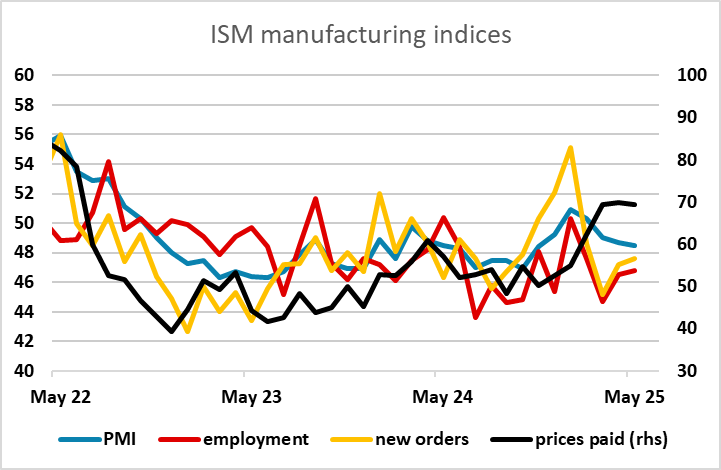

USD flows: USD softer after ISM

ISM slightly on the soft side but USD weakness reflects the market's tendency rather than the data

While there was nothing particularly surprising in the ISM survey, it was slightly on the soft side of expectations, and the USD has seen another move lower in response, although there isn’t much movement in US yields or equities. Clearly sentiment remains USD negative, and even though we aren’t likely to get any conclusively weak data in the near term, even modest softness is seen as a reason to extend USD weakness as long as the threat of a tariff induced slowdown remains. Nevertheless, we doubt we ill see a serious test of the edges of the recent range above 1.15 in EUR/USD and 140 in USD/JPY this side of the employment report, unless we get some extreme decisions on tariffs.