Preview: Due January 3 - U.S. December ISM Manufacturing - Sustaining November improvement

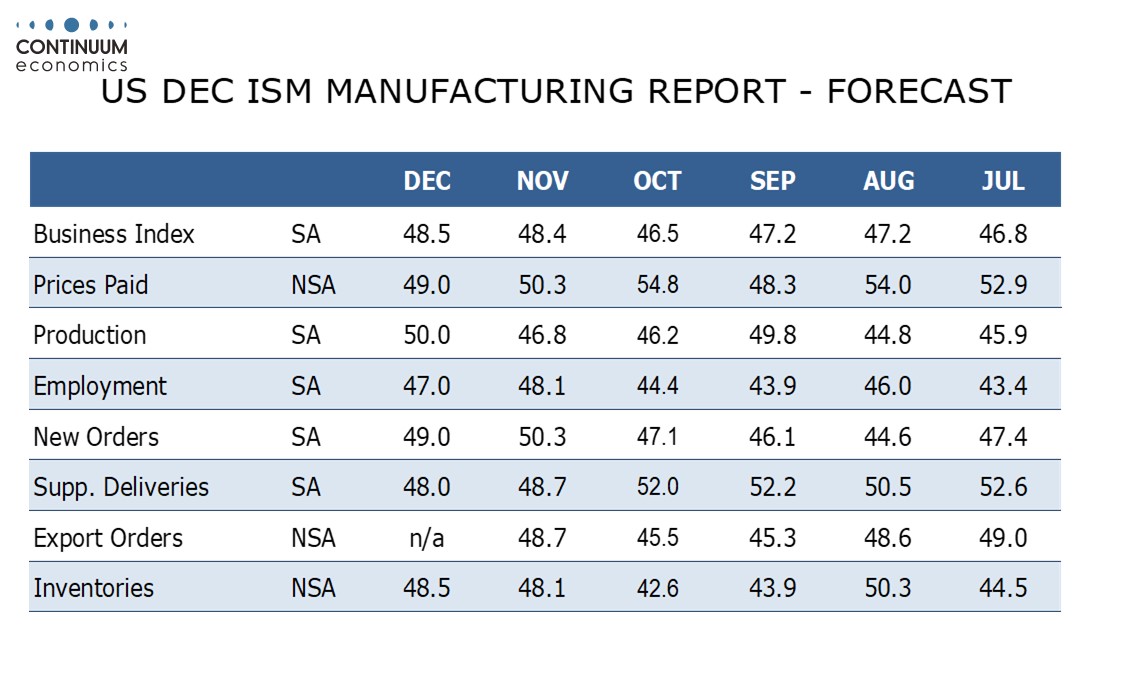

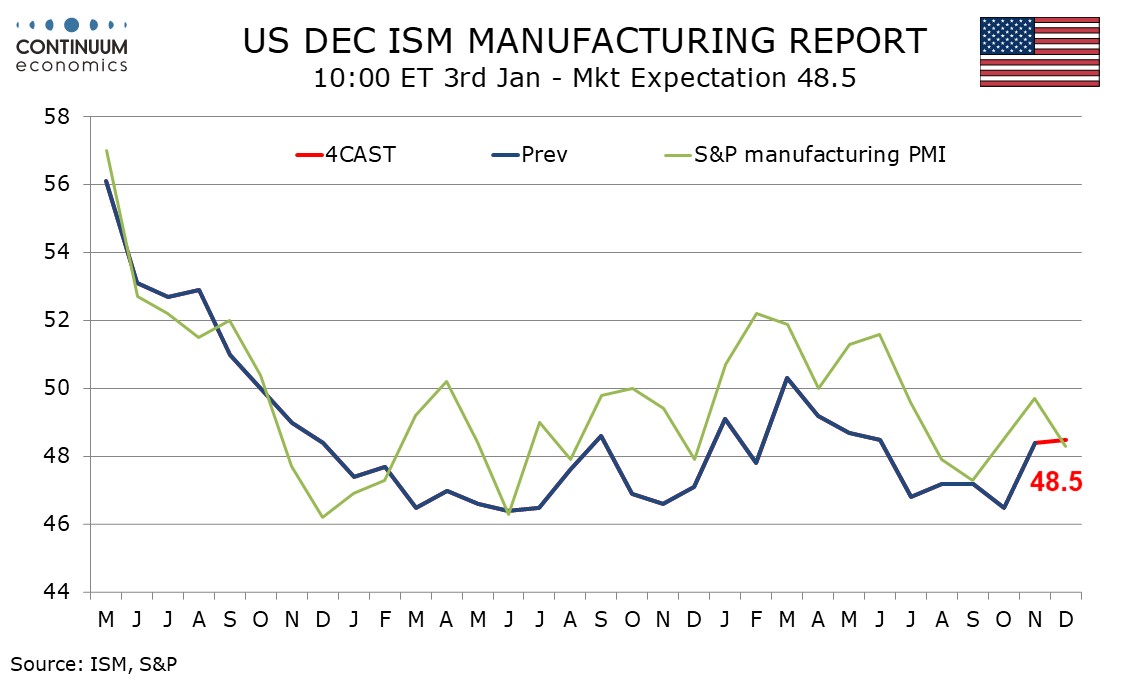

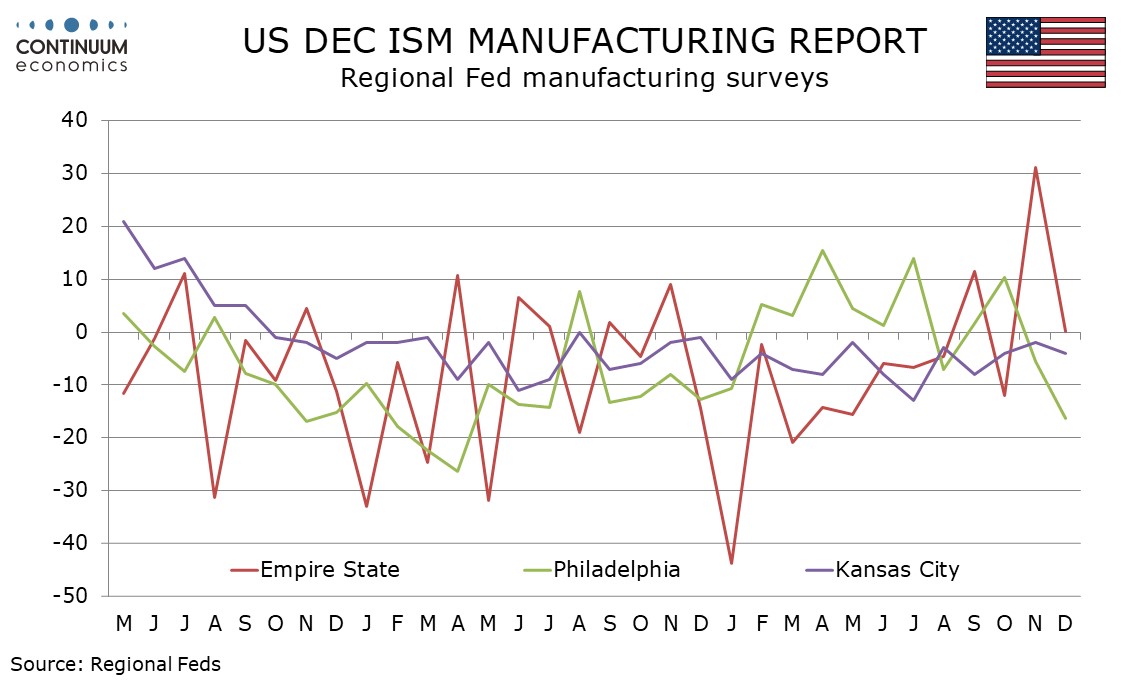

Despite a correction lower in the S and P manufacturing PMI and weakness in some regional surveys, we expect December’s ISM manufacturing index to sustain a November improvement, edging up to 48.5 from 48.4.

November saw the ISM manufacturing index bounce from a weak 46.5 in October, which may have had some restraint from hurricanes and a strike at Boeing. The gain was led by new orders which edged above the neutral 50 for the first time since March.

While new orders may correct lower supportive seasonal adjustments limit downside risk, while even more supportive seasonal adjustments in production could bring a significant bounce in that index. This could see the ISM manufacturing index holding up better than most surveys in December.

We expect inventories to also sustain an October improvement, though we expect delivery times to continue unwinding recent strength, while employment may struggle to sustain a November improvement. Prices paid do not contribute to the composite and here we expect slippage, to 49.0 from 50.3, taking the index below neutral for the first time in twelve months.