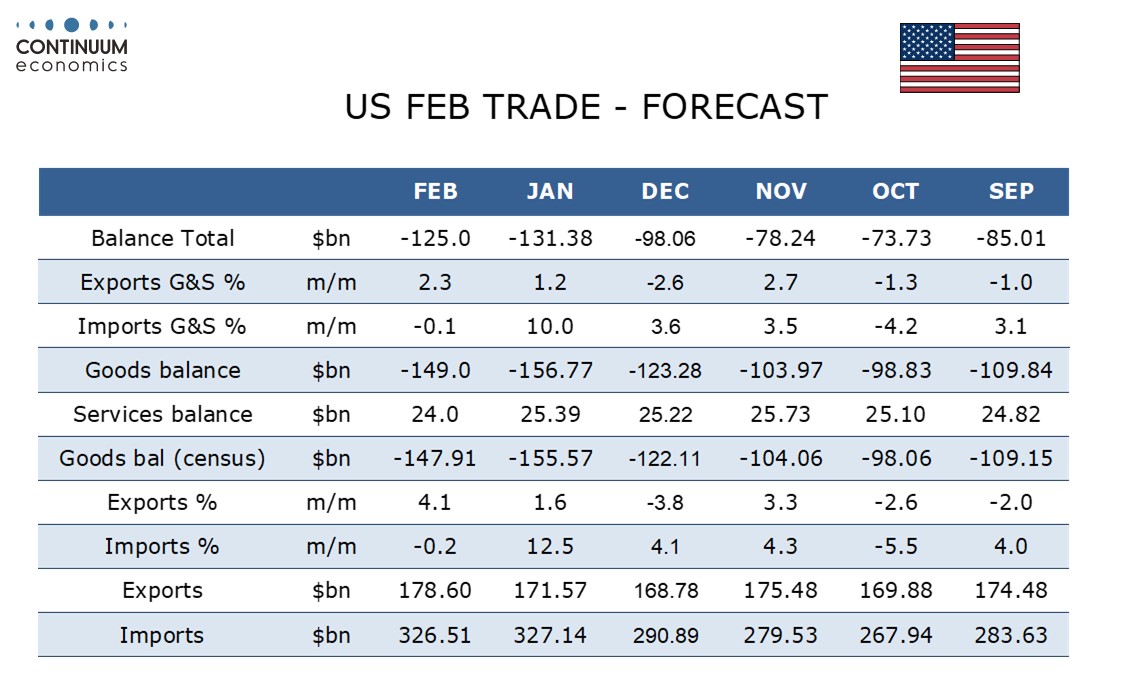

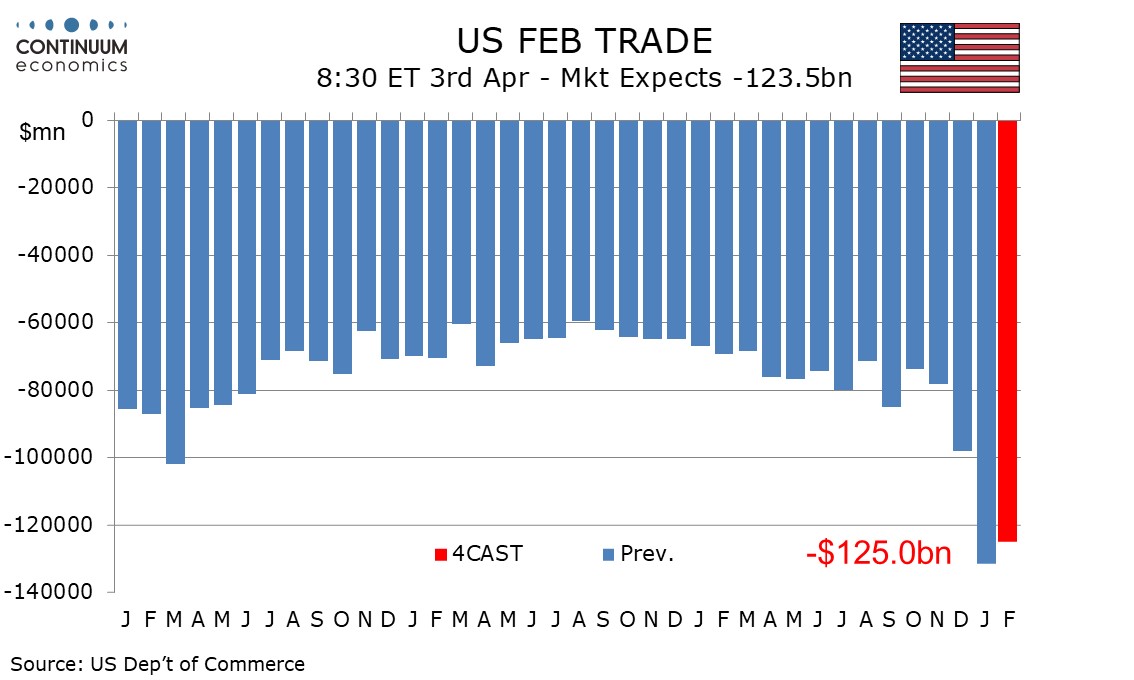

Preview: Due April 3 - U.S. February Trade Balance - Deficit down from January record but still very large

We expect a February trade deficit of $125.0bn, down from January’s record $131.4bn, but still above December’s $98.1bn, and the previous record deficit of $101.9bn seen in March 2022.

We expect exports to rise by 2.3% after a 1.2% January increase while imports slip by 0.1% after a surge of 10.0% in January. We expect goods to show a 4.1% rise in exports and a 0.2% fall in imports in line with advance goods data. We expect the service balance to weaken in response to a boycott from Canadian tourists, with service exports falling by 1.1% while service imports rise by 0.5%.

Advance goods data showed the exports gain led by a 12.7% surge in autos, perhaps in preparation for trade wars though auto imports did not show such a sharp rise, rising by only 1.2%. The advance goods imports detail showed continued gains in most components, but corrections from January strength in food and particularly industrial supplies, which fell by 4.9% after a surge of 24.3% in January. The latter January surge was led by fixed metal shapes, particularly gold, which are likely to have led February’s drop, though imports generally are being supported by a desire to beat threatened tariffs.