JPY flows: JPY staying weak as risk appetite recovers, but...

EUR/JPY hit a new high for the year. Corrective activity possible pre-emloyment report, but turn in risk sentiment needed to halt JPY weakness

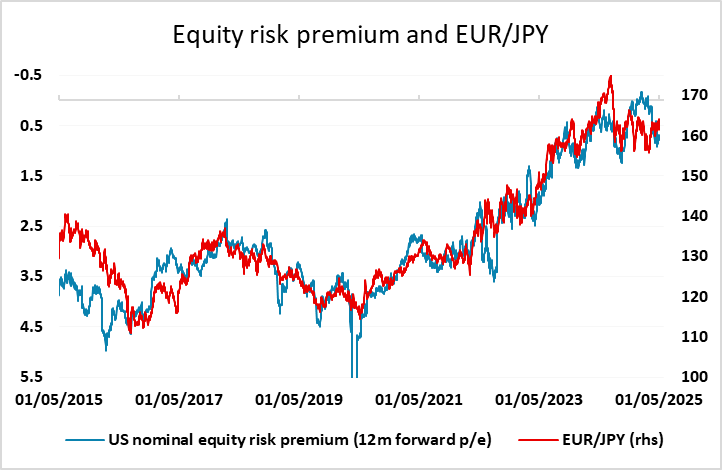

There isn’t much on the calendar in Europe ahead of the US employment report, so a relatively quiet morning seems likely. Most of Europe was on holiday on Thursday, so there may be some reaction to the market moves seen yesterday, the main one of which was the sharp decline in the JPY. This took EUR/JPY to a new high for the year overnight, boosted by the combination of better equity market sentiment and reduced expectations of BoJ rate hike safter the BoJ downgraded their growth forecasts at the latest monetary policy meeting. JPY weakness looks overdone, with equity risk premia still significantly higher than they were at the beginning of the year, and equity indices still well below their highs, while the downgrade to Japanese growth is a consequence of tariffs and should be echoed elsewhere, undermining risk sentiment and ultimately benefiting the JPY. Some profit taking on JPY shorts may be seen ahead of the employment report, but a solid report could still propel the JPY to new lows. While we remain JPY bulls longer term, a turn is unlikely to come without evidence of weakening US growth. The negative Q1 US GDP doesn’t really count on that score as it looks to have been due to a pre-tariff import surge, with domestic demand still strong.