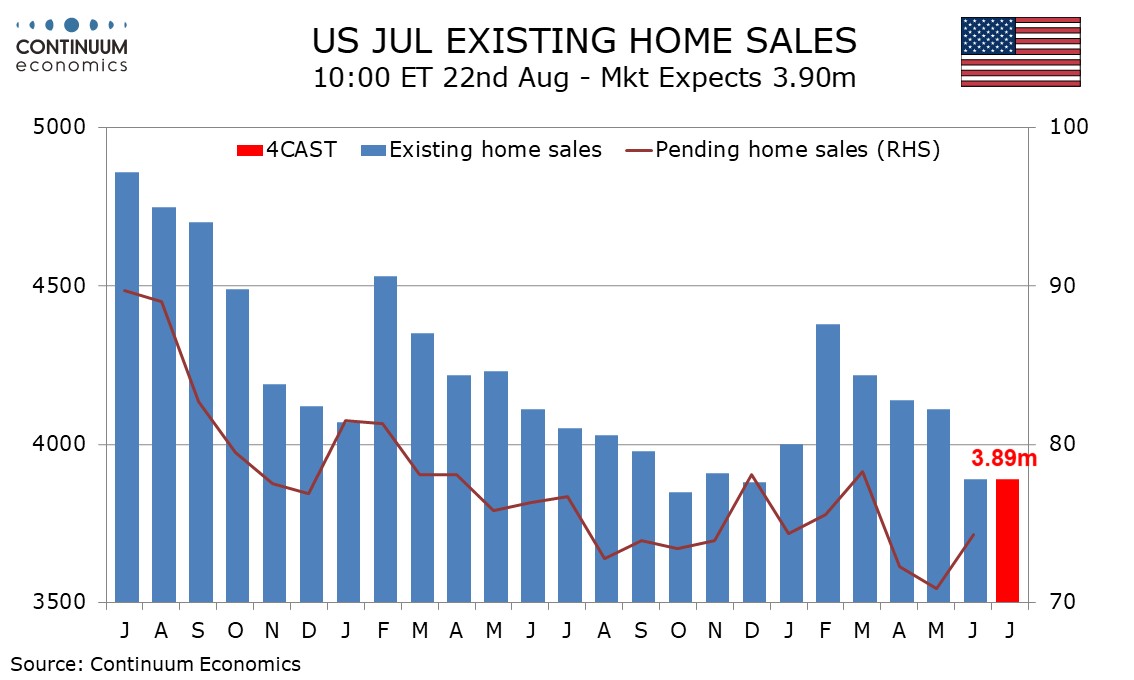

We expect an unchanged July existing home sales outcome of 3.89m, which would maintain a negative picture after a steep 5.9% decline in June, to the weakest level since December 2023.

Most housing sector signals have been moving lower recently, though in June pending home sales corrected higher after a sharp May decline took the series below the lows seen at the height of the pandemic. That pending home sales have been looking weaker than existing home sales means June’s pending home sales correction is not a clear signal for higher July existing home sales. July data from the NAHB homebuilders’ survey was marginally weaker while the MBA’s house purchase index remains weak, with little clear direction.

We expect July’s existing home sales detail to show continued moderate declines in the Northeast and West, but corrections higher in the Midwest and South after steep declines in June, leaving the overall total unchanged. We expect the median price to fall by 2.0% on the month after five straight gains. Prices usually dip in July and the monthly data is not seasonally adjusted. However a dip in the yr/yr pace to 3.1% from 4.1% as implied by our monthly forecast would imply some loss of underlying momentum.