GBP flows: GBP softer after weak GDP

GBP slips lower after weak GDP but decline is modest and underlying GBP strength remains

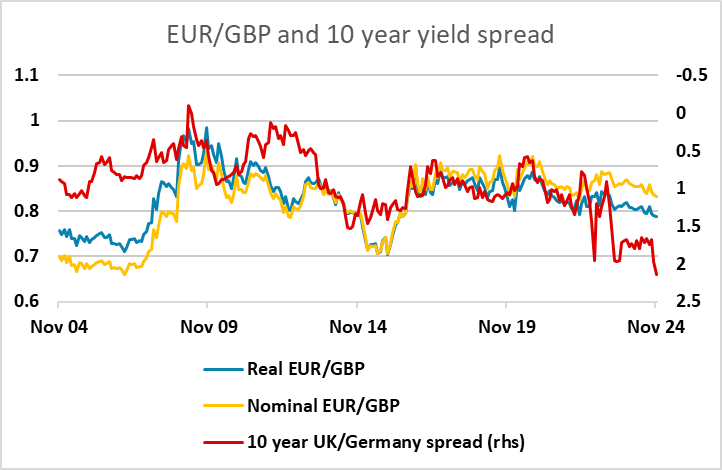

UK GDP data disappointed in September with a 0.1% decline, taking Q3 down to 0.1% from the provisional 0.2% - a significant underperformance of the Eurozone’s 0.4%. Of course, the UK performed better in H1, but this data suggests that UK outperformance was temporary. GBP is weaker in response, with EUR/GBP gaining 10 pips to 0.8325, but we doubt we will see much more of a gain. While UK growth may be weakening, UK yields remain some way above the level that would normally correlate with the current level of GBP. While some of this suggests a higher risk premium on the pound after the Budget – similar to the sharp GBP decline after the Truss/Kwarteng Budget in 2022, despite higher yields – it will still be unattractive to hold short GBP positions against the EUR at current yield spreads unless there is a clearly more negative global risk negative tone. Of course, if the 0.1% GDP decline in September continues in the coming months, GBP is likely to suffer with yields coming down, but for now the data is insufficient to turn the tide.