EUR, USD, JPY flows: USD stays firm, EUR vulnerable

USD stays firm after strong employment data. EUR vulnerable as spreads move in USD's favour.

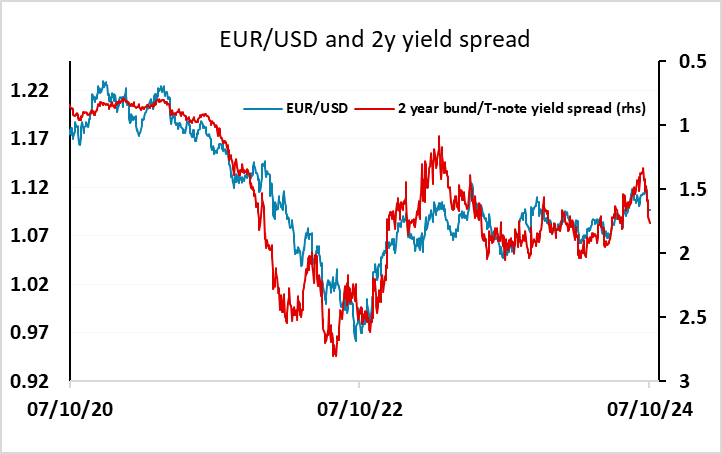

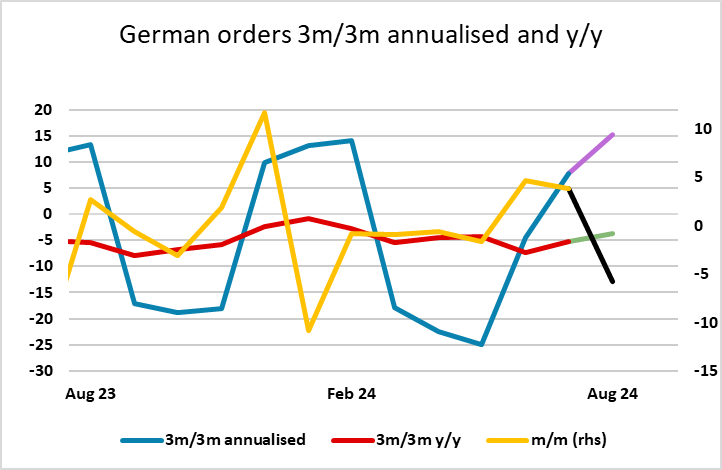

A fairly quiet start in Europe this morning in the aftermath of Friday’s strong US employment data. However, US yields have continued to move higher, and spreads suggests scope for more USD gains against the EUR as a result, but there is less case for USD strength against the JPY and the AUD, with USD/JPY in particular rising more sharply than other pairs in the last week. This morning’s German factory orders data provides a further superficial case for EUR weakness, coming in much weaker than expected at -5.8% m/m in August, but this comes after two months of strength and the July numbers were also revised higher, so the underlying trend over the last few months is still slightly more positive. Nevertheless, the European data doesn’t provide a case for European yields to follow US yields higher, and there looks to be scope for EUR/USD to slip towards 1.09.

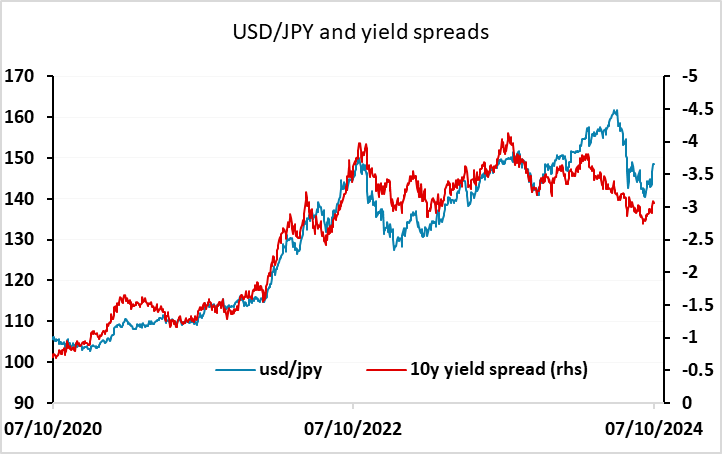

There is less case for gains in USD/JPY with a large move already seen and Japanese yields up again overnight, while Japanese FX diplomat Mimura is once again talking about “monitoring FX moves including speculative trading with a sense of urgency”, suggesting the Japanese authorities are not happy with the latest bout of JPY weakness. But we are still probably some way from actual intervention, and the market is generally fairly insensitive to verbals, so the USD/JPY bias may still be slightly higher, though there may be more scope for USD gains elsewhere.

There isn’t a lot on today’s calendar, but the market will be watching the Fed speakers later in the wake of the employment data. The market is now priced for 25bp cuts in November and December, having completely priced out the risk of a 50bp November cut, but the risk now may be that cuts are even less rapid so there will be sensitivity to any hawkish remarks.