Preview: Due December 4 - U.S. November ADP Employment - October suggested underlying strength

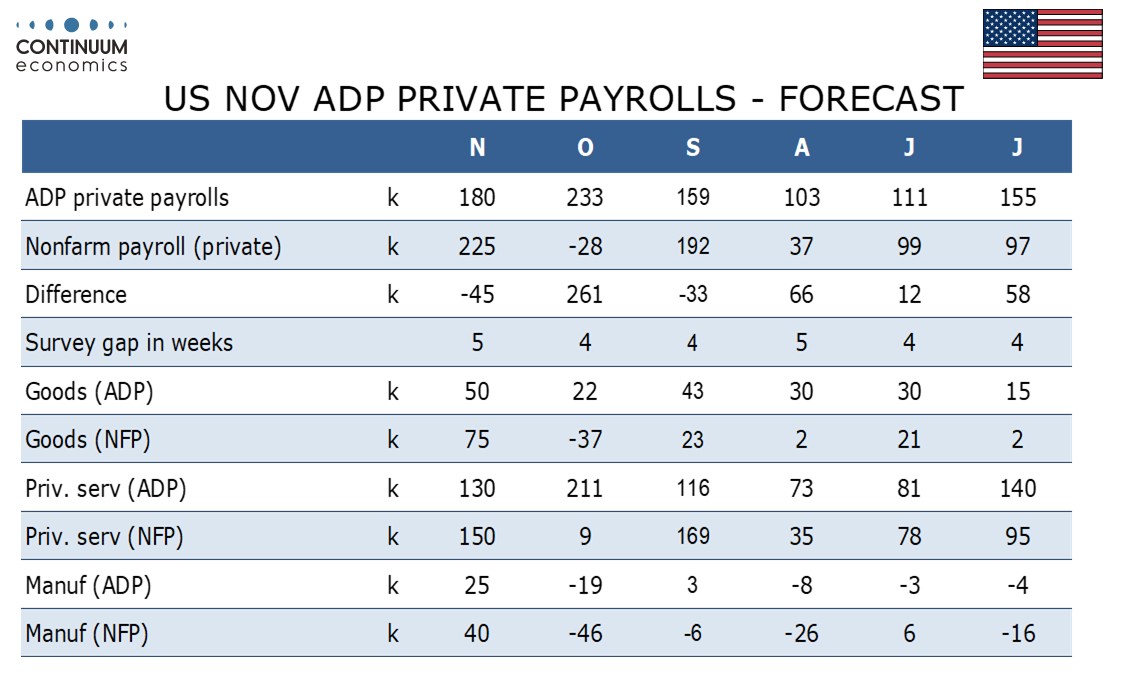

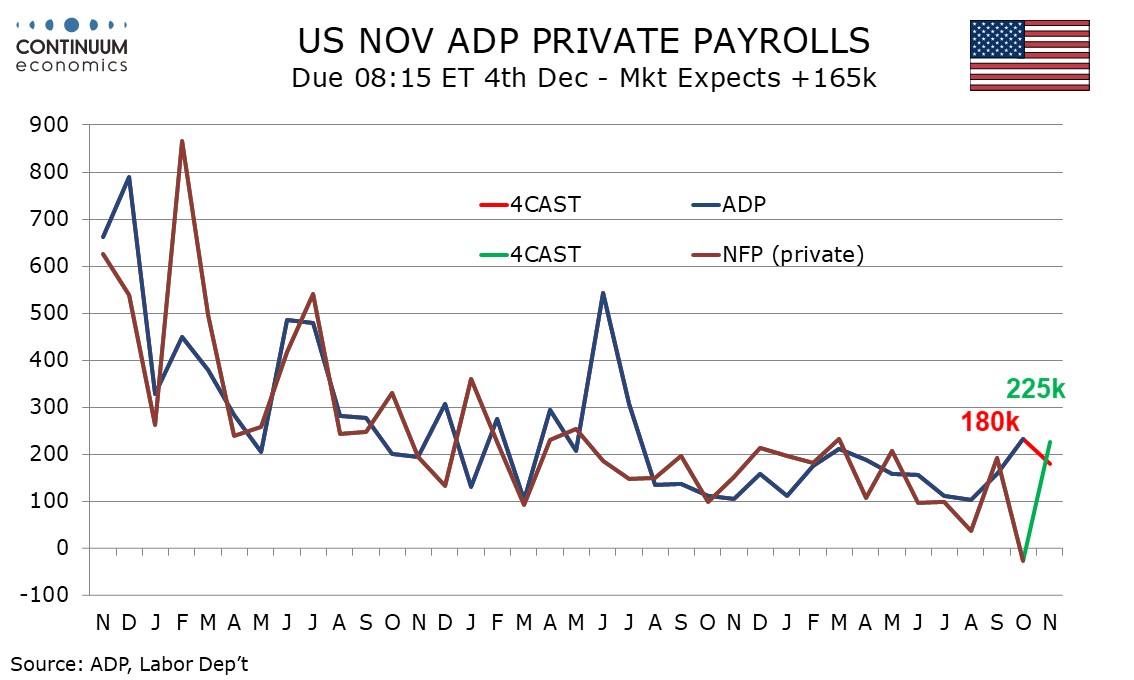

We expect a 180k increase in November’s ADP estimate for private sector employment growth, which would underperform our 225k estimate for private sector payrolls (we expect overall payrolls to rise by 260k). ADP data was strong at 233k in October, sharply outperforming a 28k decline in private sector payrolls with payrolls apparently more sensitive to weather than ADP data.

Historically ADP data has tended to be less sensitive to weather than the non-farm payroll, which was depressed by the impacts of Hurricanes Helene and Milton in October.

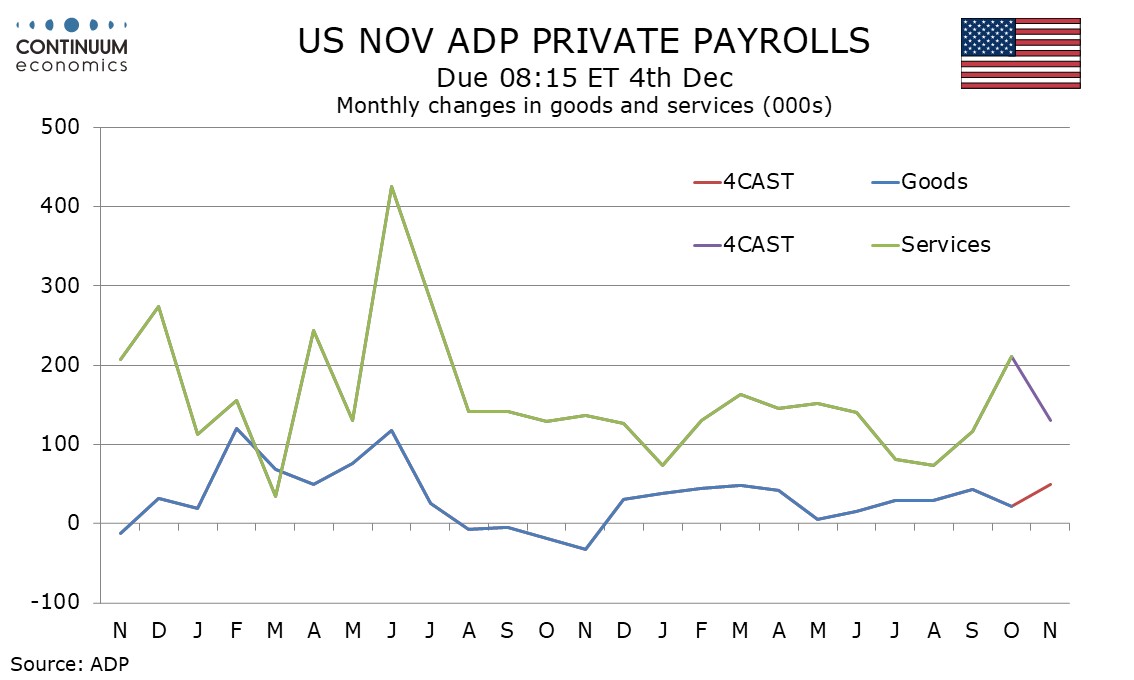

Payrolls also saw a hit from a strike at Boeing, with manufacturing falling by 44k, and a rebound is likely in November with the strike now settled. It is unclear whether a below trend 19k decline in ADP manufacturing employment was in part on the Boeing strike, but we expect a bounce of 25k in November.

Elsewhere we expect ADP data to be a little less strong than in October, with the 233k ADP increase being the strongest since July 2023. While ADP is not a reliable guide to payrolls the fact October’s ADP data was so strong suggests October’s weakness in the non-farm payroll was largely weather-related. However we expect November’s ADP data to be far from weak. Low initial claims in November after a bounce during the hurricanes in early October point to a healthy labor market in November.