U.S. February Michigan CSI - Consumers look concerned about tariffs

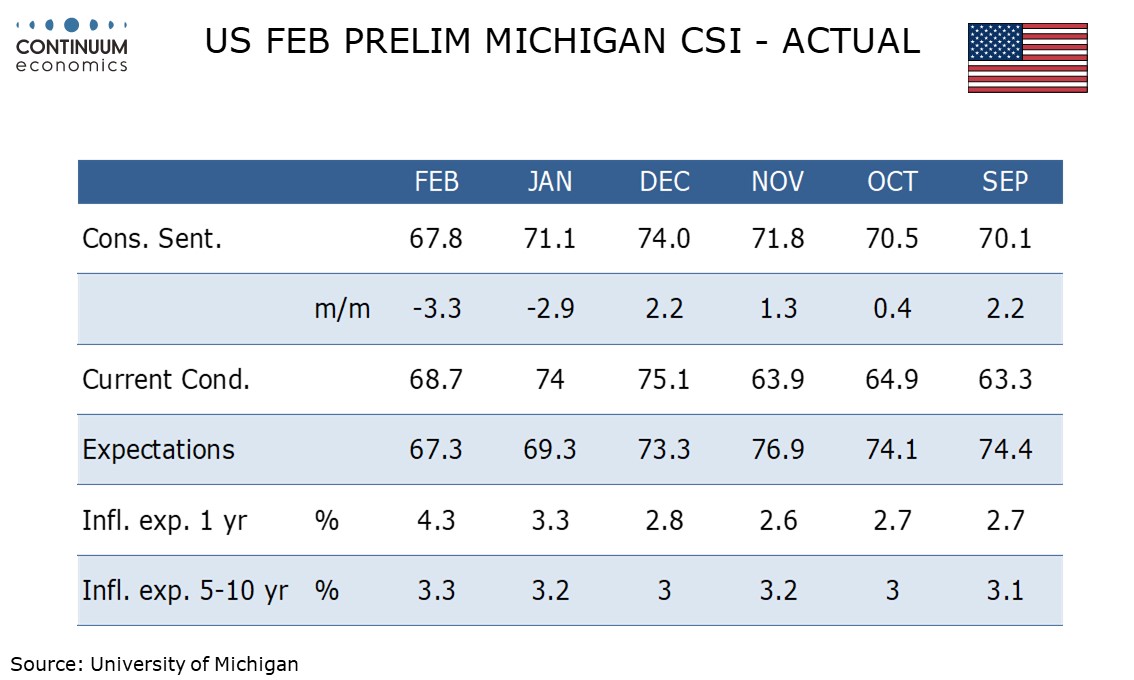

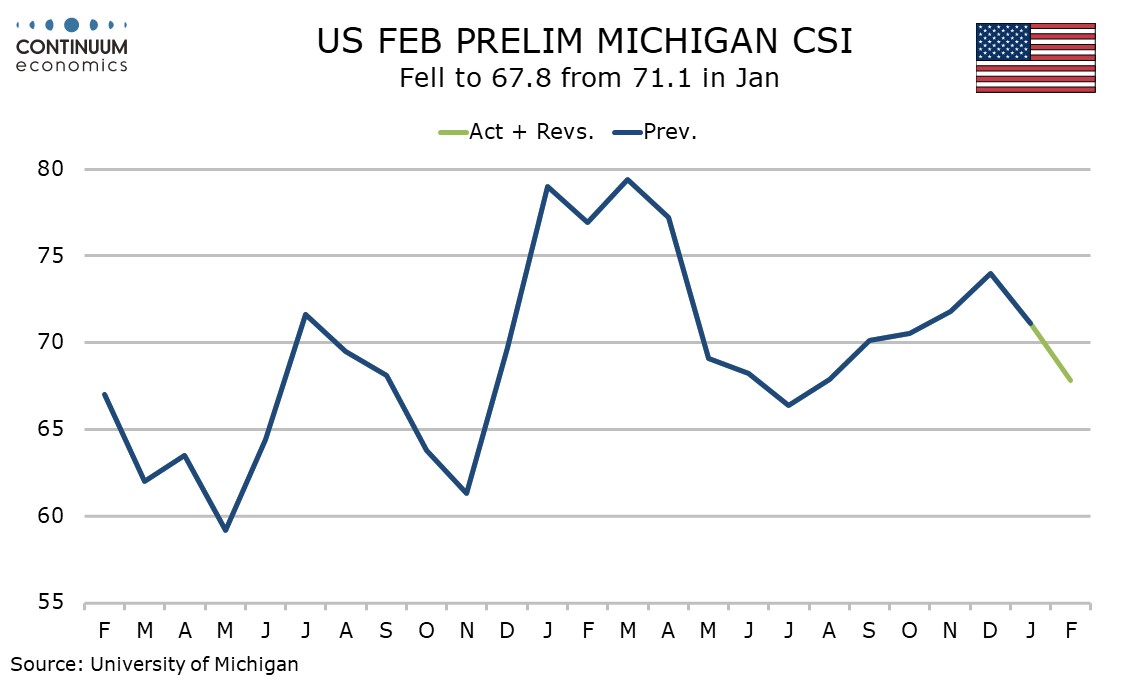

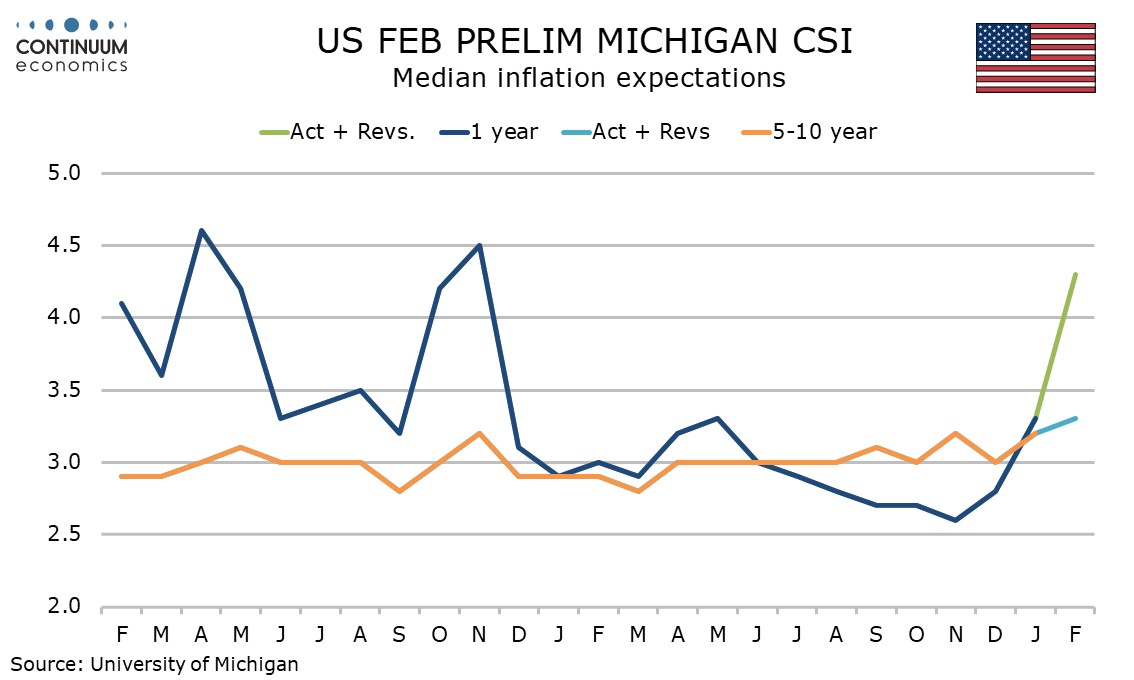

February’s preliminary Michigan CSI of 68.7 from 71.1 is weaker than expected and the lowest since July, with the dip appearing to come from a sharp rise in 1-year inflation expectations, to 4.3% from 3.3%, which is the highest since November 2023.

The obvious explanation for the bounce in inflation expectations is Trump’s tariff threats, and that is significant because some FOMC speakers have suggested that how tariffs impact expectations will matter.

The 5-10 year view is however less impacted, though at 3.3% from 3.2% has nudged outside its recent range (though the preliminary January reading was also 3.3%).

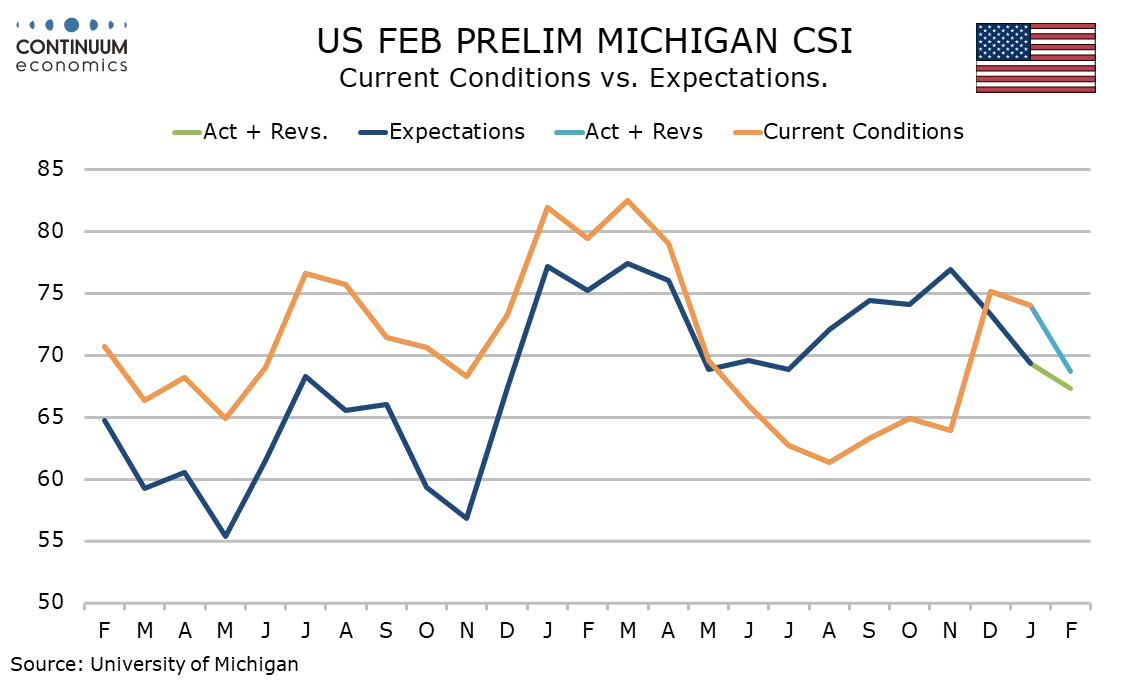

Monthly detail shows the fall more on current conditions than expectations, the former at 68.7 from 74.0 and the latter at 67.3 from 69.3. Current conditions are simply correcting a strong December bounce, which may have been a response to the election, though was also consistent with rising momentum in employment which faded in January.

The monthly dip in expectations is modest but the level is the lowest since November 2024. Michigan CSI details shows massive gaps between Democratic and Republican sentiment, but it now appears that Democratic pessimism is outweighing Republican optimism, the opposite of the immediate post-election response.