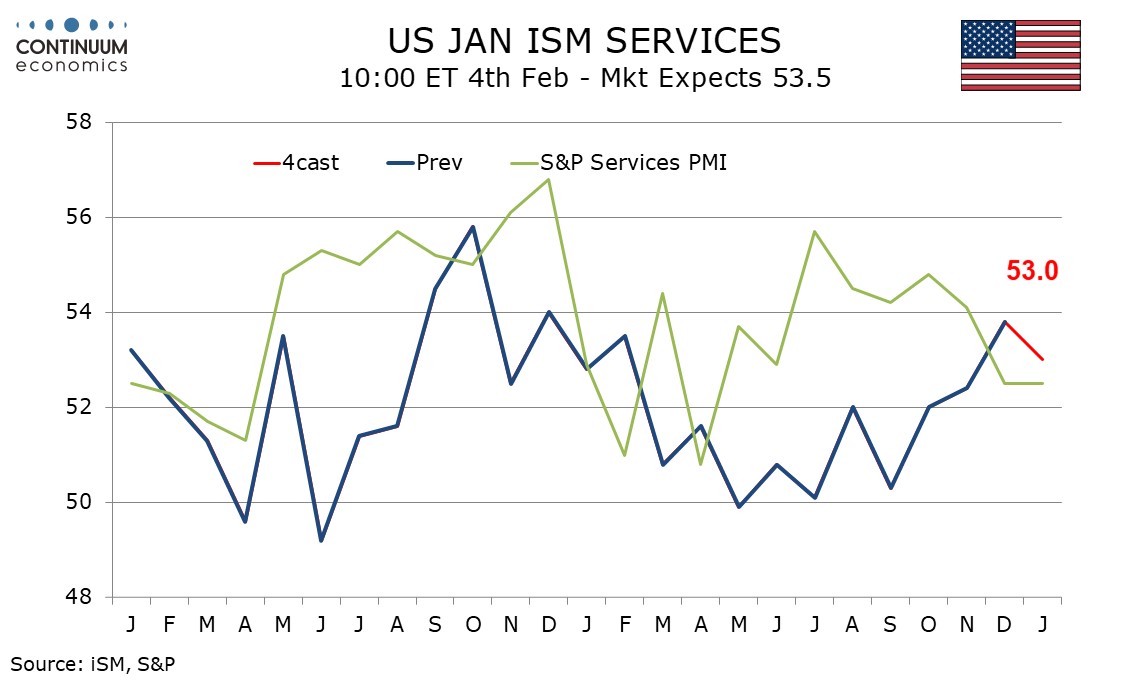

Preview: Due February 4 - U.S. January ISM Services - A partial correction from December's bounce

We expect January’s ISM services index to correct lower to 53.0 after a surprisingly strong December index of 54.4 that has since been revised down to 53.8 with the annual seasonal adjustment revisions. The data still contrasts a slower S and P services PMI of 52.5 in December. January’s S and P services index did not rebound, remaining at 52.5.

While we expect a less positive ISM services index, Fed services sector surveys from the Philly, Richmond, Dallas and Kansas City Feds, as well as the Empire State, were all improved from December, though none were strongly positive and three remained negative. We do not look for a full reversal of December’s ISM services improvement. 53.0 would be the strongest reading, bar December’s, since February 2025.

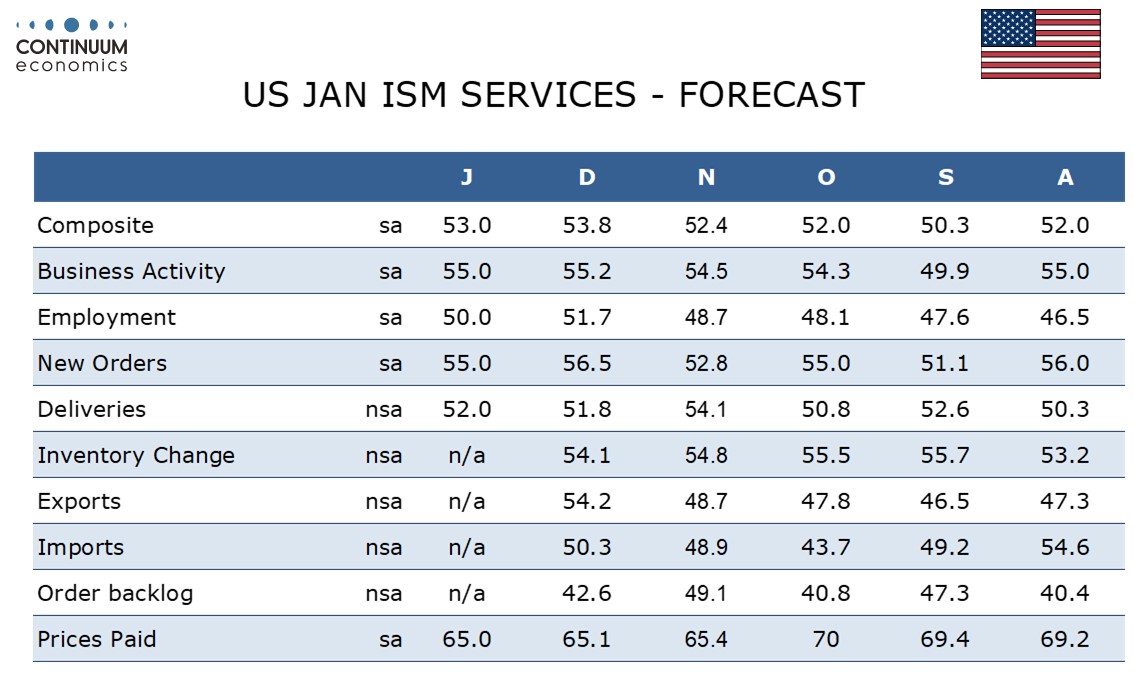

We expect January’s detail to show business activity and new orders both at 55.0, both down from December’s respective revised 55.2 and 56.5, but above November’s 54.1 and 52.8. We see employment at 50.0, down from December’s 51.7 which followed six straight below neutral readings. For the final component of the composite, delivery times, we expect a January reading of 52.0, little changed from December’s 51.8 but well below November’s 54.1

Prices paid do not contribute to the composite and here we see little change at 65.0 from 65.1, leaving the last three months softer than the preceding six, which peaked at 70.0 in October. This suggests that the lift from tariffs has peaked.