Brazil: Credit is Resilient, but Some Deceleration is Expected

In early 2024, Brazil's credit market saw an 8.2% growth, supported by easing inflation and favorable monetary policy. Both earmarked and non-earmarked credit contributed, with household credit outpacing enterprise lending. Delinquency rates remain manageable at 3.8%. However, deceleration is expected as the Central Bank may raise rates further, cooling demand. Unlike 2014-2015, the government is unlikely to inject significant funds into national banks due to budget constraints, which should limit the expansion of subsidized credit.

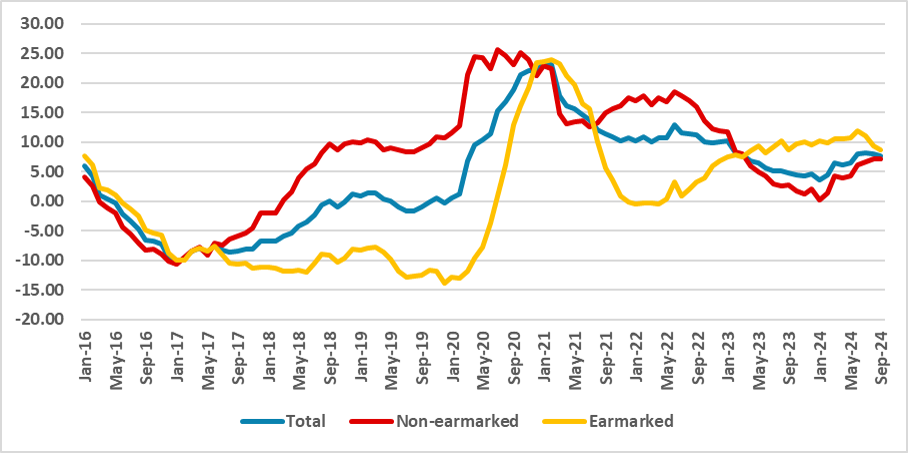

Figure 1: Nominal Annual Credit Growth (%)

Source: BCBIn the first half of 2024, credit has experienced some growth. Following a mild 2023, annual credit growth reached 8.2% in July. We believe this recovery was supported by multiple factors. First, easing inflation has boosted consumer and enterprise confidence, driving demand for new credit. Additionally, the Brazilian Central Bank's (BCB) easing of monetary conditions also contributed to the growth in credit. This expansion was a mix of earmarked and non-earmarked credit. Some government-backed programs for credit renegotiation and public banks, such as the National Development Bank, have increased their credit portfolios in 2024. However, the balance between earmarked and non-earmarked credit remains relatively even, unlike in 2014, when earmarked credit was much stronger. This balance likely maintains the effectiveness of monetary policy, a notable difference from that period.

Source: BCBIn the first half of 2024, credit has experienced some growth. Following a mild 2023, annual credit growth reached 8.2% in July. We believe this recovery was supported by multiple factors. First, easing inflation has boosted consumer and enterprise confidence, driving demand for new credit. Additionally, the Brazilian Central Bank's (BCB) easing of monetary conditions also contributed to the growth in credit. This expansion was a mix of earmarked and non-earmarked credit. Some government-backed programs for credit renegotiation and public banks, such as the National Development Bank, have increased their credit portfolios in 2024. However, the balance between earmarked and non-earmarked credit remains relatively even, unlike in 2014, when earmarked credit was much stronger. This balance likely maintains the effectiveness of monetary policy, a notable difference from that period.

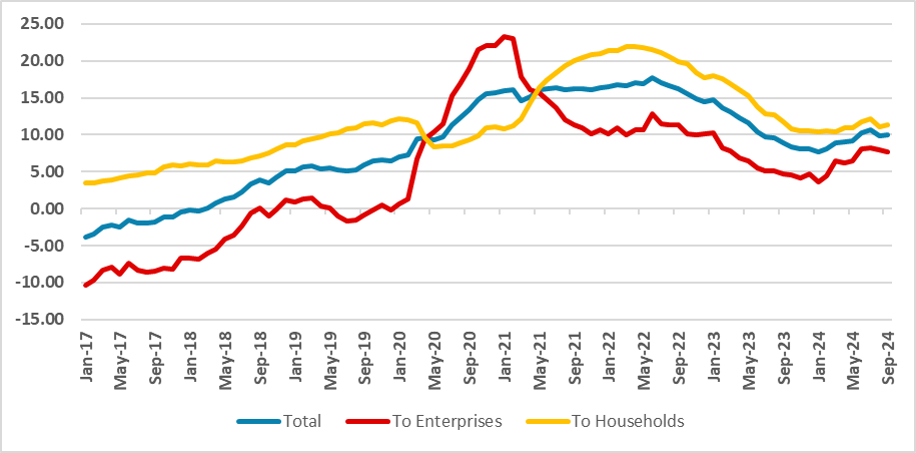

Figure 2: Nominal Annual Credit Growth (%)

Source: BCB

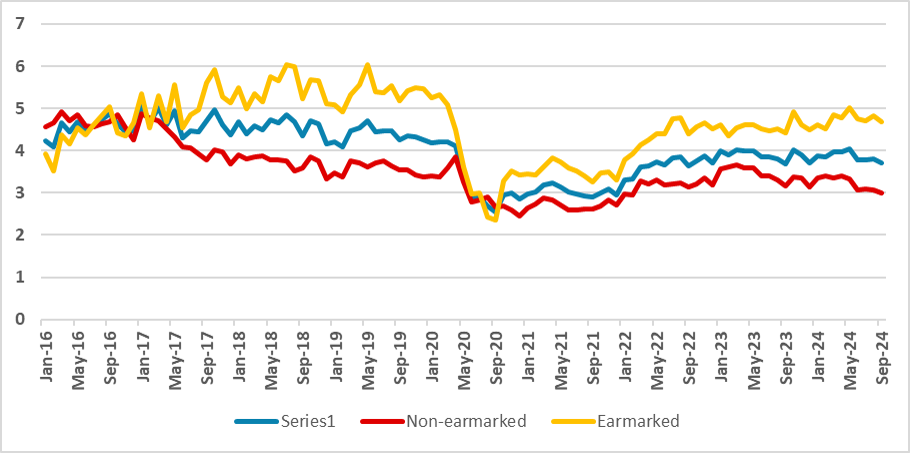

In terms of sector growth, household credit has outpaced credit to enterprises, which may explain why consumption is currently stronger than investment. Regarding interest rates, while there was a marginal decrease in the first half of the year, most rates have stabilized as the BCB paused the easing cycle. Although delinquency rates have risen slightly, they remain at a manageable level, around 3.8%, which is relatively healthy.

Figure 3: Delinquency Rate (%)

Source: BCB

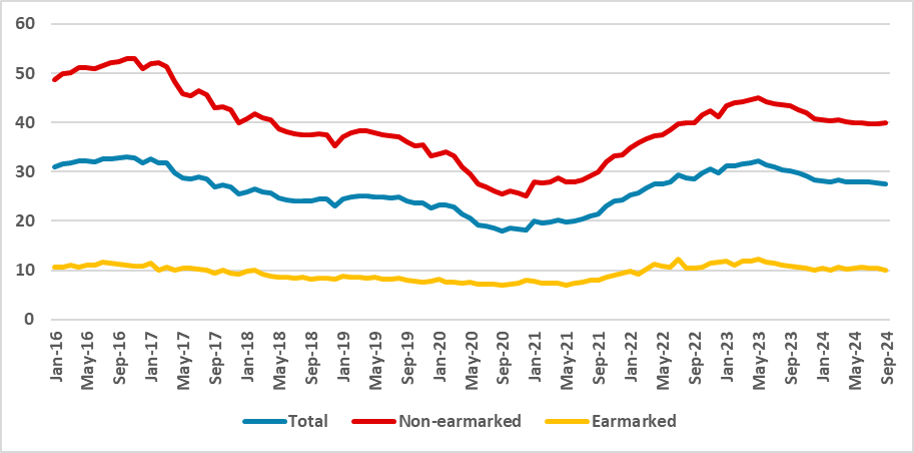

We expect some deceleration in credit growth in the coming months. The BCB is likely to raise rates by an additional 150 basis points, potentially ending the cycle at 12.25%. We believe this will negatively impact credit supply. Additionally, we have already observed some deceleration in credit growth in the second half of 2024, as a consequence of the first hike. Furthermore, demand is also likely to cool slightly, as we do not anticipate Brazil’s GDP growth exceeding 3.0% in 2025, as it has happened in the last three years.

Figure 4: New Credit Interest Rate (%)

Source: BCBA market concern is that the government might repeat the 2014-2015 strategy, increasing earmarked credit through national banks and injecting these banks with fresh funds from the federal government. However, we consider this scenario unlikely. Currently, most earmarked credit is offered at market rates rather than subsidized ones, and there is growing concern among government officials about the need to reduce expenditures, which limits the government’s capacity to provide additional funding to national banks.