CHF, JPY, EUR flows: EUR/JPY approaches all time high, CHF in spotlight

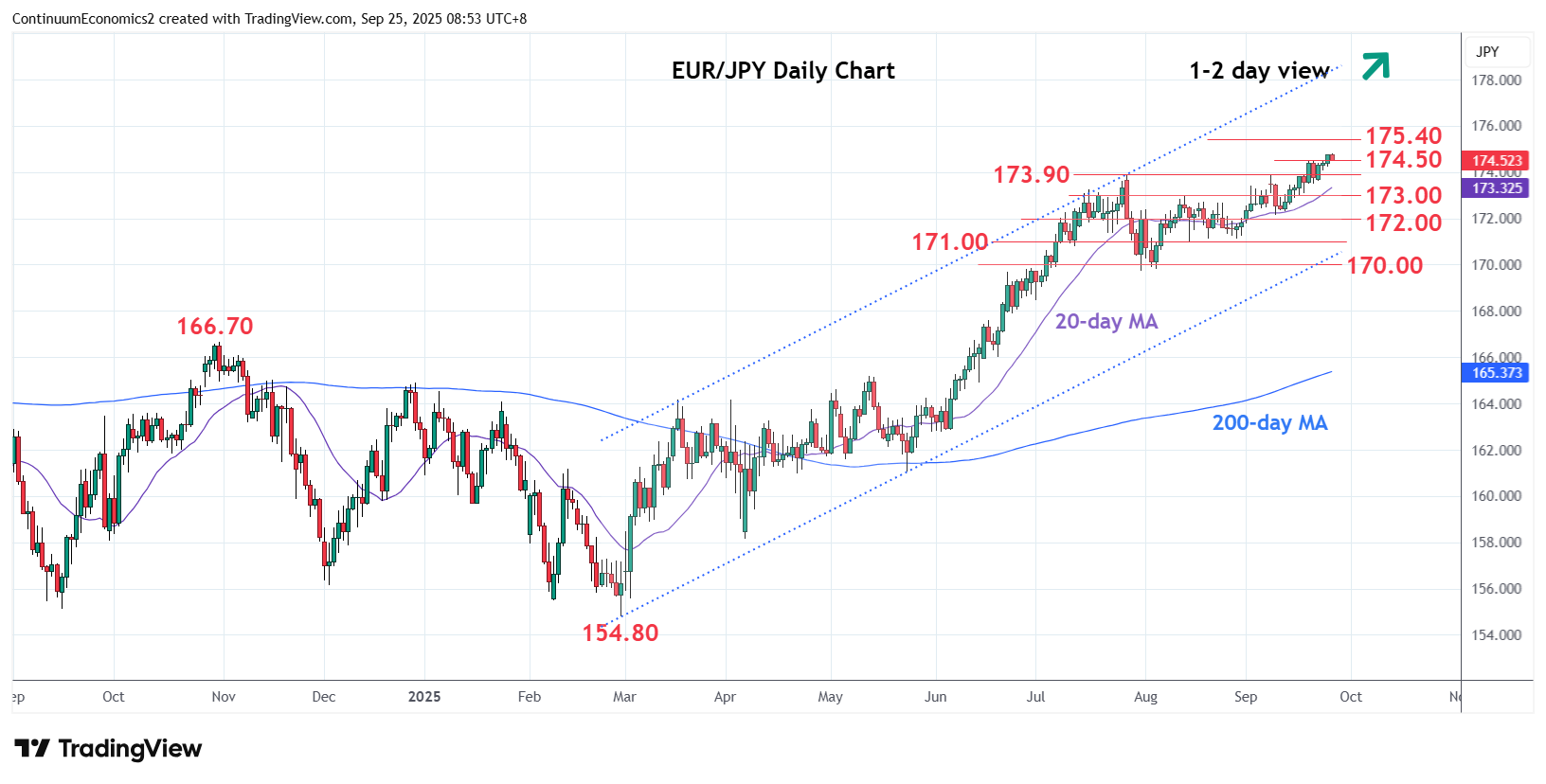

EUR/JPY contineus to rise towards the July 2024 all time high at 175.42. CHF strength in focus as SNB meets

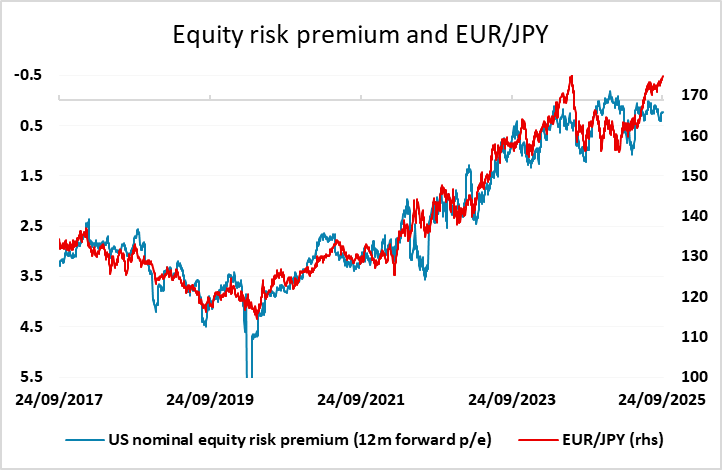

A fairly quiet start in Europe with the main focus of the morning likely to be the SNB meeting at 08:30 UK time. However, EUR/JPY has continued to rise, reaching another new post July 2024 high, and threatening the all time high at 175.40 reached then. There is no obvious driver for the mobve other than momentum, but the all time high is a clear target and may need to be broken before there can be any reversal.

The SNB meeting could be important with the CHF at 10 year highs on a real trade-weighted basis. There is little chance of a cut in the policy rate to negative, but the market will be on watch for any commentary about CHF strength and any indication that the SNB is imminently prepared to act in the FX market. They have certainly acted aggressively before, but the ultimate outcome hasn’t been particularly successful, with the market tending to oppose any SNB intervention, and the removal of intervention leading to sharp CHF gains in 2015. So verbal action is more likely, with the strength of the CHF more of a concern given the pressure on Swiss competitiveness from the 39% US tariff. Whether this will be enough to weaken the CHF is questionable, but the 0.93 level in EUR/CHF does look like an effective base.