Published: 2025-04-24T19:34:04.000Z

Preview: Due May 5 - U.S. April ISM Services - A correction higher within a weakening picture

3

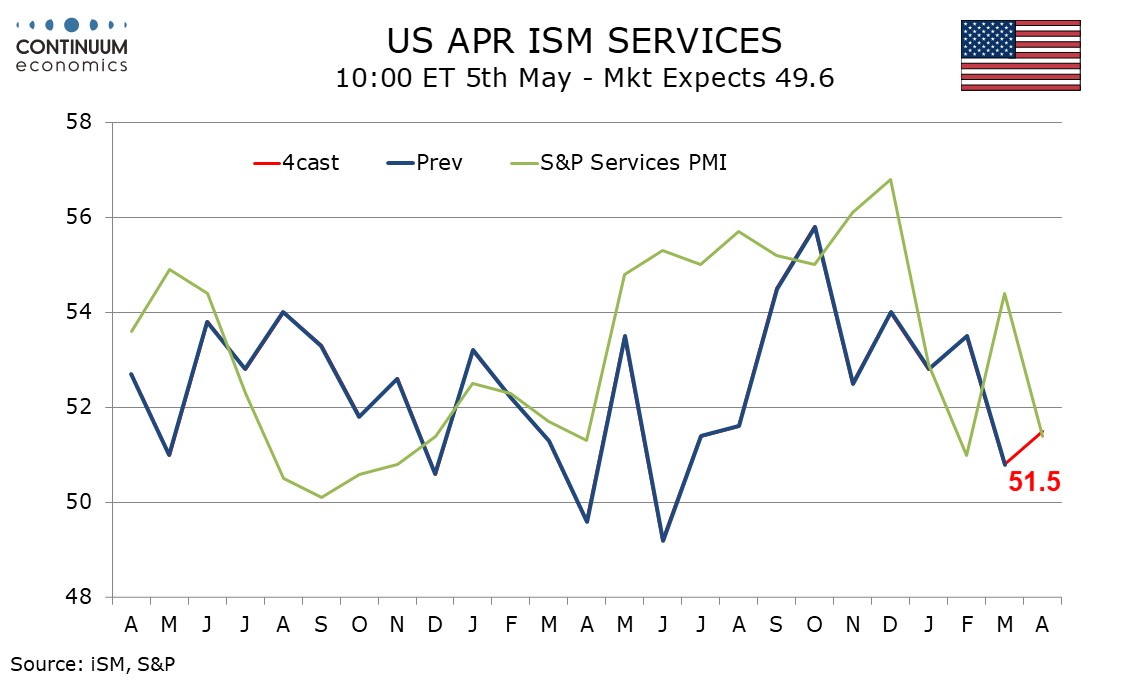

We expect April’s ISM services index to correct higher to 51.5 after March saw a fall to a 9-month low of 50.8 from 53.5 in February.

This would put the ISM services index very close to the S and P services PMI of 51.4, though that index saw a dip after a March improvement. The rise in April’s ISM services index should be seen as corrective with most regional service sector surveys seeing weakness in April.

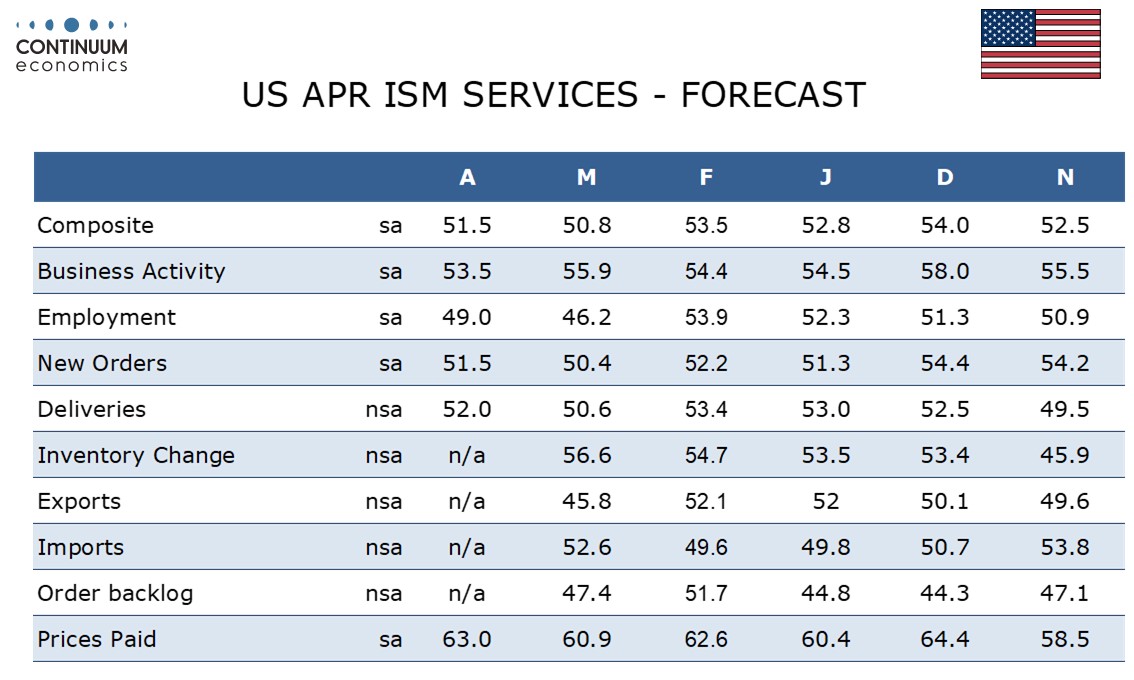

The ISM services details are likely to show a correction lower in business activity to 53.5 from March’s improved 55.9, but partial reversals from March dips in from the other three components that make up the composite, new orders, employment and delivery times. Employment saw a particularly sharp dip in March, to 46.2 from 53.9, and we expect a bounce to a still negative 49.5 in April.

Prices paid do not contribute to the composite and here we expect a modest tariff-fueled rise to 63.0 from 60.9, still below December’s 64.4. This would be a fifth straight month above 50, to follow ten straight months in the 50s.