Preview: Due November 21 - U.S. November S&P PMIs - Modest corrections lower, still healthy

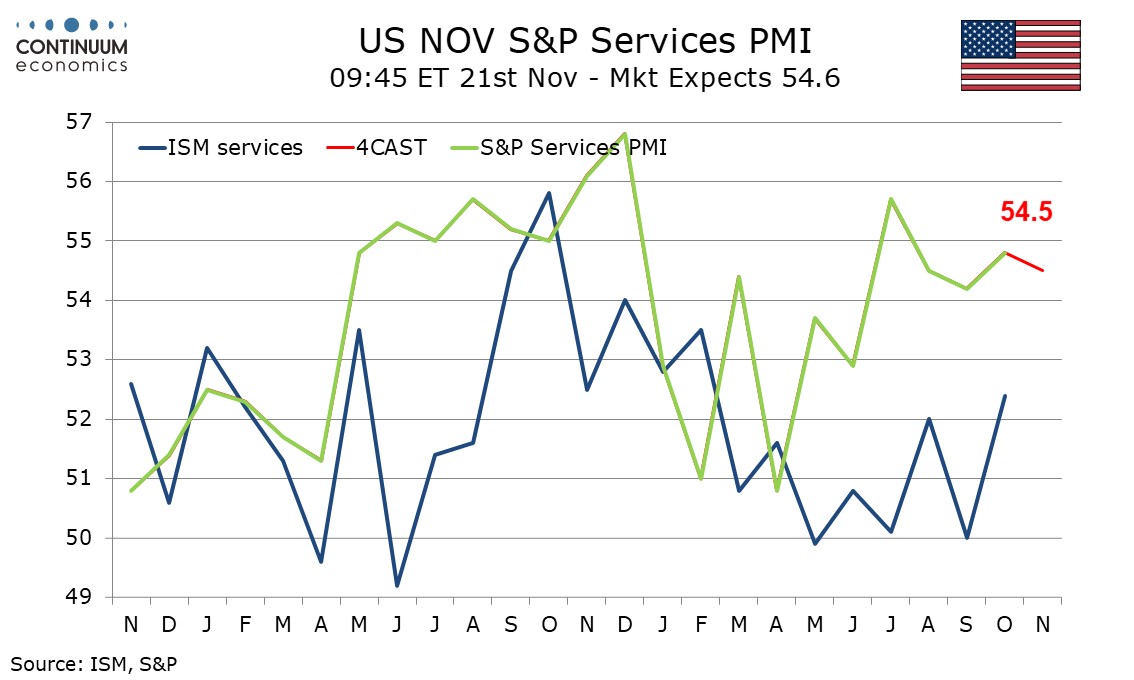

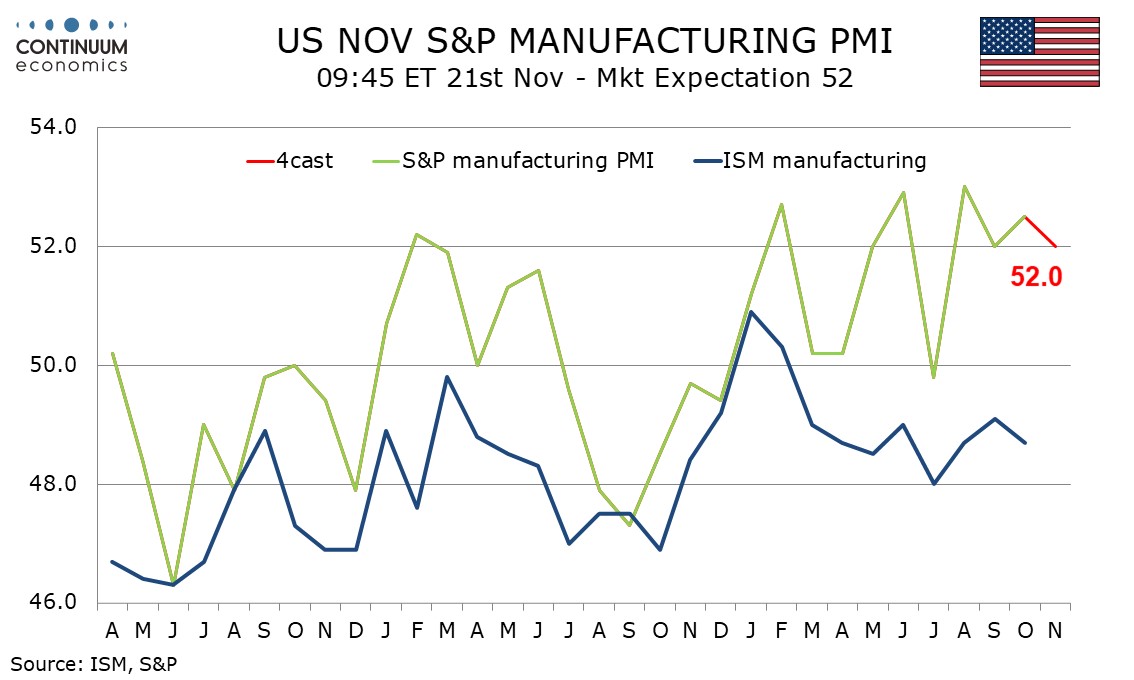

We expect November’s S and P PMIs to both see modest slippage, manufacturing to 52.0 from 52.5 and services to 54.5 from 54.8 but these will be more corrections from October improvements than any suggestion of underlying weakness. The levels will remain healthy.

The manufacturing index would be reversing an October improvement which was consistent with the message of the majority of regional manufacturing surveys but contrasted by a dip in the ISM manufacturing index. The S and P manufacturing index has been consistently outperforming the ISM’s in the year to date but may struggle to extend October’s gain.

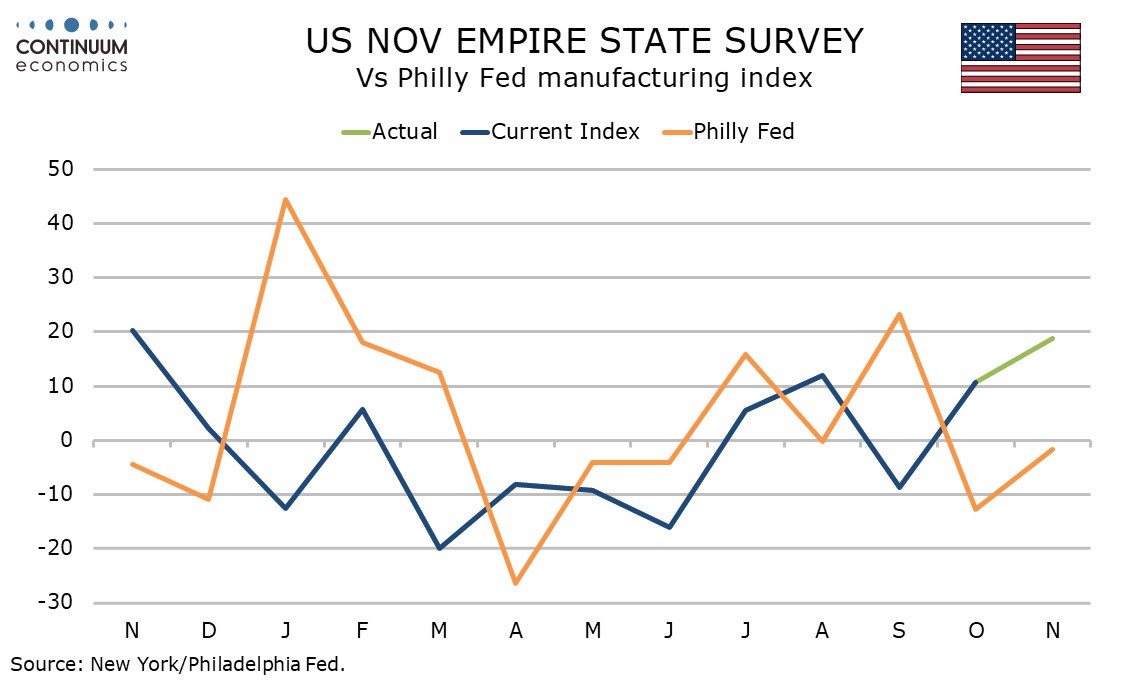

November manufacturing data shows improvements in both the Empire State and Philly Fed surveys relative to October, but the Philly Fed index remained below neutral. Philly Fed details were mixed with strong 6-month expectations but weak new orders, and price data mostly firm. November's Kansas City Fed manufacturing survey was increasingly positive, at 8 from 6.

The S and P services PMI has also been outperforming its ISM counterpart, though the ISM services index did see some catch up in October, though not by enough to suggest November’s S and P services index can extend an October rise. Regional services sector surveys were mostly subdued in October. Fed easing may be providing some support but there is downside risk coming from recent consumer strength, running ahead of real disposable income, looking unsustainable.