GBP flows: GBP up on Pill comments

PIll comments on the hawkish side, boosting GBP

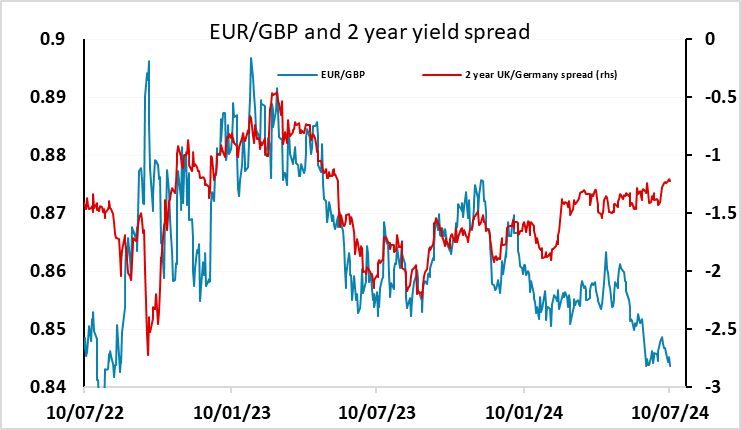

GBP has risen after the latest comments from BoE chief economist Pill. His statement that “services price inflation and wage growth continue to point to an uncomfortable strength in underlying inflation dynamics” suggests that he is not going to be in favour of a rate cut in August. There were also some hawkish comments from Jonathan Haskel, one of the established hawks on the committee, earlier in the week, but the Pill comments are more crucial as his vote is likely to be needed to carry a rate cut. He also noted that “we have to be realistic about how much any one or two releases can add to our assessment on rates”, suggesting that he is unlikely to change his mind ahead of the August meeting. As it stands, the rates market is still pricing an August cut as around a 50-50 chance, and hasn’t reacted significantly to Pill, but his comments suggest that the chances are less than that. There may consequently be some further upside for GBP here, although on the basis of short end yield spreads, there is not a strong case for significant GBP gains. The EUR/GBP lows from June just below 0.84 may therefore come under pressure, but will be tough to break below.