JPY flows: JPY firmer after Ueda as equities dip

USD/JPY dips after Ueda comments helped by weaker equities

The JPY has made some gains overnight with the USD generally a little weaker first thing in Europe. JPY strength has been helped by comments from BoJ governor Ueda, even though his comments didn’t objectively suggest a December rate hike was a done deal. He said the Bank of Japan will consider the "pros and cons" of raising interest rates at its next policy meeting, but still suggested that a rate hike was dependent on wage setting behaviour. JGB yields rose along the curve to their highest since 2008, but a December rate cut still looks to be less than 50% priced in.

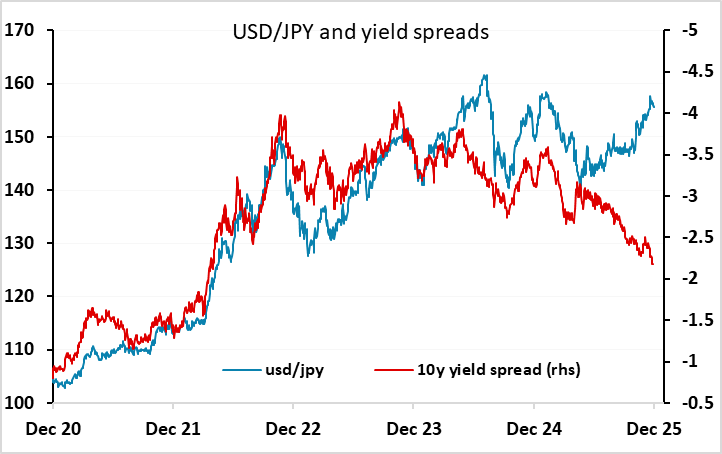

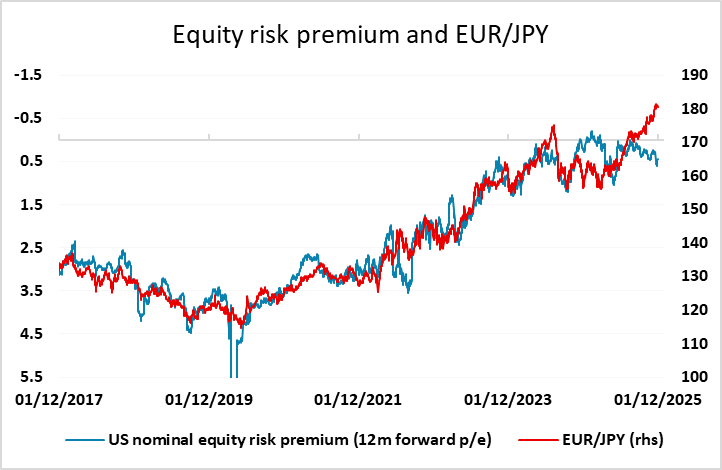

Of course, USD/JPY is already a long way above the levels suggested by the normal correlation with yield spreads, and has moved in the opposite direction to yield spreads for the last 6 months, so there is no guarantee that a rate hike will spur JPY gains. The JPY also benefitted from a generally softer tone to equities, and this may need to continue if the JPY is to make significant gains.

For today, the main data is the US ISM manufacturing survey, with the final PMIs unlikely to differ markedly from the preliminary numbers, but the ISM manufacturing survey is also normally of less interest than the services survey later in the week.